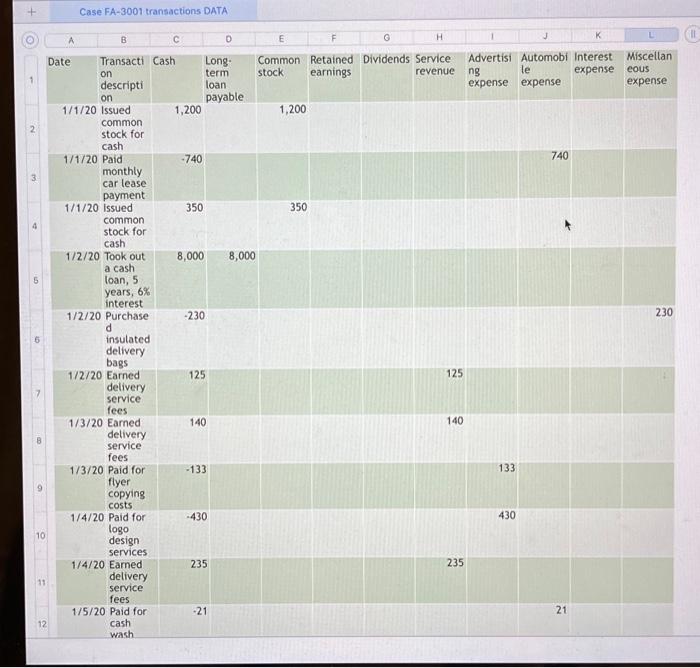

Question: Case FA-3001 transactions DATA = A B D E K H Advertisi Automobi Interest Miscellan ng le expense eous expense expense expense 740 4 5

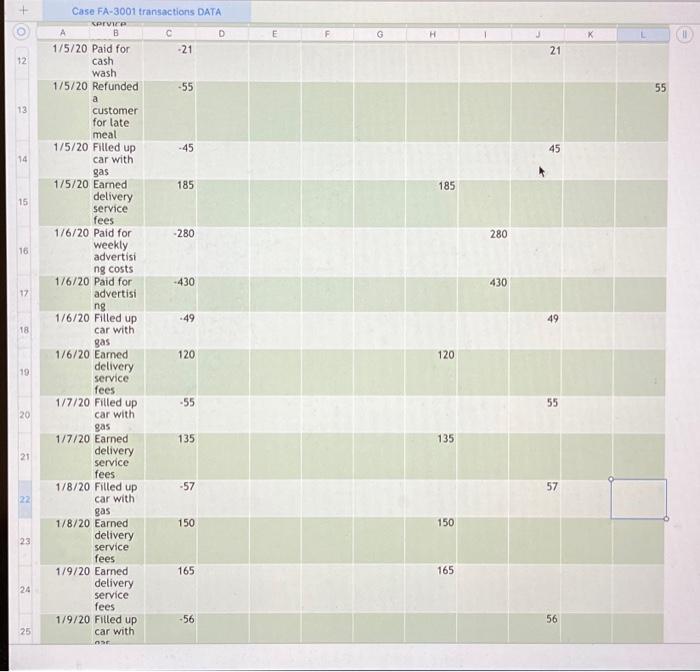

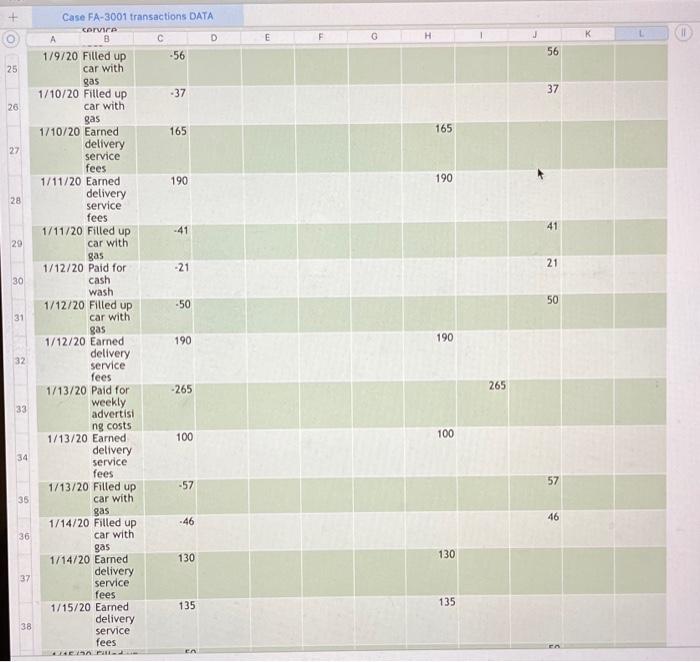

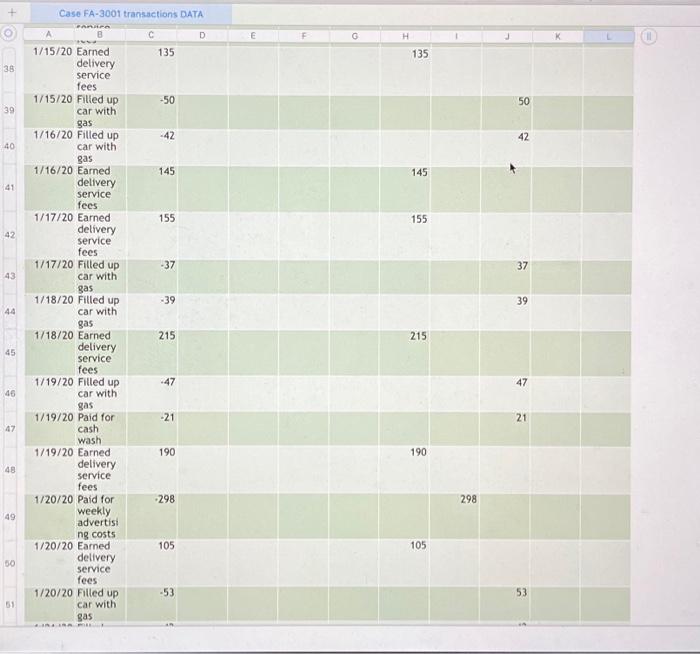

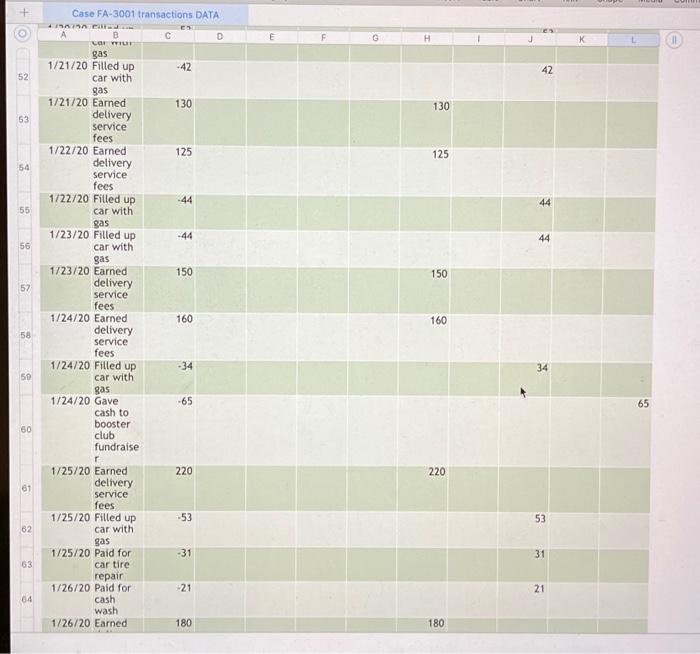

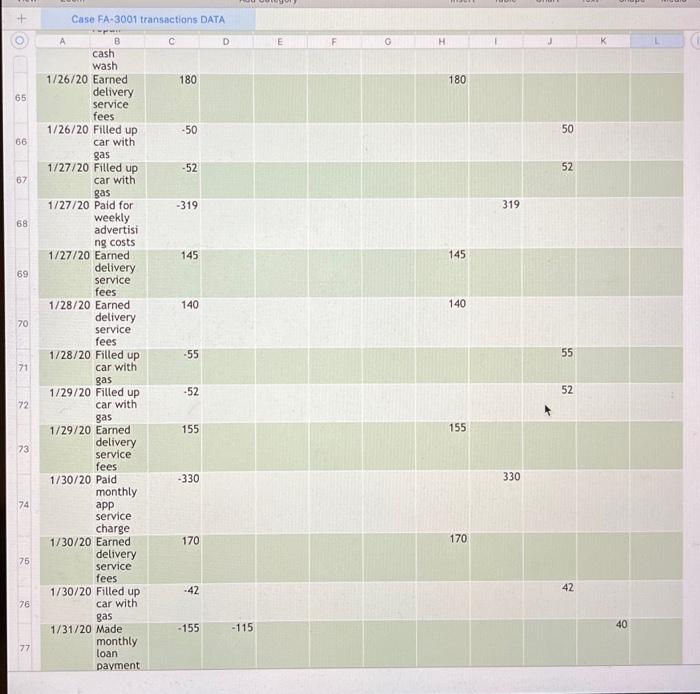

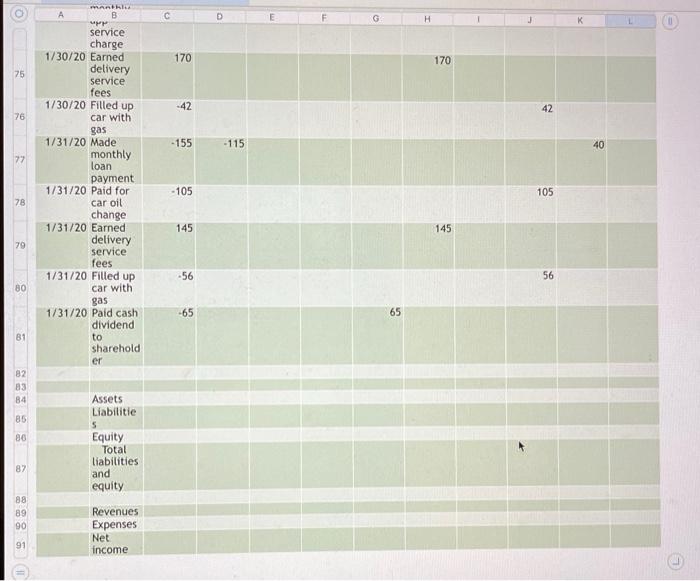

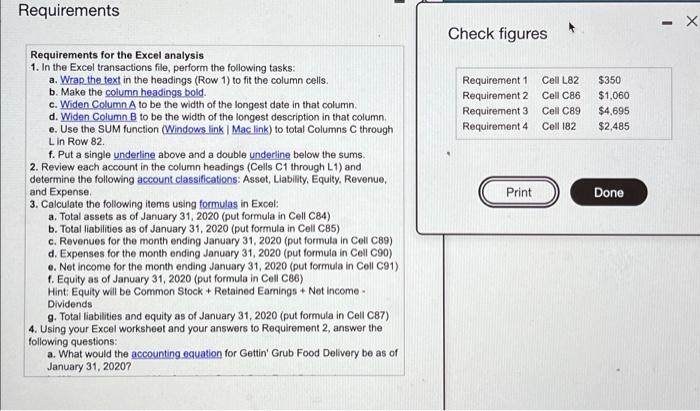

Case FA-3001 transactions DATA = A B D E K H Advertisi Automobi Interest Miscellan ng le expense eous expense expense expense 740 4 5 230 Date Transacti Cash Long: Common Retained Dividends Service on term stock earnings revenue descripti loan on payable 1/1/20 Issued 1,200 1,200 common stock for cash 1/1/20 Paid -740 monthly car lease payment 1/1/20 Issued 350 350 common stock for cash 1/2/20 Took out 8,000 8,000 a cash loan, 5 years, 6% interest 1/2/20 Purchase -230 d insulated delivery bags 1/2/20 Earned 125 125 delivery service fees 1/3/20 Earned 140 140 delivery service fees 1/3720 Paid for -133 flyer copying costs 1/4/20 Paid for -430 logo design services 1/4/20 Earned 235 235 delivery service fees 1/5/20 Paid for -21 cash wash 133 430 10 11 21 12 G H 21 12 55 13 45 14 185 15 280 16 430 17 Case FA-3001 transactions DATA Cruire A B D 1/5/20 Paid for -21 cash wash 1/5/20 Refunded -55 a customer for late meal 1/5/20 Filled up -45 car with gas 1/5720 Earned 185 delivery service fees 176/20 Paid for -280 weekly advertisi ng costs 176/20 paid for -430 advertisi ng 1/6/20 Filled up -49 car with gas 1/6/20 Eamed 120 delivery service fees 1/7/20 Filled up car with gas 1/7/20 Earned 135 delivery service fees 1/8/20 Filled up -57 car with gas 1/8/20 Earned delivery service fees 1/9/20 Earned 165 delivery service fees 1/9/20 Filled up -56 car with 49 18 120 19 55 55 20 135 21 57 22 150 150 23 165 24 56 25 H 56 25 37 26 165 27 190 28 41 29 21 30 50 31 Case FA-3001 transactions DATA corvire A B D 1/9/20 Filled up -56 car with gas 1/10/20 Filled up -37 car with gas 1/10/20 Earned 165 delivery service fees 1/11/20 Earned 190 delivery service fees 1/11/20 Filled up -41 car with gas 1/12/20 Paid for -21 cash wash 1/12/20 Filled up -50 car with gas 1/12/20 Earned 190 delivery service fees 1713/20 Paid for -265 weekly advertisi ng costs 1/13/20 Earned 100 delivery service fees 1/13/20 Filled up -57 car with gas 1/14/20 Filled up -46 car with gas 1/14/20 Earned 130 delivery service fees 1/15/20 Earned 135 delivery service fees 190 32 265 33 100 57 35 46 36 130 37 135 38 EA G H 135 38 50 39 42 40 145 41 155 42 37 43 39 40 Case FA-3001 transactions DATA CAR D 1/15/20 Earned 135 delivery service fees 1/15/20 Filled up -50 car with gas 1/16/20 Filled up -42 car with gas 1/16/20 Earned 145 delivery service fees 1/17/20 Earned 155 delivery service fees 1/17/20 Filled up -37 car with gas 1/18/20 Filled up -39 car with gas 1/18/20 Earned 215 delivery service fees 1/19/20 Filled up car with gas 1/19/20 Paid for -21 cash wash 1719/20 Earned 190 delivery service fees 1/20/20 Paid for -298 weekly advertisi ng costs 1/20/20 Earned 105 delivery service fees 1/20/20 Filled up car with gas 215 45 47 46 21 47 190 48 298 49 105 50 53 53 51 E F G K L 42 52 130 53 125 54 44 55 Case FA-3001 transactions DATA ANA B D ON Y gas 1/21/20 Filled up .42 car with gas 1/21/20 Earned 130 delivery service fees 1/22/20 Earned 125 delivery service fees 1/22/20 Filled up -44 car with gas 1/23/20 Filled up -44 car with gas 1/23/20 Earned 150 delivery service fees 1/24/20 Earned 160 delivery service fees 1/24/20 Filled up -34 car with gas 1/24/20 Gave -65 cash to booster club fundraise 44 56 150 57 160 58 34 50 65 60 220 220 61 -53 53 62 1/25/20 Earned delivery service fees 1/25/20 Filled up car with gas 1/25/20 Paid for car tire repair 1/26/20 Paid for cash wash 1/26/20 Earned -31 31 63 -21 21 64 180 180 + 0 E G H 180 65 50 66 52 67 319 68 145 69 140 70 Case FA-3001 transactions DATA A B D cash wash 1/26/20 Earned 180 delivery service fees 1/26/20 Filled up -50 car with gas 1/27/20 Filled up -52 car with gas 1/27/20 Paid for -319 weekly advertisi ng costs 1/27/20 Earned 145 delivery service fees 1/28/20 Earned 140 delivery service fees 1/28/20 Filled up -55 car with gas 1/29/20 Filled up -52 car with gas 1/29/20 Earned 155 delivery service fees 1/30/20 Paid -330 monthly app service charge 1/30/20 Earned 170 delivery service fees 1/30/20 Filled up -42 car with gas 1/31/20 Made -155 - 115 monthly loan payment 55 71 52 72 155 73 330 74 170 75 42 76 40 77 o A E G H 170 170 75 -42 42 76 - 155 - 115 40 77 Athle B service charge 1/30/20 Earned delivery Service fees 1/30/20 Filled up car with gas 1/31/20 Made monthly loan payment 1/31/20 Paid for car oil change 1/31/20 Earned delivery service fees 1/31/20 Filled up car with gas 1/31/20 Paid cash dividend to sharehold er - 105 105 78 145 145 79 -56 56 80 -65 65 81 82 83 84 85 80 Assets Liabilitie 5 Equity Total liabilities and equity 82 88 89 90 Revenues Expenses Net income 91 Requirements - Check figures Requirement 1 Cell L82 Requirement 2 Cell C86 Requirement 3 Cell C89 Requirement 4 Coll 182 $350 $1,060 $4,695 $2,485 Print Done Requirements for the Excel analysis 1. In the Excel transactions file, perform the following tasks: a. Wrap the text in the headings (Row 1) to fit the column cells. b. Make the column headings bold. C. Widen Column A to be the width of the longest date in that column d. Widen Column B to be the width of the longest description in that column e. Use the SUM function (Windows link | Mac link) to total Columns C through Lin Row 82. f. Put a single underline above and a double underline below the sums 2. Review each account in the column headings (Cells C1 through L1) and determine the following account classifications: Asset, Liability, Equity, Revenue, and Expense 3. Calculate the following items using formulas in Excel: a. Total assets as of January 31, 2020 (put formula in Cell C84) b. Total liabilities as of January 31, 2020 (put formula in Coll C85) c. Revenues for the month ending January 31, 2020 (put formula in Cell C89) d. Expenses for the month onding January 31, 2020 (put formula in Cell C90) e. Net income for the month ending January 31, 2020 (put formula in Coll C91) 1. Equity as of January 31, 2020 (put formula in Cell C86) Hint Equity will be Common Stock + Retained Earnings. Net Income Dividends 9. Total liabilities and equity as of January 31, 2020 (put formula in Cell C87) 4. Using your Excel worksheet and your answers to Requirement 2, answer the following questions: a. What would the accounting oquation for Gettin' Grub Food Delivery be as of January 31, 20207 Requirements f. Put a single underline above and a double underline below the sums. 2. Review each account in the column headings (Cells C1 through L1) and determine the following account classifications: Asset, Liability, Equity, Revenue, and Expense. 3. Calculate the following items using formulas in Excel: a. Total assets as of January 31, 2020 (put formula in Cell C84) b. Total liabilities as of January 31, 2020 (put formula in Cell C85) c. Revenues for the month ending January 31, 2020 (put formula in Cell C89) d. Expenses for the month ending January 31, 2020 (put formula in Cell C90) e. Net income for the month ending January 31, 2020 (put formula in Cell C91) f. Equity as of January 31, 2020 (put formula in Cell C86) Hint: Equity will be Common Stock + Retained Earnings + Net income- Dividends g. Total liabilities and equity as of January 31, 2020 (put formula in Cell C87) 4. Using your Excel worksheet and your answers to Requirement 2, answer the following questions: a. What would the accounting equation for Gettin' Grub Food Delivery be as of January 31, 2020? b. What accounts would be found on Gettin' Grub Food Delivery's balance sheet as of January 31, 2020? c. What accounts would be found on Gettin' Grub Food Delivery's income statement for the month ended January 31, 2020? d. Did Gettin' Grub Food Delivery have a profitable month? How do you know? e. What is the total amount that Gettin' Grub Food Delivery owes as of January 31, 2020? f. What was Gettin' Grub Food Delivery's largest total expense for January? Using your Excel worksheet, what would the accounting equation for Gettin' Grub Food Delivery be as of January 31, 2020? O A $1.060 = $1,550 + $(425) - $65 OB. $4,695 = $(425) + $5,120 C. $(425) = $4,695 - $5,120 D. $8,945 - $7,885 + $1,060 Which of the following items are assets? (Select all that apply.) A. Retained earnings C. Dividends E. Service revenue B. Long-term loan payable DC Common stock F. Automobile expense H. Interest expense J. Advertising expense G. Cash I. Miscellaneous expense What accounts affect equity in the accounting equation? (Hint: These are the accounts you used for Requirement 3.f.) (Select all that apply.) A. Dividends B. Common stock D. Automobile expense C. Advertising expense E. Miscellaneous expense H. Long-term loan payable Service revenue J. Retained earnings F Cash G. Interest expenso 1 Did Gettin' Grub Food Delivery have a profitable month? How do you know? A. No, because net income is negative: OB. No, because Gettin' Grub Food Delivery has an outstanding liability balance. OC. Yes, because Gettin' Grub Food Delivery was able to pay a dividend. D. Yes, because net income is positive I Using your Excel worksheet, what were the total dividends paid as of January 31, 2020? O A. $7,885 OB. $1,550 O c. $65 OD. $5,120 What was Gettin' Grub Food Delivery's largest total expense for January? O A. Advertising expense B. Automobile expense C. Miscellaneous expense D. Interest expense

Step by Step Solution

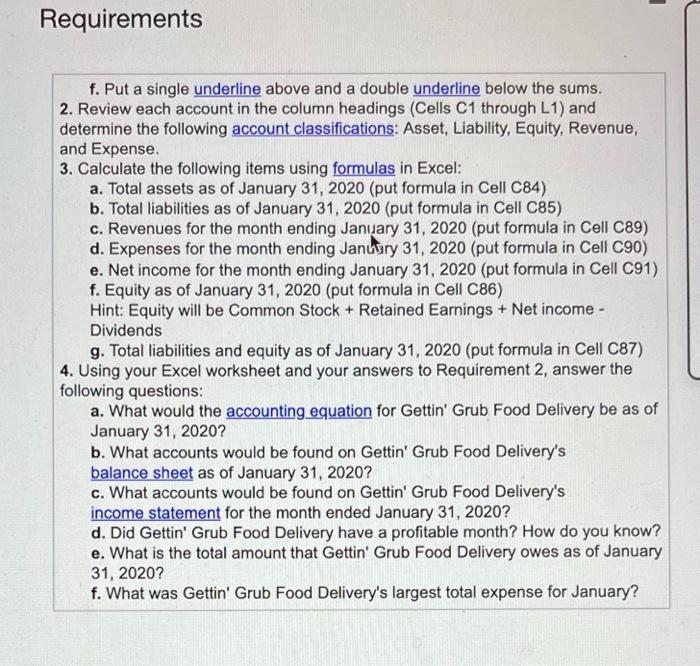

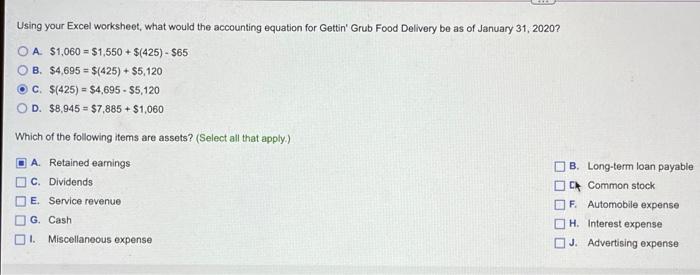

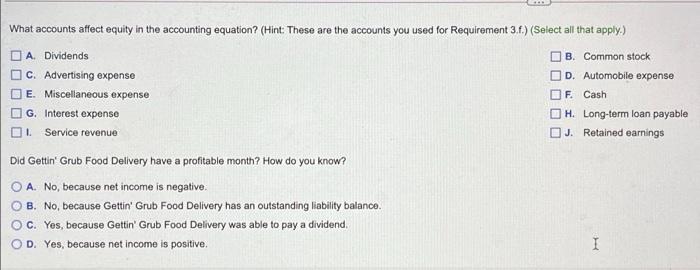

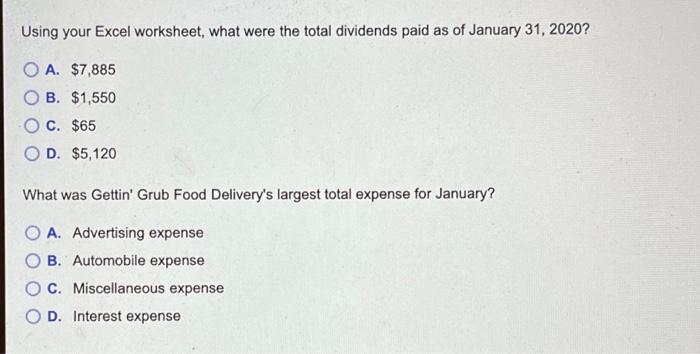

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts