Question: Case Instructions On March 1 , 2 0 2 5 , Walk Company paid ( $ 8 , 5 0 0 , 0

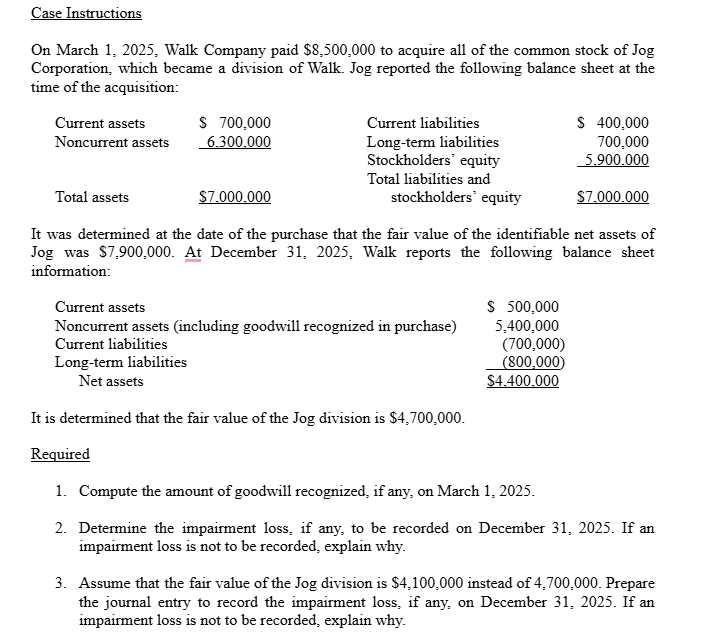

Case Instructions On March Walk Company paid $ to acquire all of the common stock of Jog Corporation, which became a division of Walk. Jog reported the following balance sheet at the time of the acquisition: It was determined at the date of the purchase that the fair value of the identifiable net assets of Jog was $ At December Walk reports the following balance sheet information: It is determined that the fair value of the Jog division is $ Required Compute the amount of goodwill recognized, if any, on March Determine the impairment loss, if any, to be recorded on December If an impairment loss is not to be recorded, explain why. Assume that the fair value of the Jog division is $ instead of Prepare the journal entry to record the impairment loss, if any, on December If an impairment loss is not to be recorded, explain why.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock