Question: Case 6 - 2 9 ( Algo ) Variable and Absorption Costing Unit Product Costs and Income Statements [ LO 6 - 1 , Case

Case Algo Variable and Absorption Costing Unit Product Costs and Income Statements LO Case Algo Variable and Absorption Costing Unit Product Costs and Income Statements LO

LO

The following information applles to the questlons displayed below.

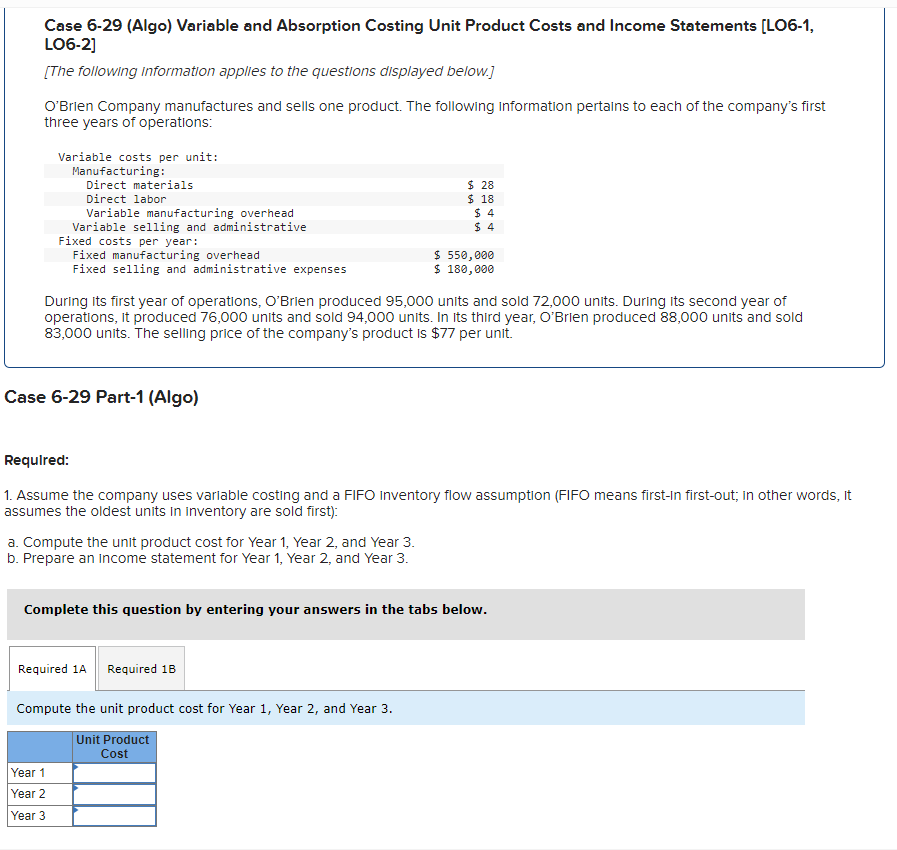

O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first

three years of operations:Manufacturing: Direct labor $ Variable selling and administrative $

Fixed costs per year:Fixed selling and administrative expenses $ During its first year of operations, O'Brien produced units and sold units. During its second year of

operations, it produced units and sold units. In its third year, O'Brien produced units and sold

units. The selling price of the company's product is $ per unit.

Case PartAlgo

Required:

Assume the company uses variable costing and a FIFO inventory flow assumption FIFO means firstIn firstout; in other words, it

assumes the oldest units in inventory are sold first:

a Compute the unit product cost for Year Year and Year

b Prepare an Income statement for Year Year and Year

Complete this question by entering your answers in the tabs below.

O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first

three years of operations:Manufacturing: Direct labor $ Variable selling and administrative $

Fixed costs per year:Fixed selling and administrative expenses $ During its first year of operations, O'Brien produced units and sold units. During its second year of

operations, it produced units and sold units. In its third year, O'Brien produced units and sold

units. The selling price of the company's product is $ per unit.

Case PartAlgo

Required information

Case Algo Varlable and Absorption Costing Unit Product Costs and Income Statements LO

LO

The following informotion opplies to the questions disployed below.

O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first

three years of operations:Manufacturing: Direct labor $ Variable selling and administrative $

Fixed costs per year:Fixed selling and adninistrative expenses $ eeeeDuring its first yesr of operations, O'Brien produced units and sold units. During its second year of

operations, it produced units and sold units. In its third yesr, O'Brien produced units and sold

units. The selling price of the company's product is $ per unit.

Case PartAlgo

Assume the company uses variable costing and a LIFO inventory flow assumption LIFO means lastin firstout; in other words, it

assumes the newest units in inventory are sold first:

a Compute the unit product cost for Year Year and Year

b Prepare an income statement for Year Year and Year

Complete this question by entering your answers in the tabs below.

Required A

Required

Prepare an income statement for Year Year and Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock