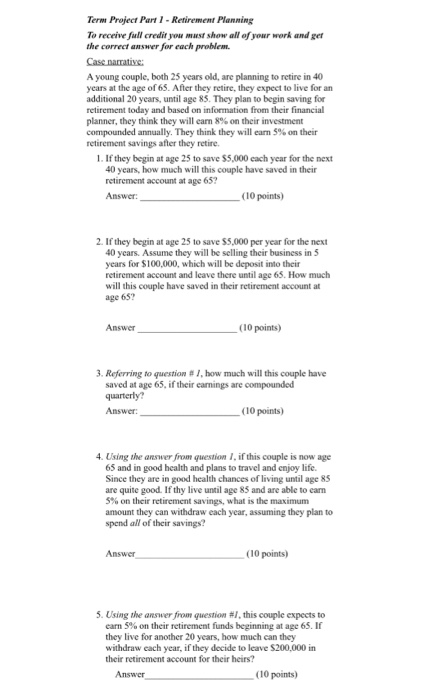

Question: Case narrative: A young couple, both 25 years old, are planning to retire in 40 years at the age of 65. After they retire, they

1:15 Back Term project-Part 1.docx e Preject PartI-Reninement Planning the correct ewswer each A young coupile, both 25 ycars old ane planning o years at the age of65. Afer y renre,they espeut she fr an planter, they think they will cam 8%onther tmet compounded amually. They think y will e n entr retirement savings after they setie 1. I dhey bepin at age 25 to sae 5,000 cach yar or the m 40 ycars, how mach will this couplic have av inhi (00 p 2. If they bepin at age 25lo sae S5,000 per year for the neu 10 years. Assame they will be selling their ss ntircment apcount and Ieave there until a 65. Ho will this couple harve saved in their aco (30 pom aved at ape5, if ther carnings are compoundod poinns 65 and in pood health and plans to travel andfe ane quite good If' thy live uveil ape 85 and an at amoum they can withdraw each year assuming ay pln pend af of heir savis Aner (10 points they live for another 20 years, how mach nh their notingment account for their hei 0 poin Previous Next To Do Inbox Term Project Part 1 -Retirement Planming To receive full credit you must show all ef your werk and get the correct answer for each problem. A young couple, both 25 years old, are planning to retire in 40 years at the age of 65. After they retire, they expect to live for an additional 20 years, until age 83. They plan to begin saving for retirement today and based on information from their financial planner, they think they will earn 8% on their investment compounded annually. They think they will earn 5% on their retirement savings after they retire. 1. If they begin at age 25 to save $5,000 each year for the next 40 years, how much will this couple have saved in their retirement account at age 65? Answer (10 points) at age 25 to save $5,000 per year for next 40 years. Assume they will be selling their business in5 years for S100,000, which will be deposit into their retirement account and leave there until age 65. How much will this couple have saved in their retirement account at age 65? Answer (10 points) 3. Referring to question # 1, how much will this couple have saved at age 65, if their earnings are compounded quarterly? Answer (10 points) 4. Using the answer from questiom I, if this couple is now age 65 and in good health and plans to travel and enjoy life. Since they are in good health chances of living until age 8 are quite good. If thy live until age 83 and are able to carn S% on their retirement savings, what is the maximum amount they can withdraw each year, assuming they plan to spend all of their savings? Answer (10 points) 5. Using the answer from question #1, this couple expects to earn 5% on their retirement funds beginning at age 65 . If they live for another 20 years, how much can they withdraw each year, if they decide to leave S200.000 in their retirement account for their heirs? Answer (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts