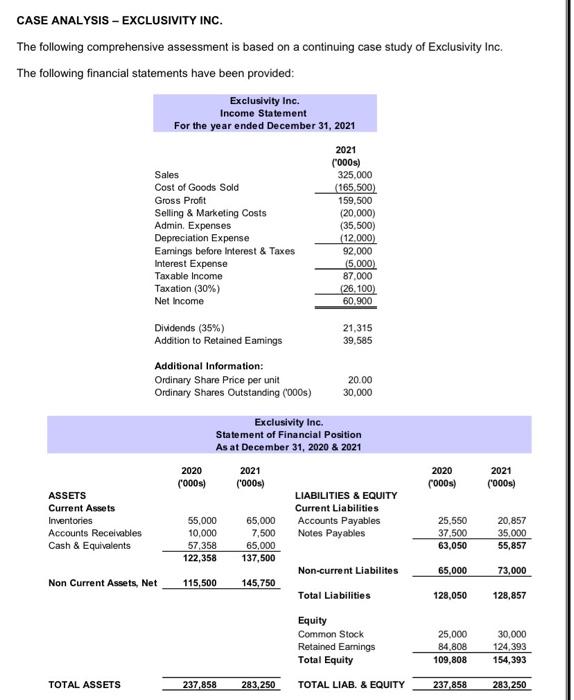

Question: CASE ANALYSIS - EXCLUSIVITY INC. The following comprehensive assessment is based on a continuing case study of Exclusivity Inc. The following financial statements have been

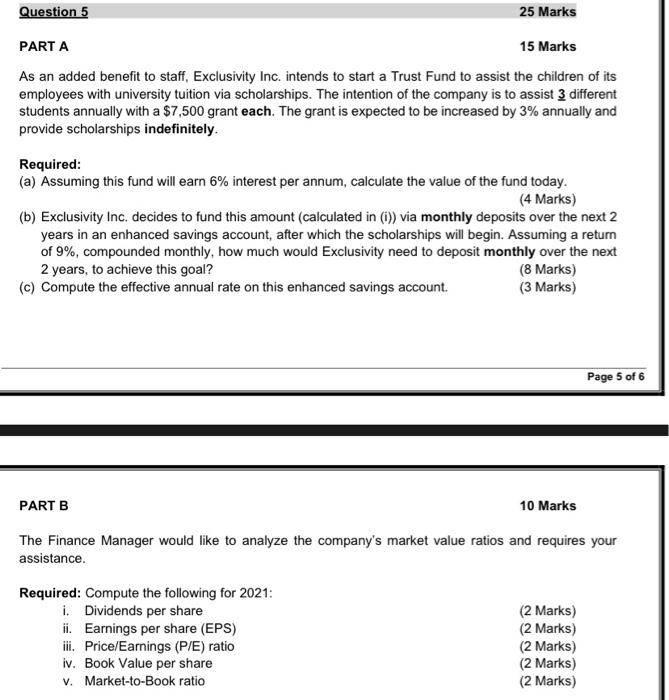

CASE ANALYSIS - EXCLUSIVITY INC. The following comprehensive assessment is based on a continuing case study of Exclusivity Inc. The following financial statements have been provided: PART A 15 Marks As an added benefit to staff, Exclusivity Inc. intends to start a Trust Fund to assist the children of its employees with university tuition via scholarships. The intention of the company is to assist 3 different students annually with a $7,500 grant each. The grant is expected to be increased by 3% annually and provide scholarships indefinitely. Required: (a) Assuming this fund will earn 6% interest per annum, calculate the value of the fund today. (4 Marks) (b) Exclusivity Inc. decides to fund this amount (calculated in (i)) via monthly deposits over the next 2 years in an enhanced savings account, after which the scholarships will begin. Assuming a return of 9%, compounded monthly, how much would Exclusivity need to deposit monthly over the next 2 years, to achieve this goal? (8 Marks) (c) Compute the effective annual rate on this enhanced savings account. (3 Marks) PART B 10 Marks The Finance Manager would like to analyze the company's market value ratios and requires your assistance. Required: Compute the following for 2021: i. Dividends per share (2 Marks) ii. Earnings per share (EPS) (2 Marks) iii. Price/Earnings (P/E) ratio (2 Marks) iv. Book Value per share (2 Marks) v. Market-to-Book ratio (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts