Question: case 9 . 5 : Immunization Clinic Inc. Ko concopt: Determining volume to achieve target profit for a taxable entity D r . Brandon started

case : Immunization Clinic Inc.

Ko concopt: Determining volume to achieve target profit for a taxable entity

r Brandon started a forprofit immunization clinic in January The clinic was founded with the vision of providing five types of immunization injections for a low price of $ each, with the aim of making them affordable to all. Immunization Clinic Inc. is located in a small building rented at a cost of $ per month. The clinic hired one nurse to work fulltime and two college students to work hoursper week. A certified public accountant CPA also was hired at a cost of $ per month to handle billings, collections, payroll, payments, financial records, monthly financial statements, and tax returns. Necessary equipment was purchased for cash. Dr Brandon has noticed that expenses for medical supplies and advertising have varied while the remaining expenses have been relatively constant.

Between and the patient volume doubled. Profits have much more than doubled. Dr Brandon does not understand why profits have gone up so much faser than patient volume. The CPA prepared the following forecasted income statement for :

tabletableImmunization Clinic Inc.Projected Income Statementfor Year Ended December Revenues$ExpensesMedical supplies,$Physician salary,Nurse salary,Hourly wages,Payroll taxesbenefits,Rent,Professional fees,Equipment depreciation,Utilities,Advertising,Miscellaneous expenses,continued

continued

Healthcare Applications: A Casebook in Accounting and Financial Management

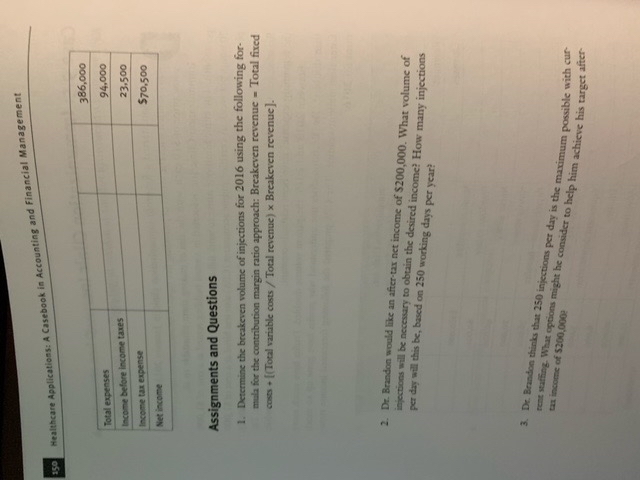

tableTotal expenses,,,Income before income taxes,,,Income tax expense,,,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock