Question: Case analysis is a multi-step process. This exercise will help you to learn to analyze a case by framing questions, labeling variables, synthesizing information, summarizing

Case analysis is a multi-step process. This exercise will help you to learn to analyze a case by framing questions, labeling variables, synthesizing information, summarizing facts, and drawing conclusions. You can use this approach to develop thoughtful solutions to any business issue or situation.

The Vanguard Group

The Vanguard Group is one of the largest asset managers in the United States, with over $2.5 trillion in assets under management and 12,000 employees at the end of 2014.i Vanguard provides individual and institutional investors with mutual funds, exchange-traded funds, bonds, certificates of deposits, annuities, 529 college savings plans, brokerage services, and investment advisory services.ii The majority of Vanguards assets are housed in instruments called mutual funds. Vanguards mutual fund business is among the largest in the United States, competing with players such as Fidelity Investments and T. Rowe Price. Unlike many other mutual fund companies, Vanguard primarily distributes its funds directly to consumers rather than through outside brokerage houses.

From inception, Vanguard has focused all of its activities on bringing low-cost and high-quality service to customers. The companys average expense ratio is among the lowest in the business,iii and all of its mutual funds are no-load funds, which have no transaction costs because they are sold without commission or sales charges.

Another component of Vanguards low-cost approach involves promoting index funds. Index funds typically mirror a major market index such as the S&P 500 and allow the investor to own a broad array of stocks. This model offers the investor diversification and low trading costs as the fund manager constructs the portfolio and does not make changes unless a company falls out of the mirrored index. In contrast, managers of nonindexed mutual funds may buy or sell different stocks for a fund on a weekly or even daily basis, increasing overall costs for the investor. While Vanguard focuses primarily on index funds, it also offers actively managed mutual funds similar to those at Fidelity. Through this activity, Vanguard is able to meet some of the differentiation measures that other firms have established, yet still maintains its overall cost leadership focus.

Vanguard also performs other activities that lead to its cost leadership position in the industry. The firm rarely advertises in traditional media, preferring word-of-mouth publicity instead. Most of the firms transactions occur on the Web, in contrast to many firms that conduct trades by phone. This Web approach creates a much lower cost per transaction than that of many of its competitors.

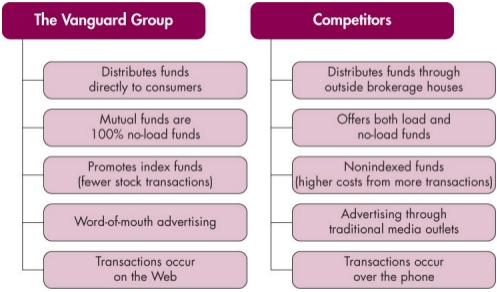

As you can see by Vanguards activities, every aspect of the business revolves around bringing low costs to the consumer (see Figure 5.10). While many competitors have attempted to copy some of Vanguards activities by offering their own index funds, Vanguard has been able to maintain its strategic position because of the fit among its activities created by promoting low cost in every aspect of the business.

Figure 5.10 - Vanguards Low-Cost Strategy

i The Vanguard Group, Inc. Company Report, 2014, http://www.premium.hoovers.com, accessed February 16, 2015.

ii Luis M. Viceira and Helen H. Tung, The Vanguard Group, Inc. in 2006 and Target Retirement Funds, Harvard Business School Case No. 9-207-129, rev. January 28, 2008 (Boston, MA: HBS Publishing, 2007), p. 2.

iii Ibid., p. 3.

Framing

1. Vanguard's strategy is:

| |||

| |||

| |||

|

Labeling

2. If Vanguard were to conduct a SWOT analysis, which of the following would be considered a strength?

| |||

| |||

| |||

|

Summarizing

3. By shunning advertising on traditional media and conducting transactions through its website, Vanguard:

| |||

| |||

| |||

|

Synthesizing

4. Vanguard feels confident it can create a nonindexed fund that will consistently perform above the S&P 500. Doing so will likely:

| |||

| |||

| |||

|

Concluding

5. The future of Vanguard:

| |||

| |||

| |||

|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts