Question: Case 5 You have just started work for Warren Co as part of the controller's group involved in current nancial reporting problems. Jane Henshaw, controller

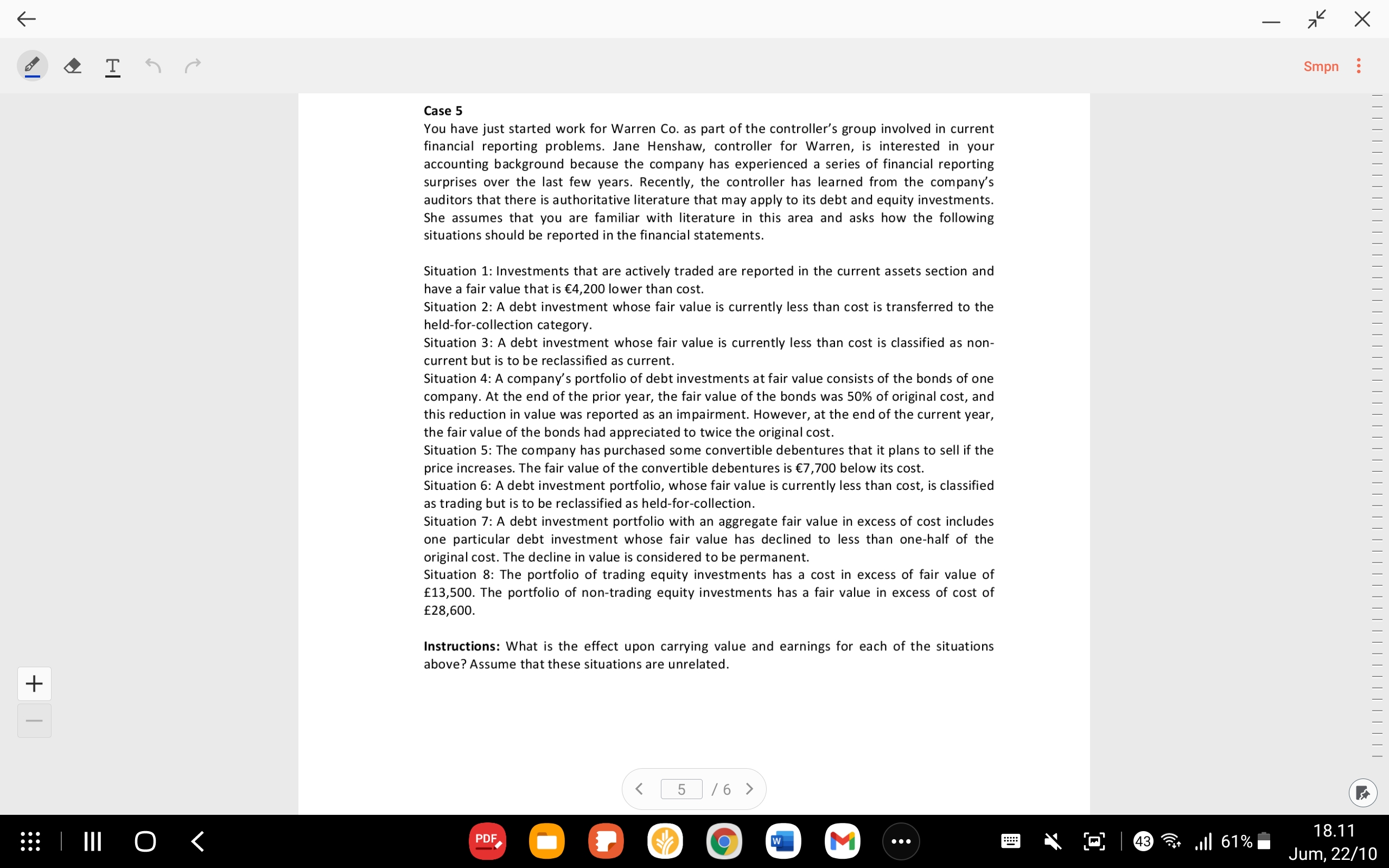

Case 5 You have just started work for Warren Co as part of the controller's group involved in current nancial reporting problems. Jane Henshaw, controller for Warren, is interested in your accounting background because the company has experienced a series of financial reporting surprises over the last few years. Recently, the controller has learned from the company's auditors that there is authoritative literature that may apply to its debt and equity investments. She assumes that you are familiar with literature in this area and asks how the following situations should be reported in the nancial statements. Situation 1: Investments that are actively traded are reported in the current assets section and have a fair value that is 4,200 Iowerthan cost. Situation 2: A debt investment whose fair value is currently less than cost is transferred to the held-for-collection category. Situation 3: A debt investment whose fair value is currently less than cost is classified as non- current but is to be reclassied as current. Situation 4: A company/s portfolio of debt investments at fair value consists of the bonds of one company. At the end ofthe prior year, the fair value of the bonds was 50% of original cost, and this reduction in value was reported as an impairment. However, at the end of the current year, the fair value of the bonds had appreciated to twice the original cost. Situation 5: The company has purchased some convertible debentures that it plans to sell if the prlce Increases. The fair value of the convertible debentures ls 7,700 below Its cost. Situation 6: A debt investment portfolio, whose fair value is currently less than cost, is classified astrading but is to be reclassified as held-for-collection. Situation 7: A debt investment portfolio with an aggregate fair value in excess of cost includes one particular debt investment whose fair value has declined to less than one-half of the original cost. The decline in value is considered to be permanent. Situation 8: The portfolio of trading equity investments has a cost in excess of fair value of 13,500. The portfolio of non-trading equity investments has a fair value in excess of cost of 28,600. Instmctlons: What is the effect upon carrying value and earnings for each of the situations above? Assume that these situations are unrelated. A Tn .III 61% I 18.11 Jum, 22/10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts