Question: Case A Simple Company had $ 1 6 0 , 0 0 0 income from continuing operations before tax and reported a $ 2 0

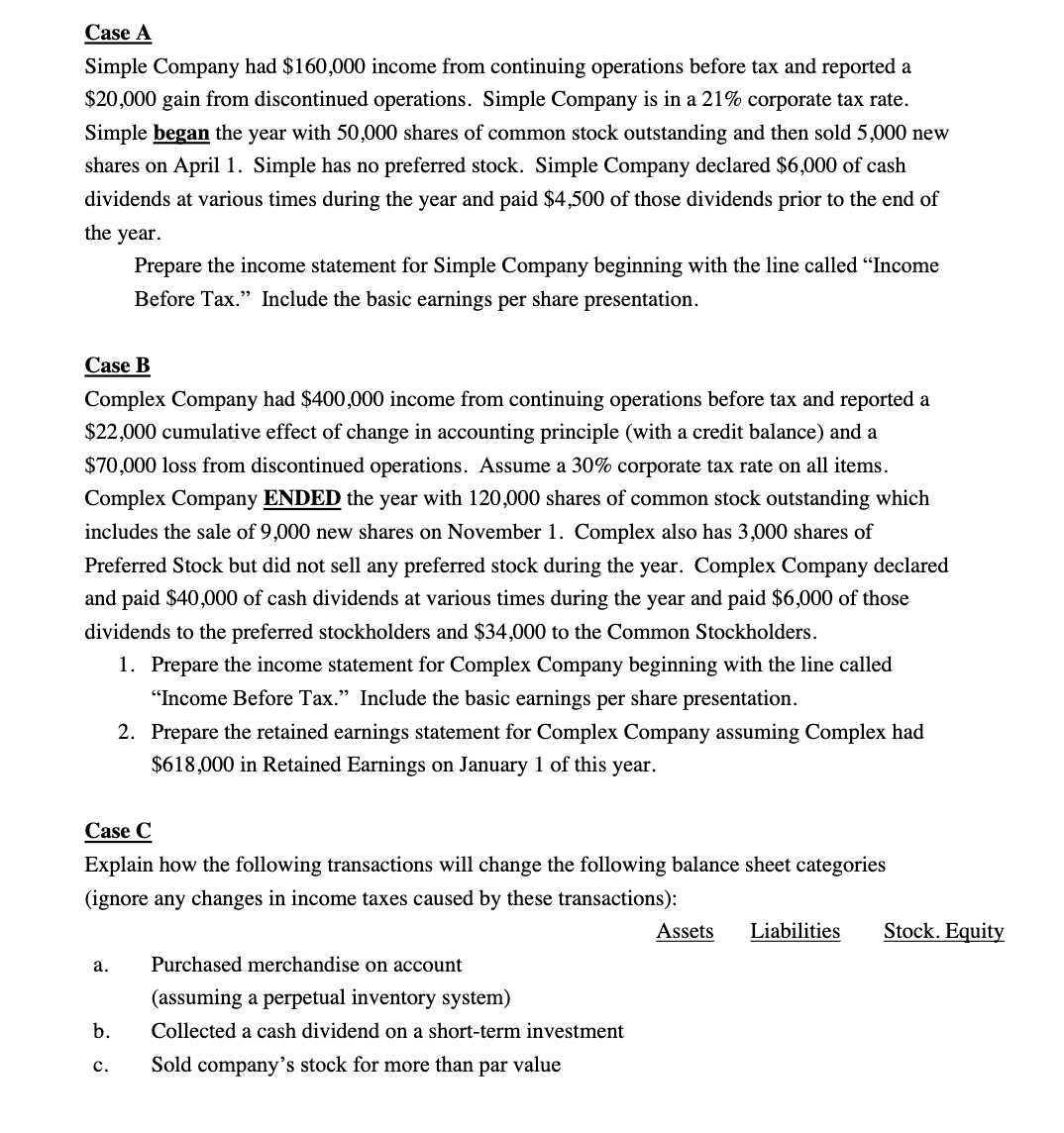

Case A

Simple Company had $ income from continuing operations before tax and reported a

$ gain from discontinued operations. Simple Company is in a corporate tax rate.

Simple began the year with shares of common stock outstanding and then sold new

shares on April Simple has no preferred stock. Simple Company declared $ of cash

dividends at various times during the year and paid $ of those dividends prior to the end of

the year.

Prepare the income statement for Simple Company beginning with the line called "Income

Before Tax." Include the basic earnings per share presentation.

Case B

Complex Company had $ income from continuing operations before tax and reported a

$ cumulative effect of change in accounting principle with a credit balance and a

$ loss from discontinued operations. Assume a corporate tax rate on all items.

Complex Company ENDED the year with shares of common stock outstanding which

includes the sale of new shares on November Complex also has shares of

Preferred Stock but did not sell any preferred stock during the year. Complex Company declared

and paid $ of cash dividends at various times during the year and paid $ of those

dividends to the preferred stockholders and $ to the Common Stockholders.

Prepare the income statement for Complex Company beginning with the line called

"Income Before Tax." Include the basic earnings per share presentation.

Prepare the retained earnings statement for Complex Company assuming Complex had

$ in Retained Earnings on January of this year.

Case C

Explain how the following transactions will change the following balance sheet categories

ignore any changes in income taxes caused by these transactions:

Assets Liabilities Stock. Equity

a Purchased merchandise on account

assuming a perpetual inventory system

b Collected a cash dividend on a shortterm investment

c Sold company's stock for more than par value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock