Question: CASE: Blizzy CoffeeStudent Name: Class/Section: 1. French is concerned about the amount of cash that the business is consuming. How much cash has Bizzy Coffee

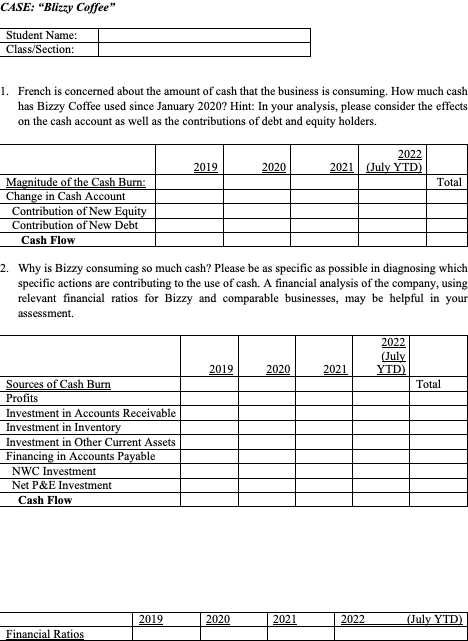

CASE: "Blizzy Coffee"Student Name: Class/Section: 1. French is concerned about the amount of cash that the business is consuming. How much cash has Bizzy Coffee used since January 2020? Hint: In your analysis, please consider the effects on the cash account as well as the contributions of debt and equity holders. 2019 2020 2021 2022 (July YTD) Magnitude of the Cash Burn: TotalChange in Cash Account Contribution of New Equity Contribution of New Debt Cash Flow 2. Why is Bizzy consuming so much cash? Please be as specific as possible in diagnosing which specific actions are contributing to the use of cash. A financial analysis of the company, using relevant financial ratios for Bizzy and comparable businesses, may be helpful in your assessment. 2019 2020 2021 2022 (July YTD) Sources of Cash Burn TotalProfits Investment in Accounts Receivable Investment in Inventory Investment in Other Current Assets Financing in Accounts Payable NWC Investment Net P&E Investment Cash Flow 2019 2020 2021 2022 (July YTD)Financial Ratios Revenue Growth Return on Assets Gross Margin Operating Margin Net Margin AR Days Inventory Days AP Days P&E Turns Note: AR = accounts receivable; AP = accounts payable; P&E = property and equipment; NWC = net working capital.3. How much additional cash does Bizzy ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts