Question: CASE CASE 8.1 Low Nail Company After making some wise short-term investments at a race nails to order at any time. Initially, only two costs

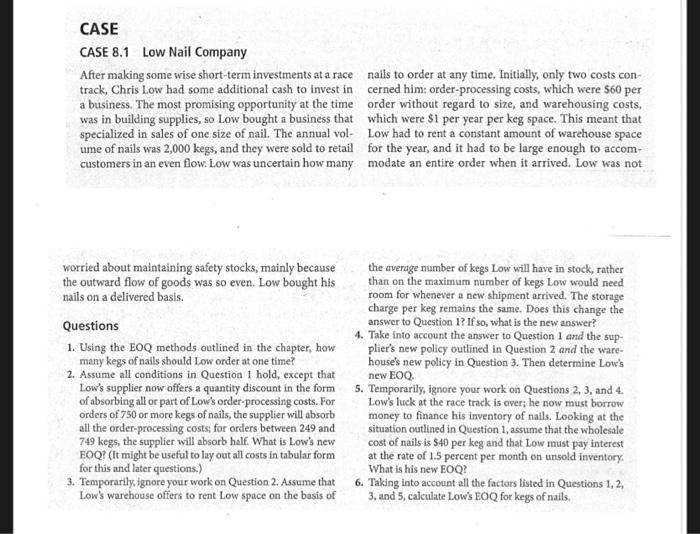

CASE CASE 8.1 Low Nail Company After making some wise short-term investments at a race nails to order at any time. Initially, only two costs con- track, Chris Low had some additional cash to invest in cerned him: order-processing costs, which were 560 per a business. The most promising opportunity at the time order without regard to size, and warehousing costs, was in building supplies, so Low bought a business that which were $1 per year per keg space. This meant that specialized in sales of one size of nail. The annual vol- Low had to rent a constant amount of warehouse space ume of nails was 2,000 kegs, and they were sold to retail for the year, and it had to be large enough to accom- customers in an even flow. Low was uncertain how many modate an entire order when it arrived. Low was not worried about maintaining safety stocks, mainly because the outward flow of goods was so even. Low bought his nails on a delivered basis. Questions 1. Using the EOQ methods outlined in the chapter, how many kegs of nails should Low order at one time? 2. Assume all conditions in Question 1 hold, except that Low's supplier now offers a quantity discount in the form of absorbing all or part of Low's order-processing costs. For orders of 750 or more kegs of nails, the supplier will absorb all the order-processing costs, for orders between 249 and 749 kegs, the supplier will absorb half. What is Low's new EOQ? (It might be useful to lay out all costs in tabular form for this and later questions.) 3. Temporarily, ignore your work on Question 2. Assume that Low's warehouse offers to rent Low space on the basis of the average number of kegs Low will have in stock, rather than on the maximum number of kegs Low would need room for whenever a new shipment arrived. The storage charge per keg remains the same. Does this change the answer to Question 1? If so, what is the new answer? 4. Take into account the answer to Question 1 and the sup- plier's new policy outlined in Question 2 and the ware- house's new policy in Question 3. Then determine Low's new EOQ. 5. Temporarily, ignore your work on Questions 2, 3, and 4. Low's luck at the race track is over; he now must borrow money to finance his inventory of nails. Looking at the situation outlined in Question 1, assume that the wholesale cost of nails is $40 per keg and that Low must pay interest at the rate of 1.5 percent per month on unsold inventory What is his new EOQ? 6. Taking into account all the factors listed in Questions 1, 2, 3, and 5, calculate Low's EOQ for kegs of nails