Question: Case Company allocates $5.00 overhead to each unit produced. The company uses a plantwide overhead rate with machine hours as the allocation base. Given the

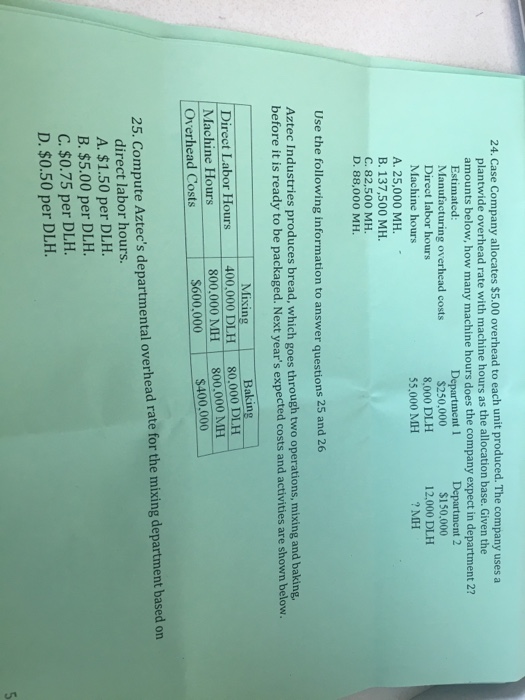

Case Company allocates $5.00 overhead to each unit produced. The company uses a plantwide overhead rate with machine hours as the allocation base. Given the amounts below, how many machine hours does the company expect in department 2? Estimated: Department 1 Department 2 Manufacturing overhead costs $250,000 $150,000 Direct labor hours 8,000 DLH 12,000 DLH Machine hours 55,000 MH ?MH A. 25,000 MH. B. 137,500 MH. C. 82,500 MH. D. 88,000 MM. Use the following information to answer questions 25 and 26 Aztec Industries produces bread, which goes through two operations, mixing and baking, before it is ready to be packaged. Next year's expected costs and activities are shown below. Compute Aztec's department overhead rate for the mixing department based on direct labor hours. A. $1.50 per DLH. B. $5.00 per DLH. C. $0.75 per DLH. D. $0.50 per DLH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts