Question: Case Financial Ratios A financial ratio analysis will spotlight potential issues that a business may not even be aware of. A good counselor follows

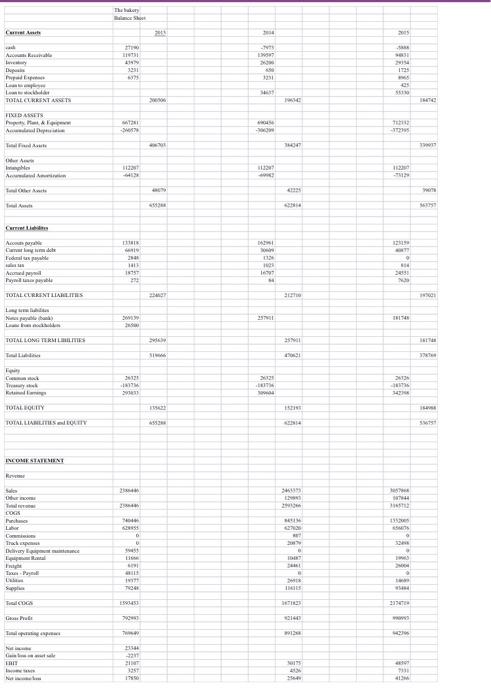

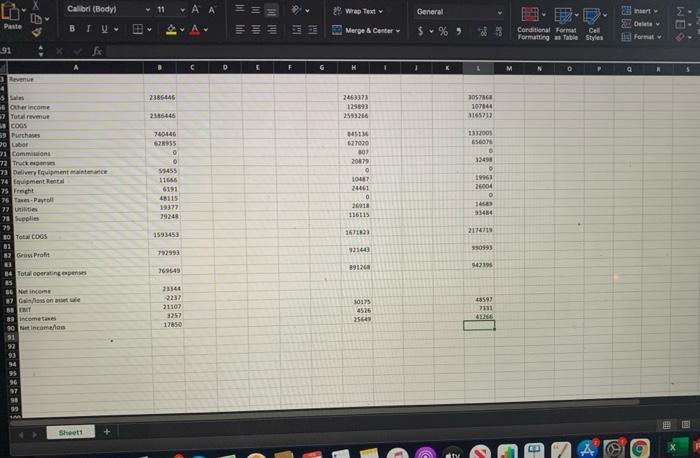

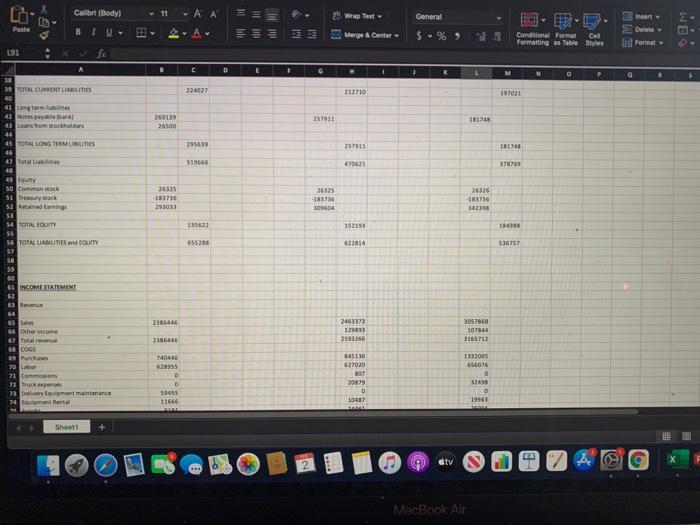

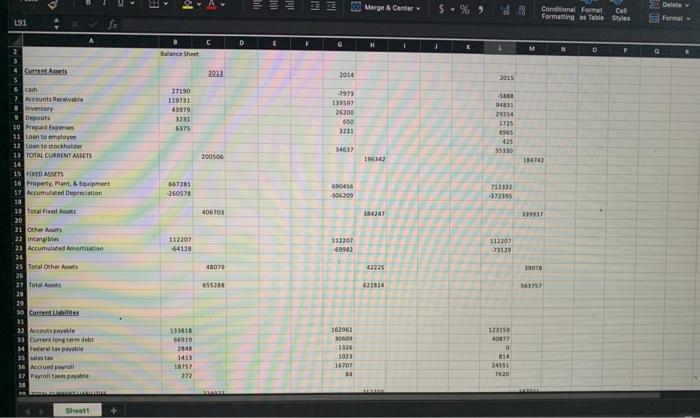

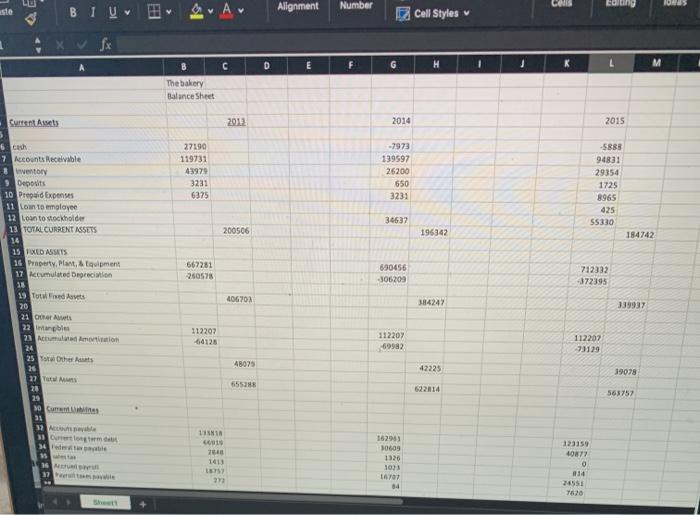

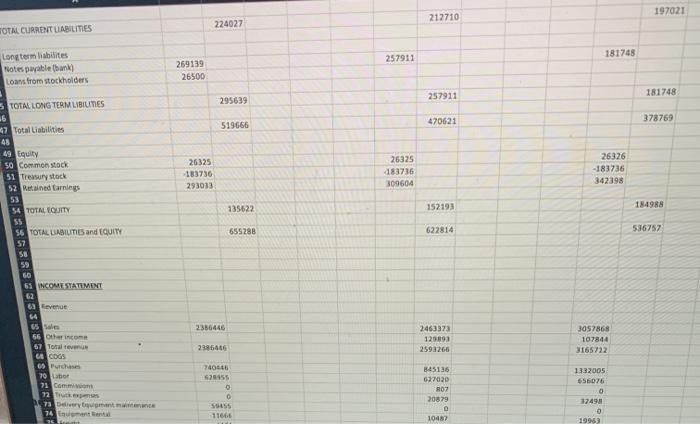

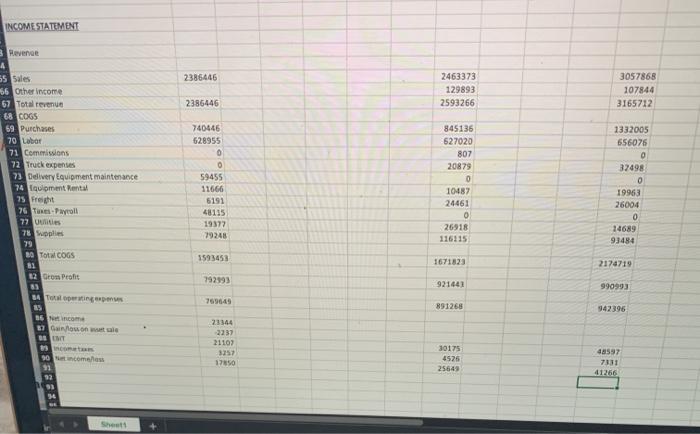

Case Financial Ratios A financial ratio analysis will spotlight potential issues that a business may not even be aware of. A good counselor follows several steps. The first is listening to the client's story. Make notes. The second step is performing a complete financial analysis. You must understand the ratios, and what they are telling you. There are many financial ratios, but not every ratio is needed in every case. However, there are several ratios that are needed in every instance. These include the liquidity ratios, both current and quick, the solvency ratio, debt to equity ratio, inventory turnover ratio, days receivable, and payables, and net profit ratio. Other ratios that may be needed, at your discretion on case by case basis, include: 1. Profitability Ratios A. ROA B. ROE C. COGS D. ROI 2. Efficiency Ratios A. Accounts receivable ratio B. Fixed asset turnover 3. Coverage Ratio A. Times interest earned B. Debt service ratio 4. Market Ratios A. Dividend yield B. P/E Ratio C. EPS D. Dividend Payout Ratio Analyze the company with the ratios you deem important to this case. The client has come to you for assistance. The owner wants to expand to another location in Raleigh. Should the owner continue on this venture?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts