Question: case B. help creating journal entry Every three years, a major component (Part #45) in a machine must be replaced. By doing this regular but

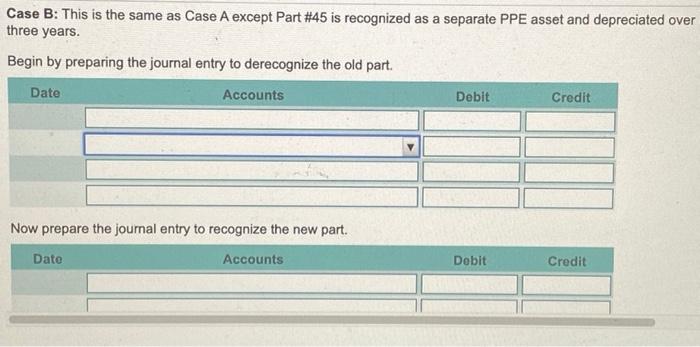

Every three years, a major component (Part #45) in a machine must be replaced. By doing this regular but expensive repair, the machine can be used for 15 years. If Part #45 were not replaced, the machine could be used only for a maximum of six years. When the machine was originally purchased for $3,000,000, it was set up as one asset and depreciated over its estimated useful life of 15 years. Recently, this repair was completed at a cost of $650,000 for Part #45. The earlier Part #45 cost $500,000 when it was installed three years ago. Neither the old nor the new Part #45 has residual value. Case B: This is the same as Case A except Part #45 is recognized as a separate PPE asset and depreciated over three years. Begin by preparing the journal entry to derecognize the old part. Date Accounts Debit Credit Now prepare the journal entry to recognize the new part. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts