Question: Case 9 - 3 P Co . is looking for some additional financing in order to renovate one of the company s manufacturing plants. It

Case

P Co is looking for some additional financing in order to renovate one of the companys manufacturing plants. It is having difficulty getting new debt financing because its debttoequity ratio is higher than the : limit stated in its bank covenant. It is unable to attract an equity partner because the sole owner of P Co has set equity partner conditions that make it practically impossible to find a new equity investor.

Part of the problem results from the use of historical cost accounting. If the companys assets were recorded at fair value, the debttoequity ratio would be much lower. In order to get around the requirements for historical cost accounting, Jamal Irving, the CFO for P Co came up with the following plan.

On July Year P Co will sell its manufacturing facility to SPE at its fair value of $ in the form of a noninterestbearing note receivable. SPE will be set up for the sole purpose of renovating the manufacturing facility. No other activities may be carried out by SPE without the approval of P Co Mr Renovator, an unrelated party, will invest $ in cash as the sole owner of SPE. SPE will borrow $ to provide additional funds to cover the $ estimated cost of the renovation, which is expected to take months. P Co will guarantee the amount borrowed by SPE.

On January Year after the renovation is complete and one day after P Cos yearend, SPE will sell the manufacturing facility back to P Co at $ and will be wound up P Co will finance the repurchase with a $ bank loan, offsetting the $ note receivable from SPE and $ in cash. By selling the unrenovated facility and repurchasing the renovated facility, P Co hopes to reflect the facility at its fair value, borrow the money to finance the renovation, and improve its debttoequity position.

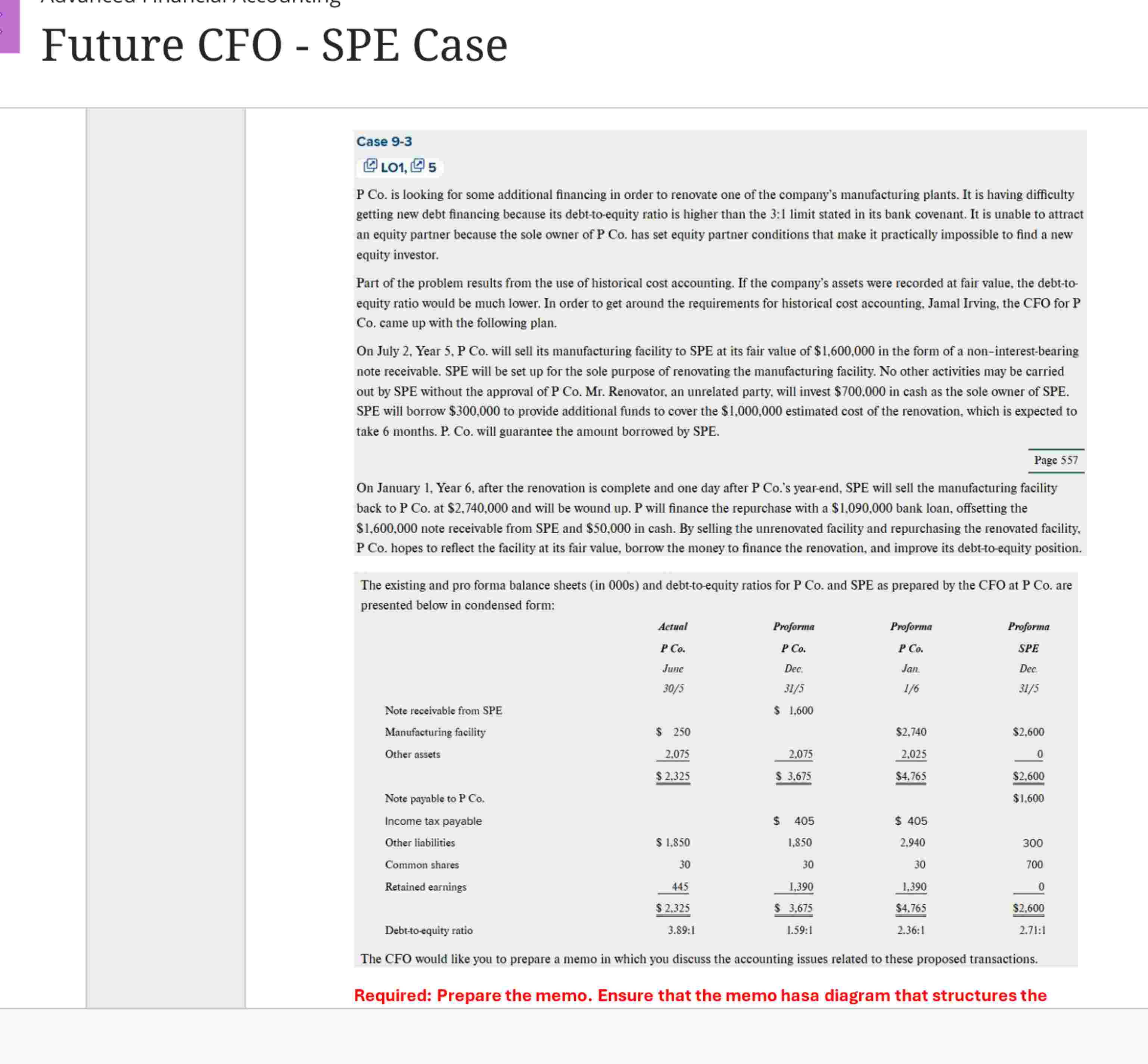

The existing and pro forma balance sheets in s and debttoequity ratios for P Co and SPE as prepared by the CFO at P Co are presented below in condensed form:

Actual P Co June Pro Forma P Co Dec. Pro Forma P Co Jan. Pro Forma SPE Dec. Note receivable from SPE$$$$Manufacturing facilityOther assetsNote payable to P CoIncome tax payable$$Other liabilitiesCommon sharesRetained earningsDebttoequity ratio::::

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock