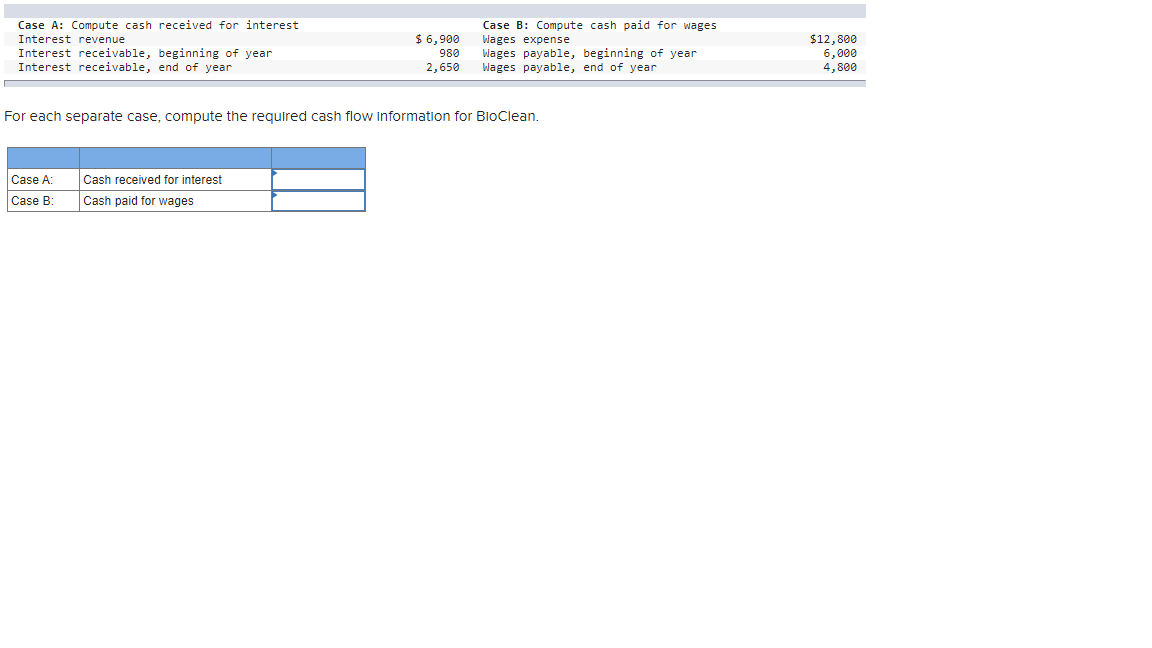

Question: Case A: Compute cash received for interest Case B: Compute cash paid for wages Interest revenue $ 6,900 Wages expense $ 12,800 Interest receivable, beginning

| Case A: Compute cash received for interest | Case B: Compute cash paid for wages | ||||||

| Interest revenue | $ | 6,900 | Wages expense | $ | 12,800 | ||

| Interest receivable, beginning of year | 980 | Wages payable, beginning of year | 6,000 | ||||

| Interest receivable, end of year | 2,650 | Wages payable, end of year | 4,800 | ||||

For each separate case, compute the required cash flow information for BioClean.

Case A: Compute cash received for interest Interest revenue Interest receivable, beginning of year Interest receivable, end of year $ 6,900 980 2,650 Case B: Compute cash paid for wages Wages expense Wages payable, beginning of year Wages payable, end of year $12,800 6,000 4,800 For each separate case, compute the required cash flow Information for BioClean. Case A Case B: Cash received for interest Cash paid for wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts