Question: Case C Below is the company data for Apple Inc, currently being traded on the US markets. The measures are stated om millions of USD

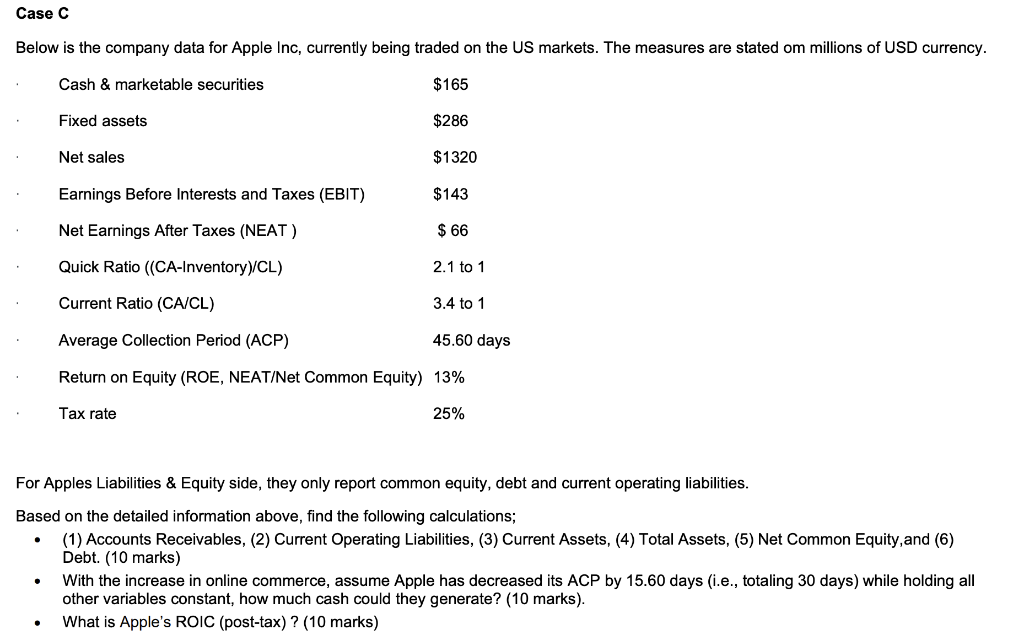

Case C Below is the company data for Apple Inc, currently being traded on the US markets. The measures are stated om millions of USD currency. Cash & marketable securities $165 Fixed assets $286 Net sales $1320 Earnings Before Interests and Taxes (EBIT) $143 Net Earnings After Taxes (NEAT) $ 66 Quick Ratio ((CA-Inventory)/CL) 2.1 to 1 Current Ratio (CA/CL) 3.4 to 1 Average Collection Period (ACP) 45.60 days Return on Equity (ROE, NEAT/Net Common Equity) 13% Tax rate 25% . For Apples Liabilities & Equity side, they only report common equity, debt and current operating liabilities. Based on the detailed information above, find the following calculations; (1) Accounts Receivables, (2) Current Operating Liabilities, (3) Current Assets, (4) Total Assets, (5) Net Common Equity, and (6) Debt. (10 marks) With the increase in online commerce, assume Apple has decreased its ACP by 15.60 days (i.e., totaling 30 days) while holding all other variables constant, how much cash could they generate? (10 marks). What is Apple's ROIC (post-tax) ? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts