Question: Case Guidelines: Cases have no word - count requirement. Simply answer the questions for each case. When using intermediate decimal calculations which require rounding, please

Case Guidelines:

Cases have no wordcount requirement. Simply answer the questions for each case.

When using intermediate decimal calculations which require rounding, please use this rule for maximum accuracy of your final answer: intermediate calculations should be rounded to as many decimal places as there are digits in your underlying data. For example, if your data is in the ten millions you should round intermediate calculations to eight decimal places. If your data is in the ten thousands you should round intermediate calculations to decimal places.

Final answers should be rounded to the nearest cent if the answer does not come out as an even dollar amount

The importance of proper rounding using the intermediate calculation rule is illustrated in the following example:

X

If you round to two decimal places, you will get X

If you round to decimal places per the above rule you will get X

If you do not round properly, your final answer will be off by

Hint: To help you with Requirement the formula for residual income is:

RI Operating Income Minimum Required Rate of Return X Operating Assets

The EVA formula illustrated in the textbook on page is a refinement of this basic formula. EVA uses aftertax income and assumes the minimum required rate of return is the cost of capital. Chapter Case

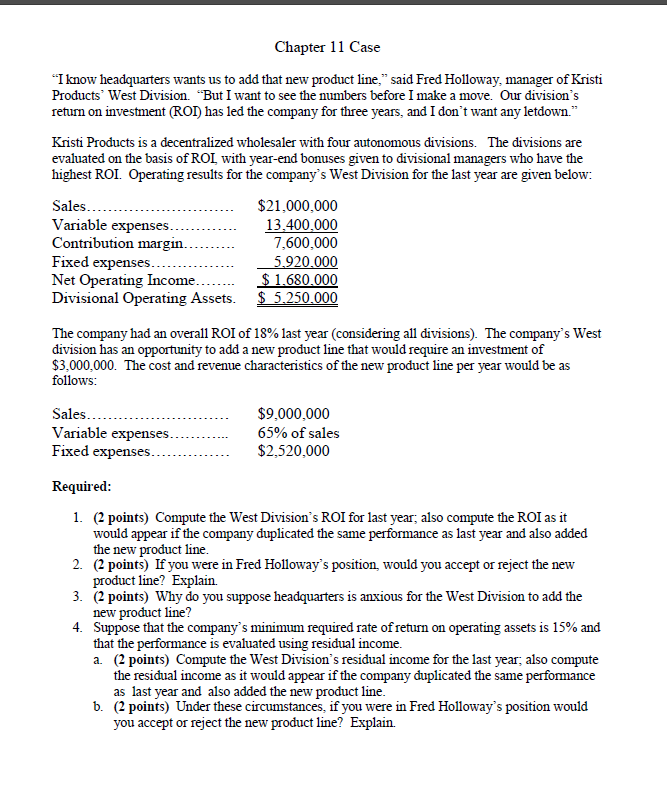

"I know headquarters wants us to add that new product line," said Fred Holloway, manager of Kristi Products' West Division. "But I want to see the numbers before I make a move. Our division's return on investment ROI has led the company for three years, and I don't want any letdown."

Kristi Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with yearend bonuses given to divisional managers who have the highest ROI. Operating results for the company's West Division for the last year are given below:

The company had an overall ROI of last year considering all divisions The company's West division has an opportunity to add a new product line that would require an investment of $ The cost and revenue characteristics of the new product line per year would be as follows:

Sales................................ $

Variable expenses............ of sales

Fixed expenses.

$

Required:

points Compute the West Division's ROI for last year; also compute the ROI as it would appear if the company duplicated the same performance as last year and also added the new product line.

points If you were in Fred Holloway's position, would you accept or reject the new product line? Explain.

points Why do you suppose headquarters is anxious for the West Division to add the new product line?

Suppose that the company's minimum required rate of return on operating assets is and that the performance is evaluated using residual income.

a points Compute the West Division's residual income for the last year; also compute the residual income as it would appear if the company duplicated the same performance as last year and also added the new product line.

b points Under these circumstances, if you were in Fred Holloway's position would you accept or reject the new product line? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock