Question: Case No. 2: (6 marks) Read the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are

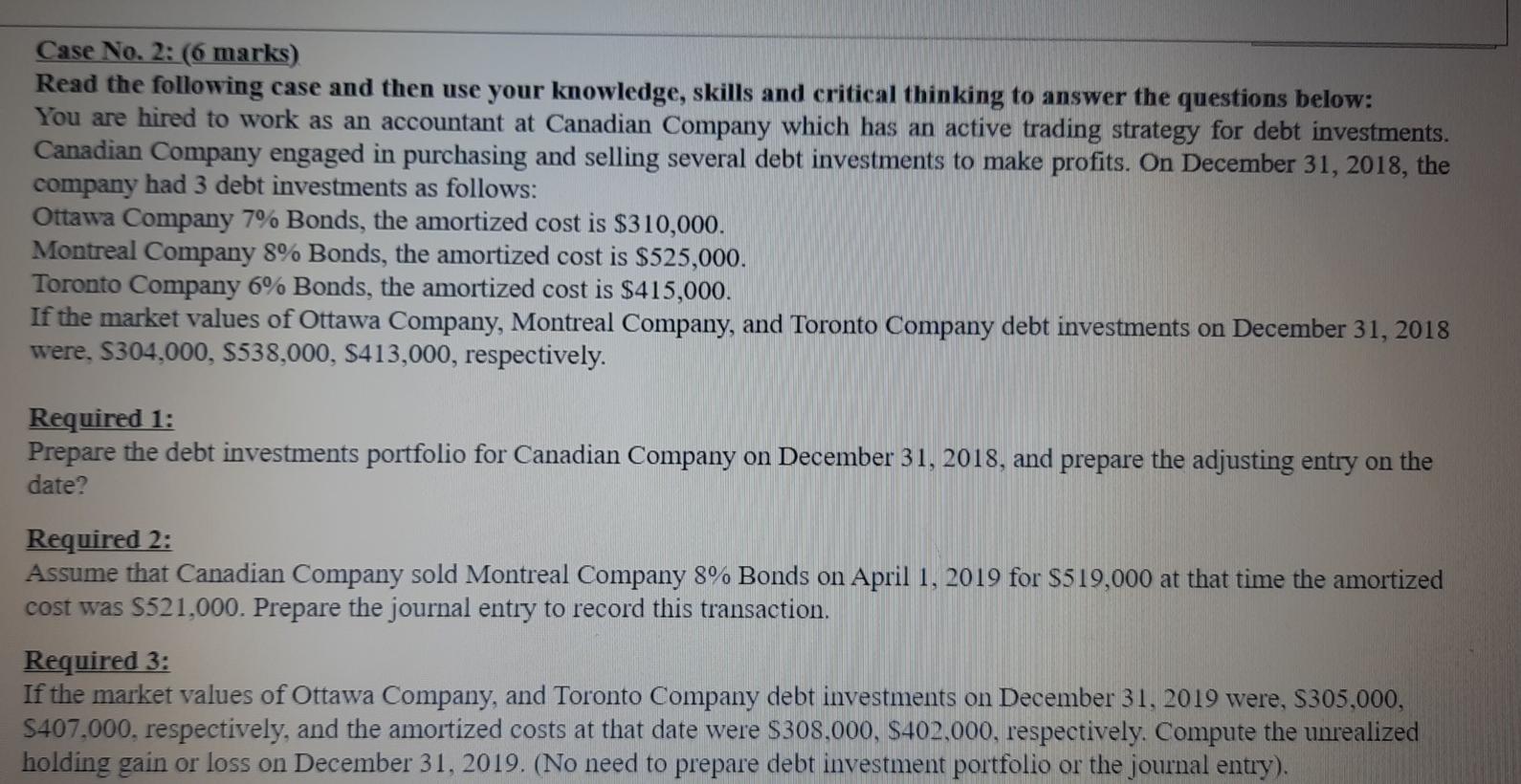

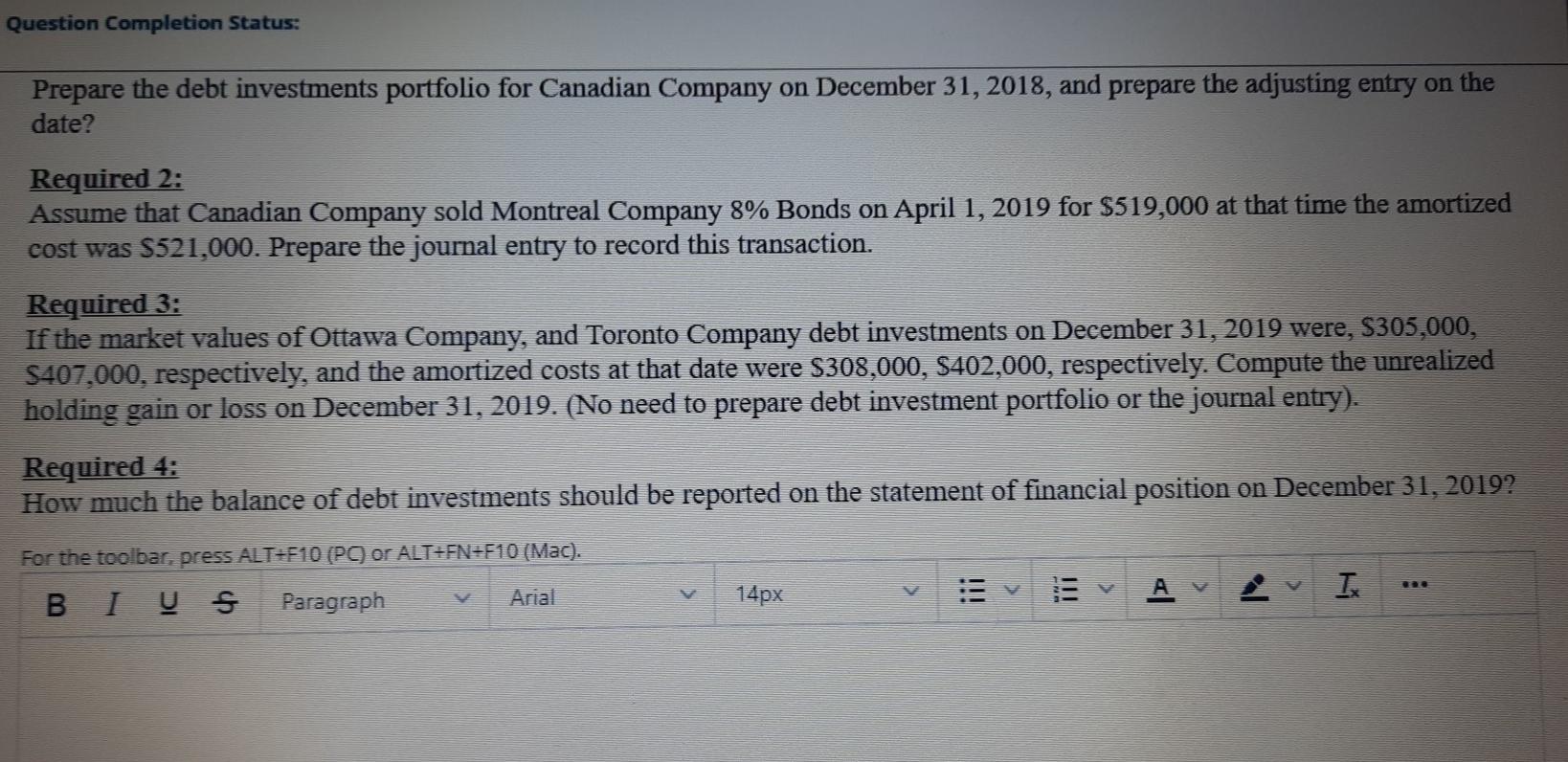

Case No. 2: (6 marks) Read the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are hired to work as an accountant at Canadian Company which has an active trading strategy for debt investments. Canadian Company engaged in purchasing and selling several debt investments to make profits. On December 31, 2018, the company had 3 debt investments as follows: Ottawa Company 7% Bonds, the amortized cost is $310,000. Montreal Company 8% Bonds, the amortized cost is $525,000. Toronto Company 6% Bonds, the amortized cost is $415,000. If the market values of Ottawa Company, Montreal Company, and Toronto Company debt investments on December 31, 2018 were. S304,000, $538,000, S413,000, respectively. Required 1: Prepare the debt investments portfolio for Canadian Company on December 31, 2018, and prepare the adjusting entry on the date? Required 2: Assume that Canadian Company sold Montreal Company 8% Bonds on April 1, 2019 for $519,000 at that time the amortized cost was S521,000. Prepare the journal entry to record this transaction. Required 3: If the market values of Ottawa Company, and Toronto Company debt investments on December 31, 2019 were, $305,000, S407.000, respectively, and the amortized costs at that date were $308,000, $402,000, respectively. Compute the unrealized holding gain or loss on December 31, 2019. (No need to prepare debt investment portfolio or the journal entry). Question Completion Status: Prepare the debt investments portfolio for Canadian Company on December 31, 2018, and prepare the adjusting entry on the date? Required 2: Assume that Canadian Company sold Montreal Company 8% Bonds on April 1, 2019 for $519,000 at that time the amortized cost was S521,000. Prepare the journal entry to record this transaction. Required 3: If the market values of Ottawa Company, and Toronto Company debt investments on December 31, 2019 were, S305,000, S407,000, respectively, and the amortized costs at that date were S308,000, S402,000, respectively. Compute the unrealized holding gain or loss on December 31, 2019. (No need to prepare debt investment portfolio or the journal entry). Required 4: How much the balance of debt investments should be reported on the statement of financial position on December 31, 2019? For the toolbar, press ALT=F10 (PC or ALT=FN+F10 (Mac). BI v Paragraph Arial 14px v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts