Question: Case Link Question (2) Directions: Click the Commercial Shearing Ltd case link and use the information to answer this question: What was the approximate impact

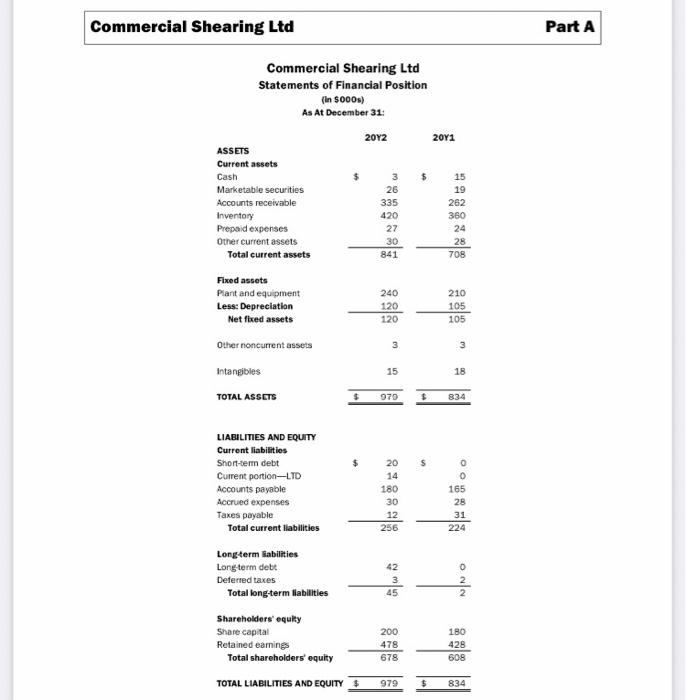

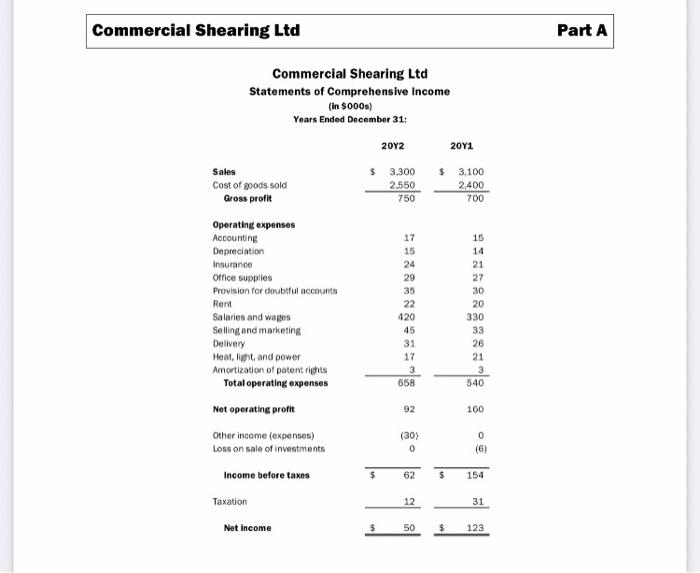

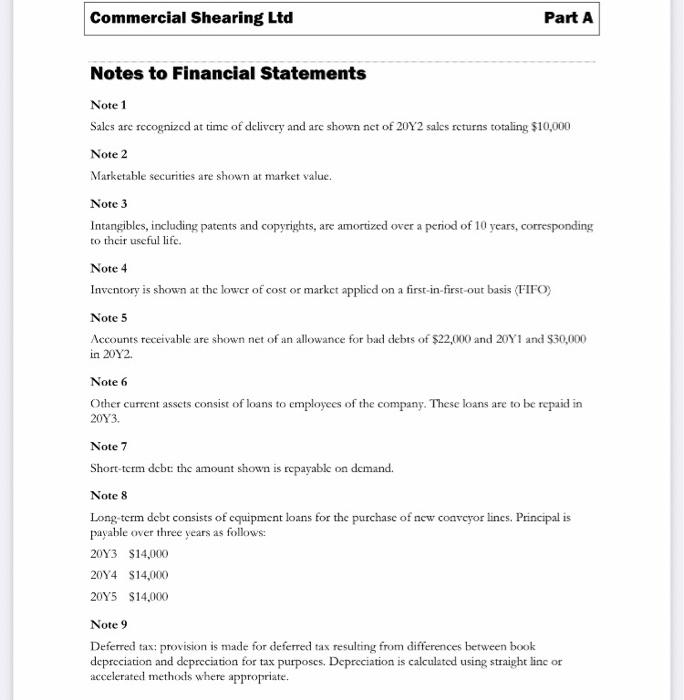

Case Link Question (2) Directions: Click the Commercial Shearing Ltd case link and use the information to answer this question: What was the approximate impact of the slowdown in Commercial Shearing's 20Y2 collection period on the company's borrowing needs? A decrease of about $57,000 A decrease of about $43,000 An increase of about $43,000 An increase of about $57,000 Commercial Shearing Ltd Commercial Shearing Ltd The following case information includes: Part A Statements of financial position Statements of comprehensive income Notes to financial statements Commercial Shearing Ltd Part A Commercial Shearing Ltd Statements of Financial Position (in 5000 As At December 31: 2012 2011 ASSETS Current assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Other current assets Total current assets 26 335 420 27 30 841 15 19 262 360 24 28 708 240 120 120 210 105 105 Fixed assets Plant and equipment Less: Depreciation Net fixed assets Other noncurrent assets Intangibles TOTAL ASSETS 3 15 18 979 $ 834 s LIABILITIES AND EQUITY Current liabilities Short-term debt Current portion-LTD Accounts payable Accrued expenses Taxes payable Total current liabilities 20 14 180 30 12 256 0 o 165 28 31 224 Long-term labilities Long term debt Deferred taxes Total long-term liabilities 42 3 45 ONN 180 Shareholders' equity Share capital Retained earnings Total shareholders' equity TOTAL LIABILITIES AND EQUITY $ 200 478 678 428 608 979 $ 834 Commercial Shearing Ltd Part A Commercial Shearing Ltd Statements of Comprehensive Income (in 8000s) Years Ended December 31 2012 2011 $ Sales Cost of goods sold Gross profit $ 3.300 2.550 750 3.100 2,400 700 15 14 21 27 30 Operating expenses Accounting Depreciation Insurance Office supplies Provision for doubtful accounts Rent Salaries and wages Selling and marketing Delivery Heat, light and power Amortization of patent rights Total operating expenses Not operating profil 17 15 24 29 35 22 420 45 31 17 3 658 20 330 33 26 21 3 540 92 100 Other income (expenses) Loss on sale of investments (30) 0 0 (6) $ 62 $ 154 Income before taxes Taxation 12 31 Net Income 50 $ 123 Commercial Shearing Ltd Part A Notes to Financial Statements Note 1 Sales are recognized at time of delivery and are shown net of 20Y2 sales returns totaling $10,000 Note 2 Marketable securities are shown at market value. Note 3 Intangibles, including patents and copyrights are amortized over a period of 10 years, corresponding to their useful life. Note 4 Inventory is shown at the lower of cost or market applicd on a first-in-first-out basis (FIFO) Note 5 Accounts receivable are shown net of an allowance for bad debts of $22,000 and 20Y1 and $30,000 in 2012 Note 6 Other current assets consist of loans to employees of the company. These loans are to be repaid in 20Y3. Note 7 Short-term debe the amount shown is repayable on demand. Note 8 Long-term debt consists of equipment loans for the purchase of new conveyor lines. Principal is payable over three years as follows: 2093 $14,000 2094 $14,000 2095 $14,000 Note 9 Deferred tax; provision is made for deferred tax resulting from differences between book depreciation and depreciation for tax purposes. Depreciation is calculated using straight linc or accelerated methoxis where appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts