Question: Case 6.1: The Pharmaceutical Industry For this analysis, you will want to refer to the section in chapter 7 of the Baye/Prince text on the

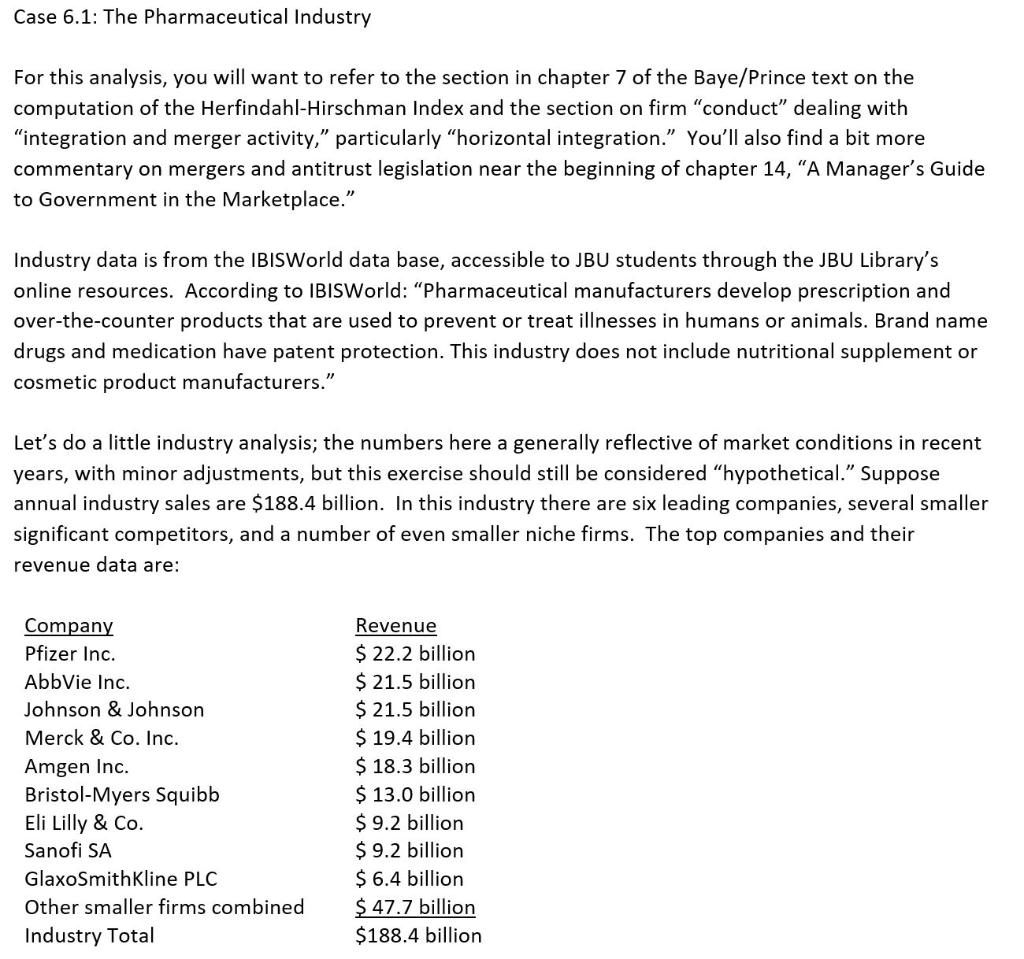

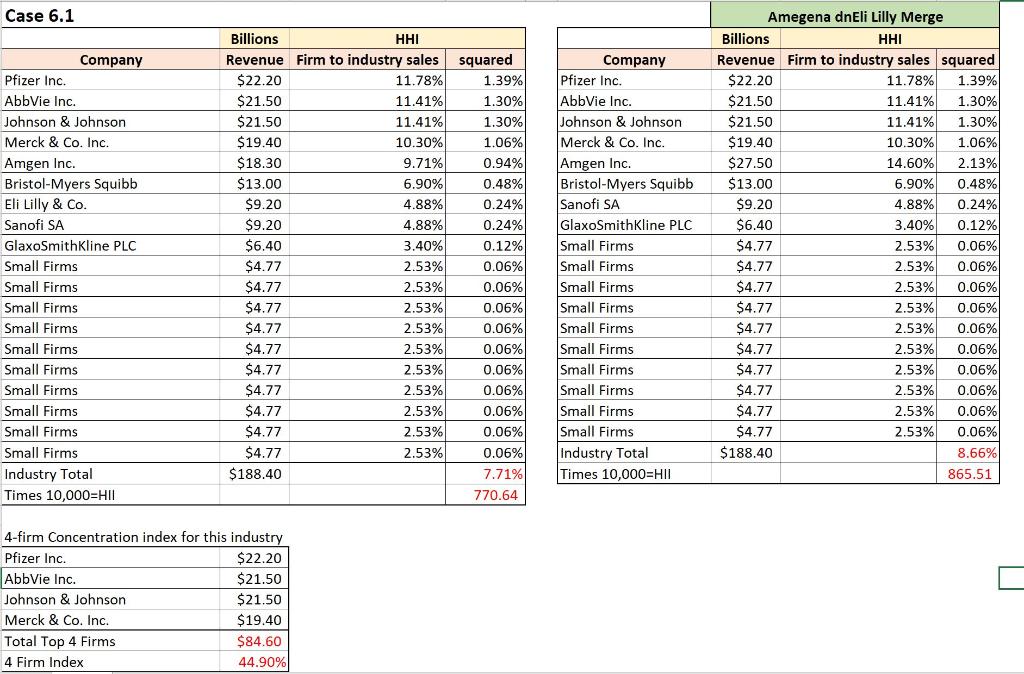

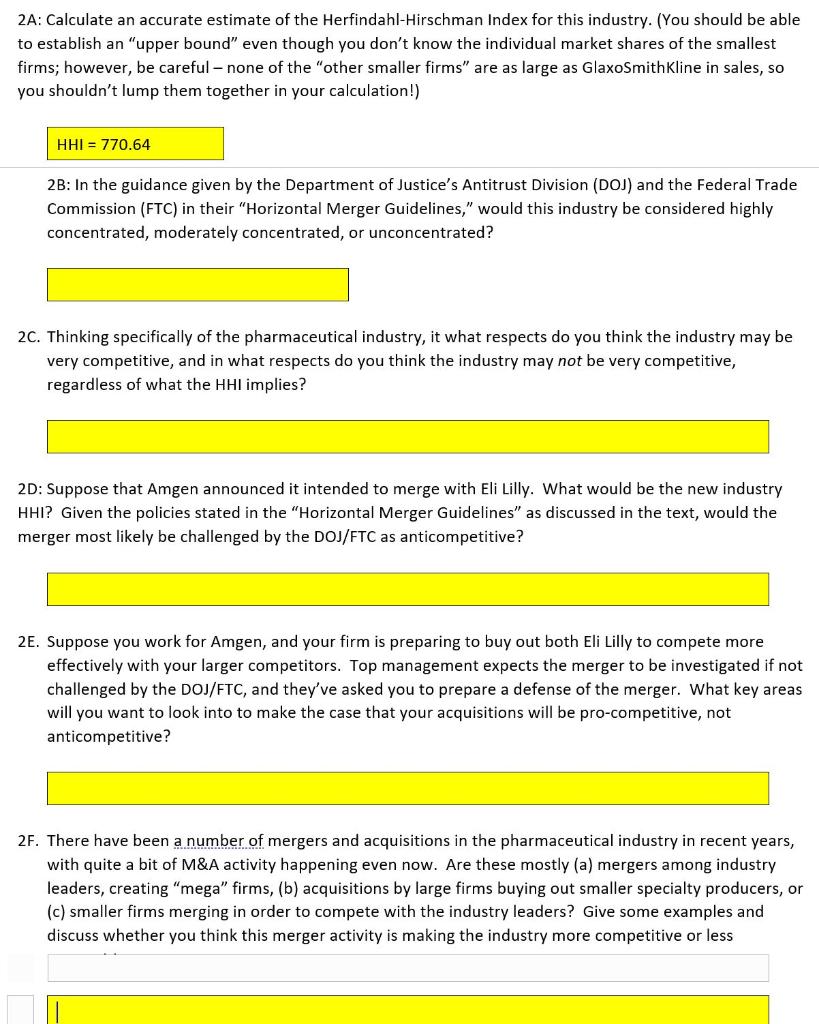

Case 6.1: The Pharmaceutical Industry For this analysis, you will want to refer to the section in chapter 7 of the Baye/Prince text on the computation of the Herfindahl-Hirschman Index and the section on firm "conduct" dealing with "integration and merger activity, particularly horizontal integration." You'll also find a bit more commentary on mergers and antitrust legislation near the beginning of chapter 14, "A Manager's Guide to Government in the Marketplace. Industry data is from the IBISWorld data base, accessible to JBU students through the JBU Library's online resources. According to IBISWorld: "Pharmaceutical manufacturers develop prescription and over-the-counter products that are used to prevent or treat illnesses in humans or animals. Brand name drugs and medication have patent protection. This industry does not include nutritional supplement or cosmetic product manufacturers." Let's do a little industry analysis; the numbers here a generally reflective of market conditions in recent years, with minor adjustments, but this exercise should still be considered hypothetical. Suppose annual industry sales are $188.4 billion. In this industry there are six leading companies, several smaller significant competitors, and a number of even smaller niche firms. The top companies and their revenue data are: Company Pfizer Inc. AbbVie Inc. Johnson & Johnson Merck & Co. Inc. Amgen Inc. Bristol-Myers Squibb Eli Lilly & Co. Sanofi SA GlaxoSmithKline PLC Other smaller firms combined Industry Total Revenue $ 22.2 billion $ 21.5 billion $ 21.5 billion $ 19.4 billion $ 18.3 billion $ 13.0 billion $ 9.2 billion $ 9.2 billion $ 6.4 billion $ 47.7 billion $188.4 billion Case 6.1 1.30% Company Pfizer Inc. AbbVie Inc. Johnson & Johnson Merck & Co. Inc. Amgen Inc. Bristol-Myers Squibb Eli Lilly & Co. Sanofi SA GlaxoSmithKline PLC Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Industry Total Times 10,000=HII Billions HHI Revenue Firm to industry sales $22.20 11.78% $21.50 11.41% $21.50 11.41% $19.40 10.30% $18.30 9.71% $13.00 6.90% $9.20 4.88% $9.20 4.88% $6.40 3.40% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $4.77 2.53% $188.40 squared 1.39% 1.30% 1.30% 1.06% 0.94% 0.48% 0.24% 0.24% 0.12% 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% 7.71% 770.64 Company Pfizer Inc. AbbVie Inc. Johnson & Johnson Merck & Co. Inc. Amgen Inc. Bristol-Myers Squibb Sanofi SA GlaxoSmithKline PLC Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Small Firms Industry Total Times 10,000=HII Amegena dnEli Lilly Merge Billions HHI Revenue Firm to industry sales squared $22.20 11.78% 1.39% $21.50 11.41% 1.30% $21.50 11.41% $19.40 10.30% 1.06% $27.50 14.60% 2.13% $13.00 6.90% 0.48% $9.20 4.88% 0.24% $6.40 3.40% 0.12% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $4.77 2.53% 0.06% $188.40 8.66% 865.51 4-firm Concentration index for this industry Pfizer Inc. $22.20 AbbVie Inc. $21.50 Johnson & Johnson $21.50 Merck & Co. Inc. $19.40 Total Top 4 Firms $84.60 4 Firm Index 44.90% 2A: Calculate an accurate estimate of the Herfindahl-Hirschman Index for this industry. (You should be able to establish an "upper bound" even though you don't know the individual market shares of the smallest firms; however, be careful - none of the "other smaller firms" are as large as GlaxoSmithKline in sales, so you shouldn't lump them together in your calculation!) HHI = 770.64 2B: In the guidance given by the Department of Justice's Antitrust Division (DOJ) and the Federal Trade Commission (FTC) in their "Horizontal Merger Guidelines," would this industry be considered highly concentrated, moderately concentrated, or unconcentrated? 20. Thinking specifically of the pharmaceutical industry, it what respects do you think the industry may be very competitive, and in what respects do you think the industry may not be very competitive, regardless of what the HHI implies? 2D: Suppose that Amgen announced it intended to merge with Eli Lilly. What would be the new industry HHI? Given the policies stated in the "Horizontal Merger Guidelines" as discussed in the text, would the merger most likely be challenged by the DOJ/FTC as anticompetitive? 2. Suppose you work for Amgen, and your firm is preparing to buy out both Eli Lilly to compete more effectively with your larger competitors. Top management expects the merger to be investigated if not challenged by the DOJ/FTC, and they've asked you to prepare a defense of the merger. What key areas will you want to look into to make the case that your acquisitions will be pro-competitive, not anticompetitive? 2F. There have been a number of mergers and acquisitions in the pharmaceutical industry in recent years, with quite a bit of M&A activity happening even now. Are these mostly (a) mergers among industry leaders, creating "mega" firms, (b) acquisitions by large firms buying out smaller specialty producers, or (c) smaller firms merging in order to compete with the industry leaders? Give some examples and discuss whether you think this merger activity is making the industry more competitive or less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts