Case 6

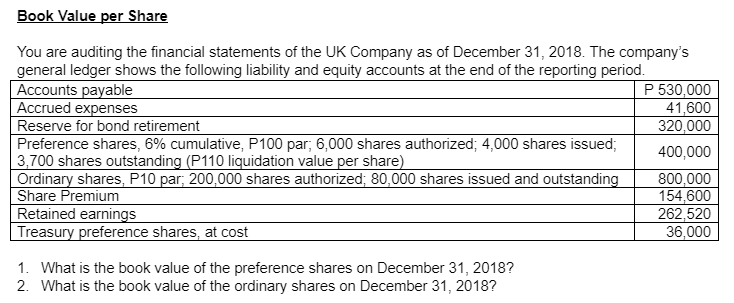

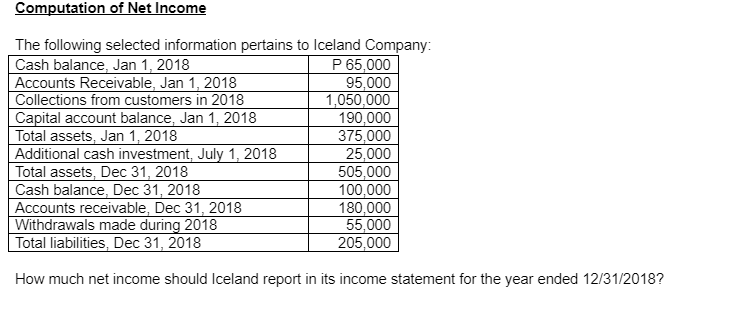

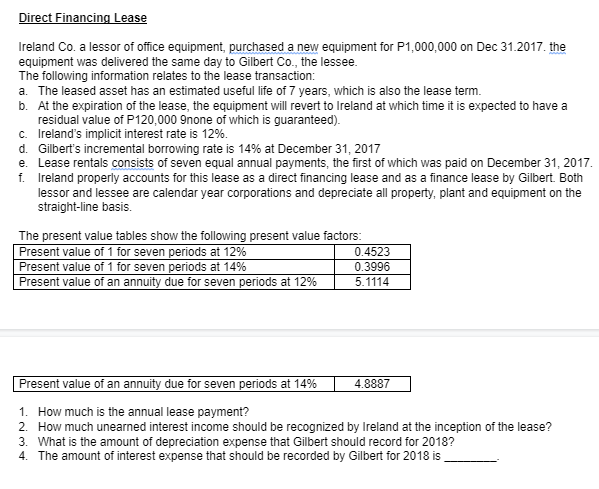

Book Value per Share You are auditing the financial statements of the UK Company as of December 31, 2018. The company's general ledger shows the following liability and equity accounts at the end of the reporting period. Accounts payable P 530,000 Accrued expenses 41,600 Reserve for bond retirement 320,000 Preference shares, 6% cumulative, P100 par; 6,000 shares authorized; 4,000 shares issued; 400,000 3,700 shares outstanding (P110 liquidation value per share) Ordinary shares, P10 par; 200,000 shares authorized; 80,000 shares issued and outstanding 800,000 Share Premium 154,600 Retained earnings 262,520 Treasury preference shares, at cost 36,000 1. What is the book value of the preference shares on December 31, 2018? 2. What is the book value of the ordinary shares on December 31, 2018?Computation of Net Income The following selected information pertains to Iceland Company: Cash balance, Jan 1, 2018 P 65,000 Accounts Receivable, Jan 1, 2018 95,000 Collections from customers in 2018 1,050,000 Capital account balance, Jan 1, 2018 190,000 Total assets, Jan 1, 2018 375,000 Additional cash investment, July 1, 2018 25,000 Total assets, Dec 31, 2018 505,000 Cash balance, Dec 31, 2018 100,000 Accounts receivable, Dec 31, 2018 180,000 Withdrawals made during 2018 55,000 Total liabilities, Dec 31, 2018 205,000 How much net income should Iceland report in its income statement for the year ended 12/31/2018?Direct Financing Lease Ireland Co. a lessor of office equipment, purchased a new equipment for P1,000,000 on Dec 31.2017. the equipment was delivered the same day to Gilbert Co., the lessee. The following information relates to the lease transaction: a. The leased asset has an estimated useful life of 7 years, which is also the lease term. b. At the expiration of the lease, the equipment will revert to Ireland at which time it is expected to have a residual value of P120,000 9none of which is guaranteed). c. Ireland's implicit interest rate is 12%. d. Gilbert's incremental borrowing rate is 14% at December 31, 2017 e. Lease rentals consists of seven equal annual payments, the first of which was paid on December 31, 2017. f. Ireland properly accounts for this lease as a direct financing lease and as a finance lease by Gilbert. Both lessor and lessee are calendar year corporations and depreciate all property, plant and equipment on the straight-line basis. The present value tables show the following present value factors: Present value of 1 for seven periods at 12% 0.4523 Present value of 1 for seven periods at 14% 0.3996 Present value of an annuity due for seven periods at 12% 5.1114 Present value of an annuity due for seven periods at 14% 4.8887 1. How much is the annual lease payment? 2. How much unearned interest income should be recognized by Ireland at the inception of the lease? 3. What is the amount of depreciation expense that Gilbert should record for 2018? The amount of interest expense that should be recorded by Gilbert for 2018 is