Question: Case Notes: Jesse, age 67 and Tanner, age 58, are married. They elect to file Married Filing Jointly. Jesse is retired. He received Social Security

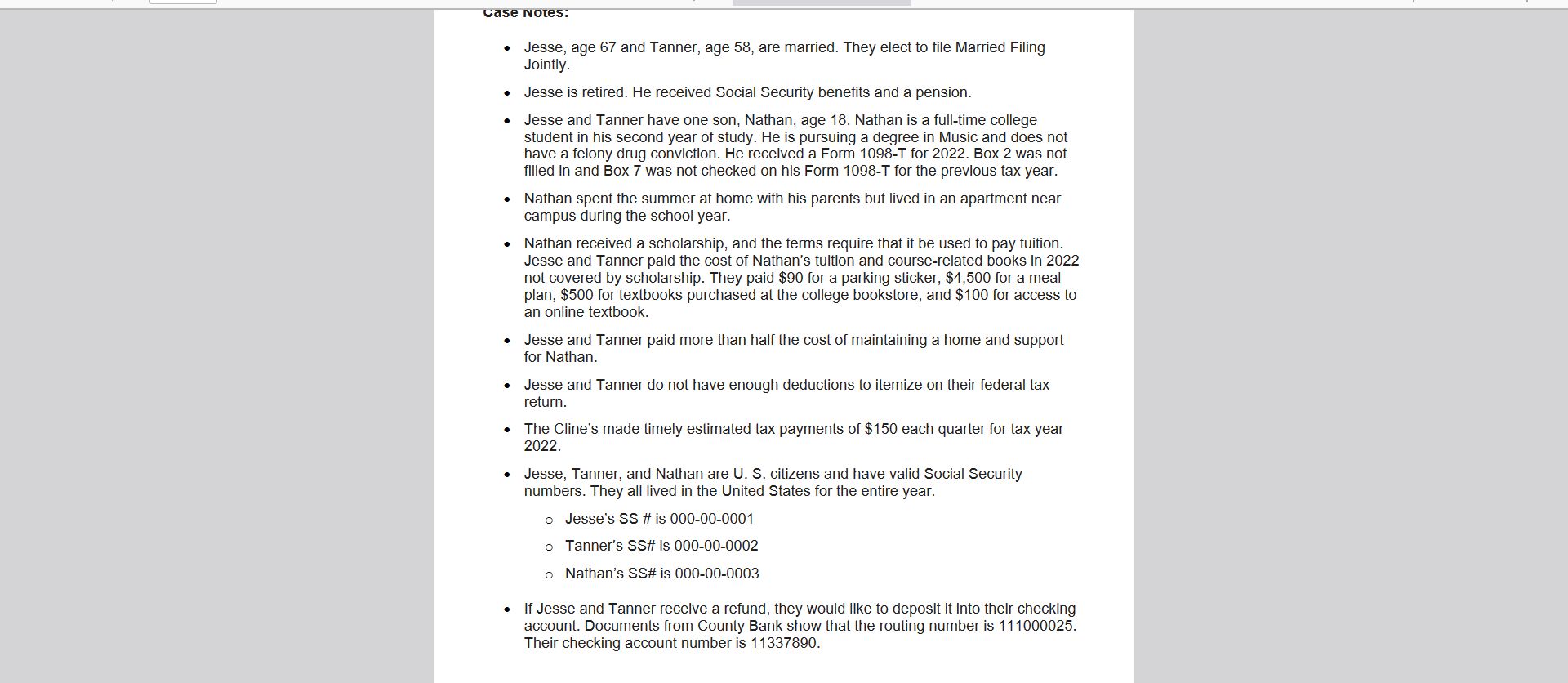

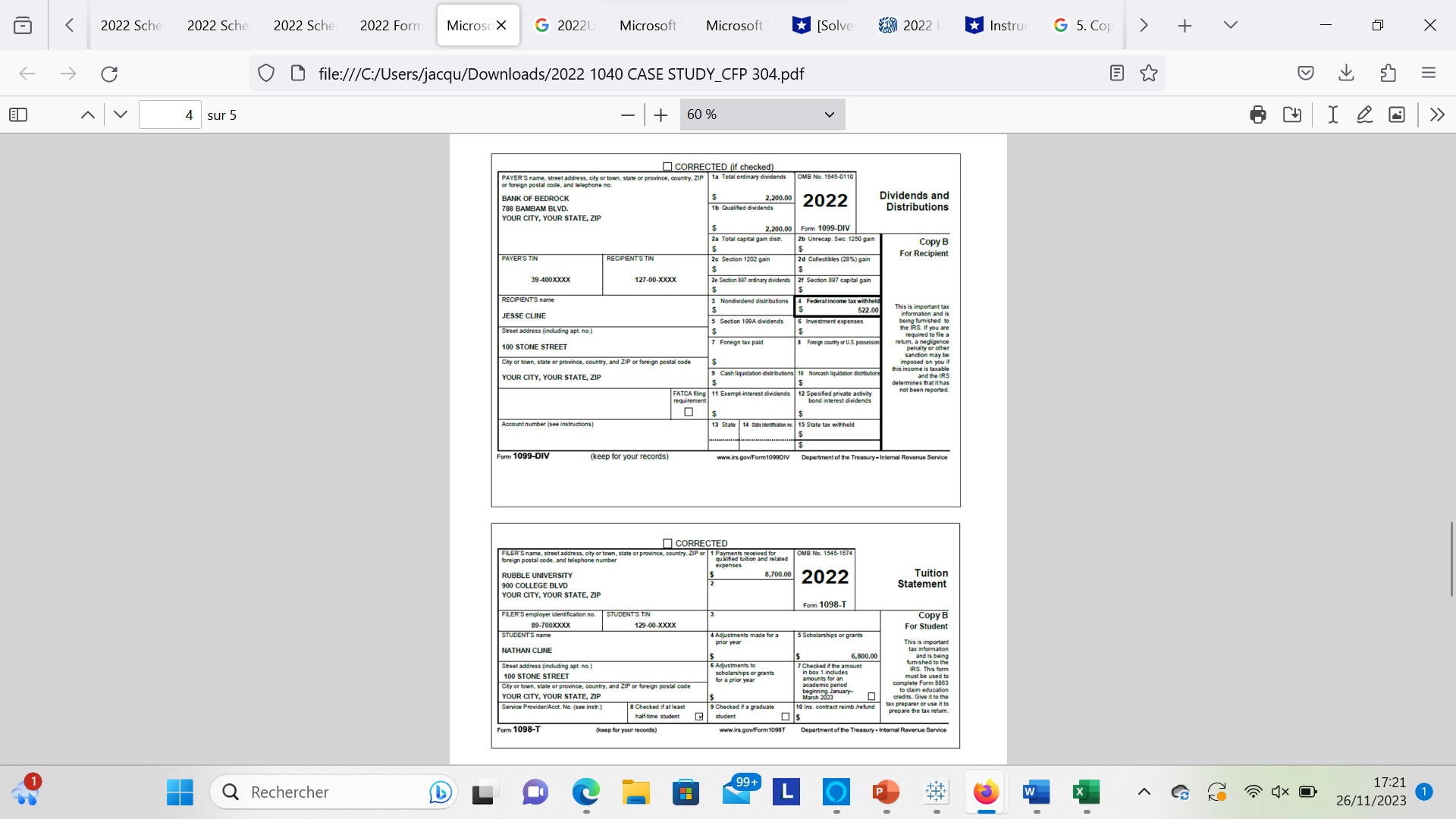

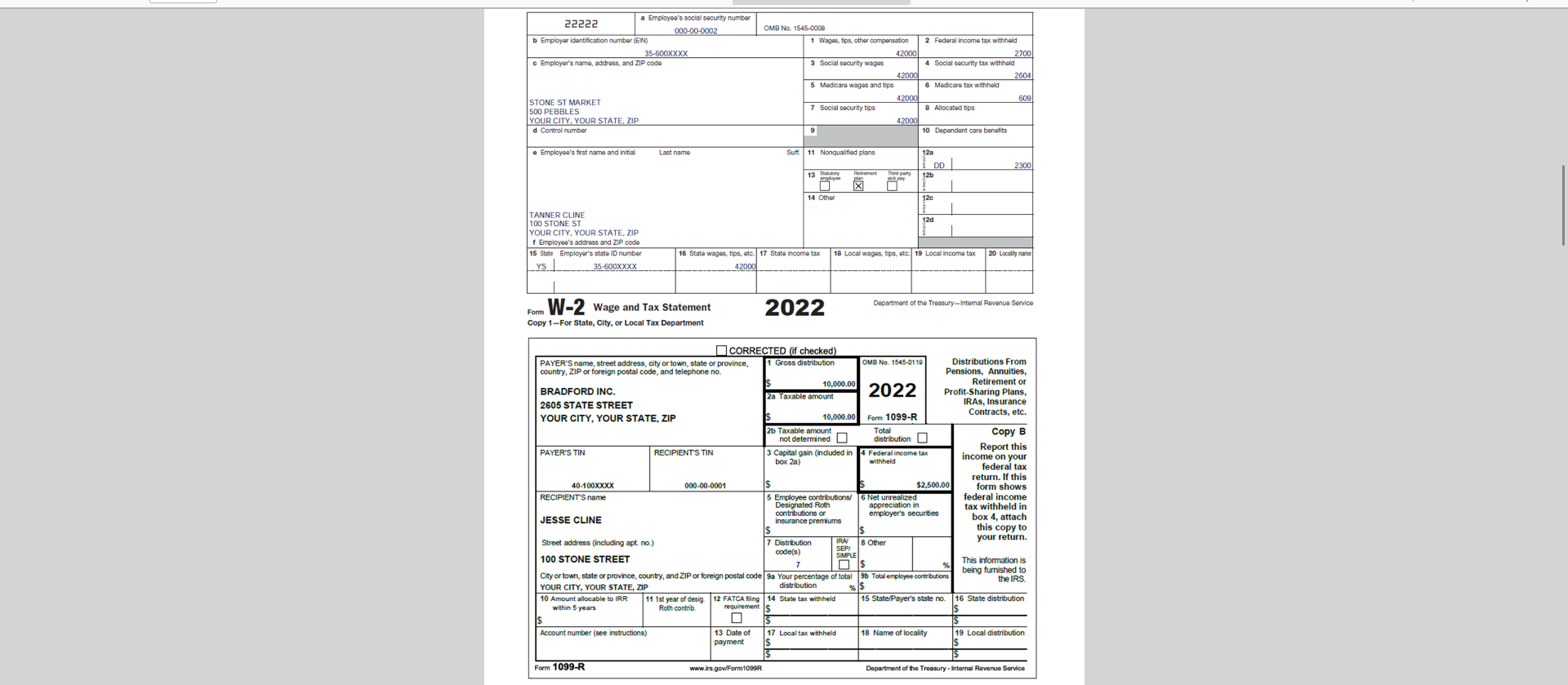

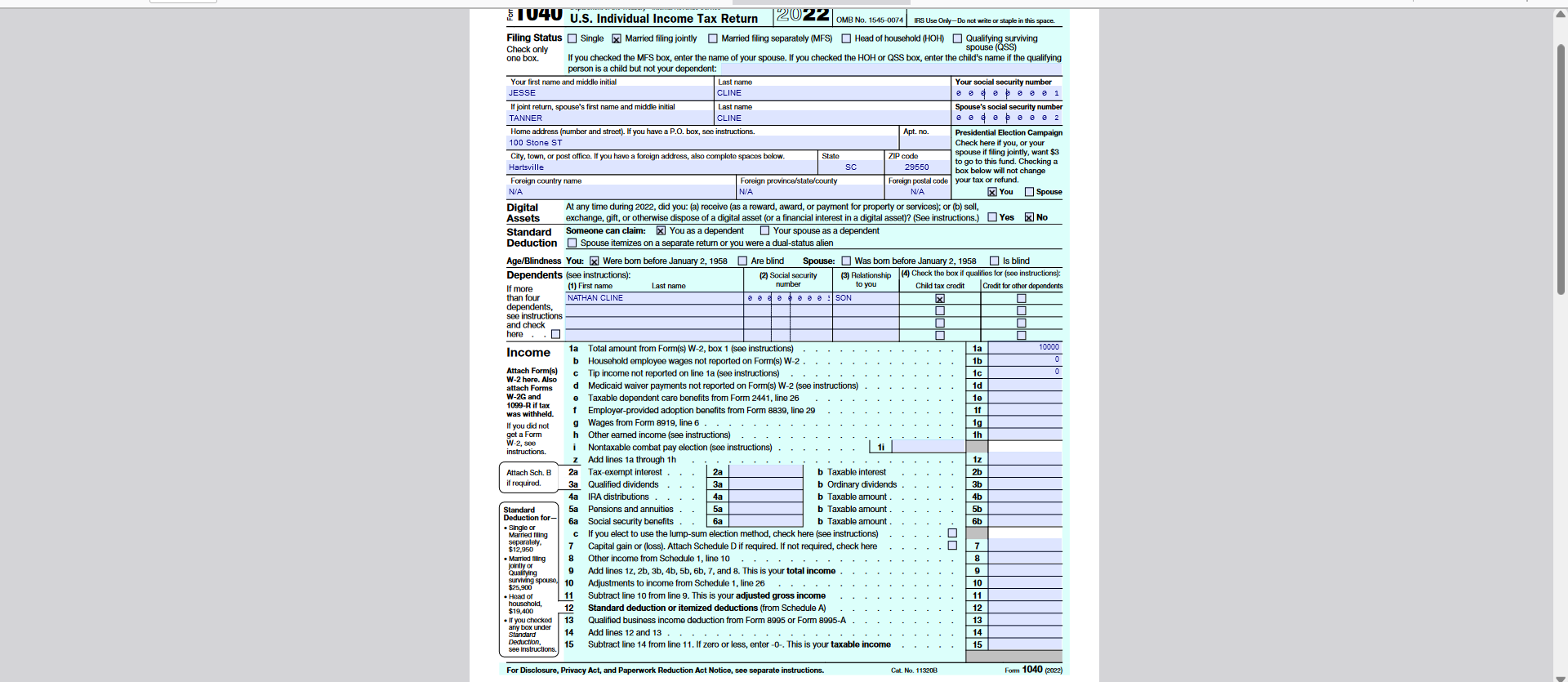

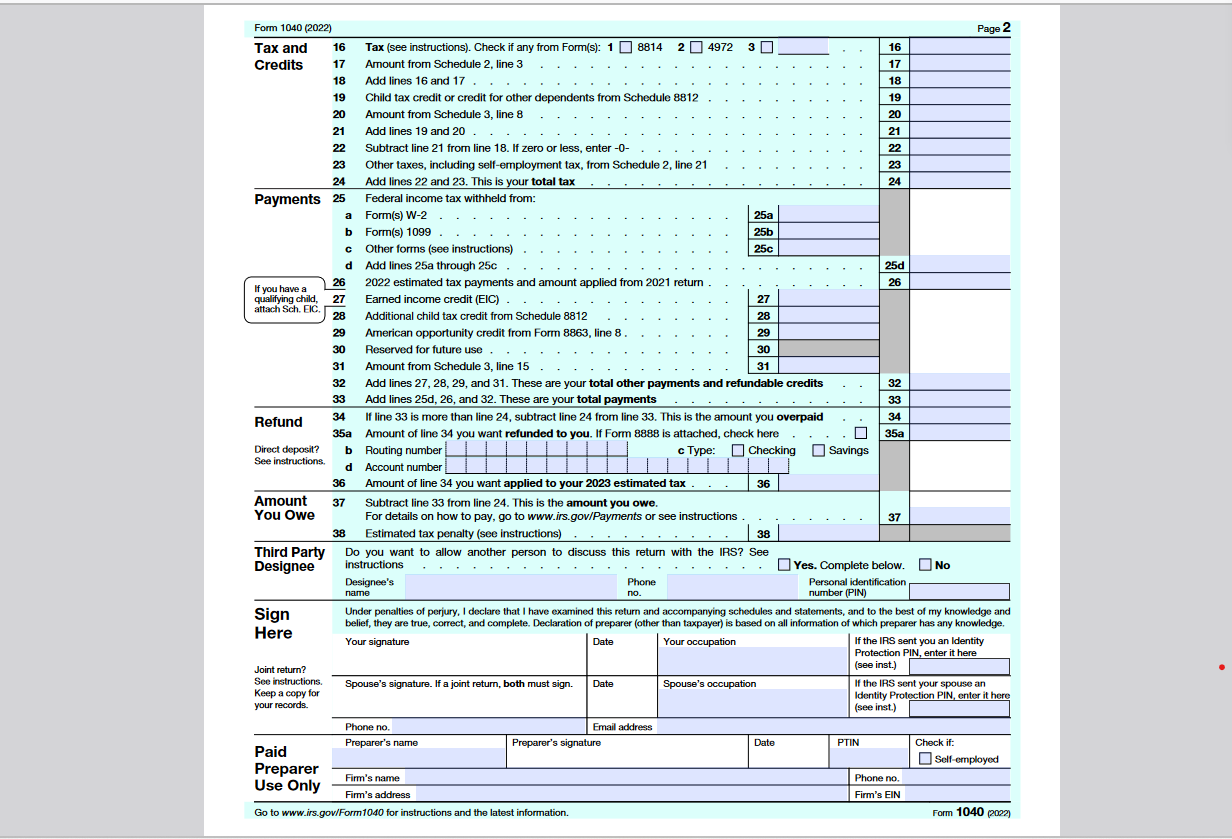

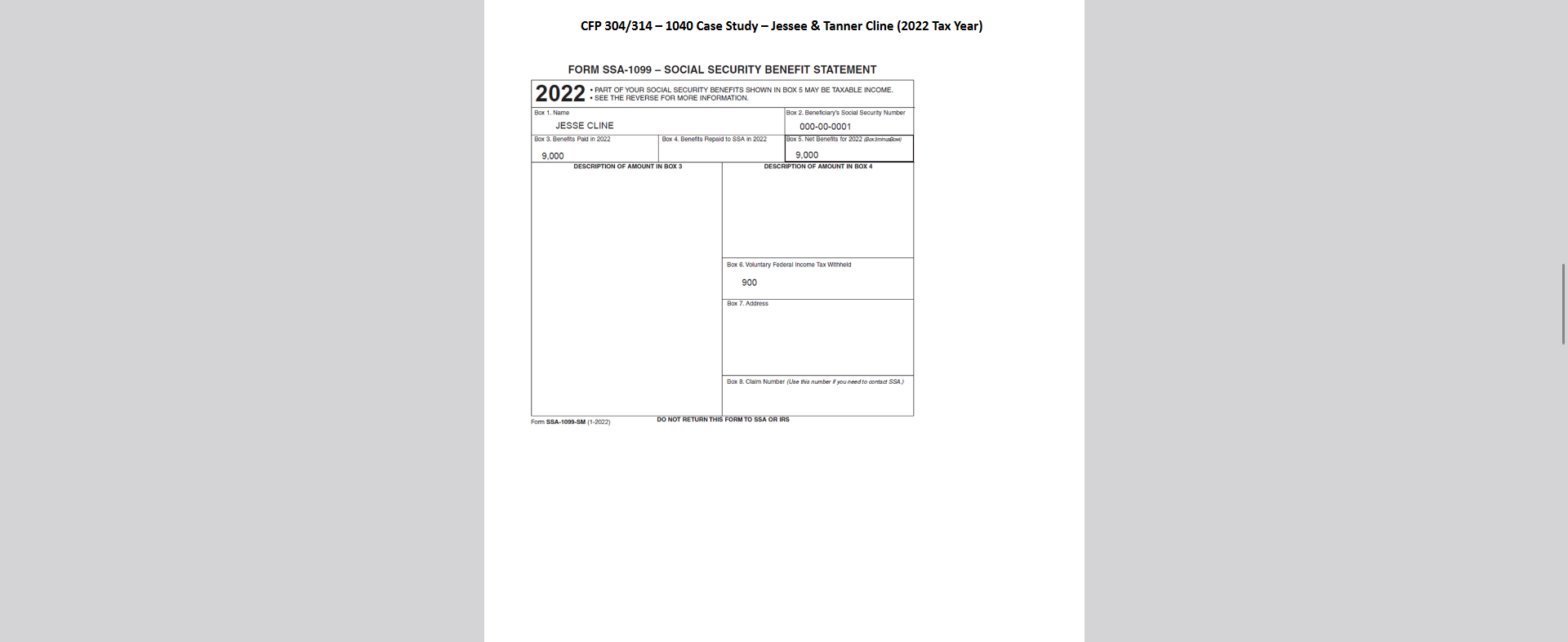

Case Notes: Jesse, age 67 and Tanner, age 58, are married. They elect to file Married Filing Jointly. Jesse is retired. He received Social Security benefits and a pension. . Jesse and Tanner have one son, Nathan, age 18. Nathan is a full-time college student in his second year of study. He is pursuing a degree in Music and does not have a felony drug conviction. He received a Form 1098-T for 2022. Box 2 was not filled in and Box 7 was not checked on his Form 1098-T for the previous tax year. Nathan spent the summer at home with his parents but lived in an apartment near campus during the school year. Nathan received a scholarship, and the terms require that it be used to pay tuition. Jesse and Tanner paid the cost of Nathan's tuition and course-related books in 2022 not covered by scholarship. They paid $90 for a parking sticker, $4,500 for a meal plan, $500 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. Jesse and Tanner paid more than half the cost of maintaining a home and support for Nathan. Jesse and Tanner do not have enough deductions to itemize on their federal tax return. The Cline's made timely estimated tax payments of $150 each quarter for tax year 2022. Jesse, Tanner, and Nathan are U. S. citizens and have valid Social Security numbers. They all lived in the United States for the entire year. o Jesse's SS # is 000-00-0001 o Tanner's SS# is 000-00-0002 o Nathan's SS# is 000-00-0003 If Jesse and Tanner receive a refund, they would like to deposit it into their checking account. Documents from County Bank show that the routing number is 111000025. Their checking account number is 11337890.> CORRECTED (if checked) PAYER'S name. street address. street address. city or town. town, state or province, country, Zip 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code, and telephone no. BANK OF BEDROCK 2,200.00 2022 Dividends and 788 BAMBAM BLVD. 1b Qualifed dividends Distributions YOUR CITY, YOUR STATE, ZIP 2,200.00 Form 1099-DIV Total capital gain distr 2b Unrecap. Sec. 1250 gain Copy B PAYER'S TIN RECIPIENT'S TIN ze Section 1202 gain 2d Collectibles (28%%) gain For Recipient 39-400XXXX 127-00-XXXX Ze Section ends 2f Section 807 capital gain RECIPIENT'S name dend distribution come tax withhel 522.00 JESSE CLINE This is important tax 5 Section 190A dividends 6 Investment expenses Street address (including apt. no.) 100 STONE STREET Foreign tax paid Foreign country or U.S. po enalty or ot City or town, state or province, country, and ZIP or foreign postal code inction may be S YOUR CITY, YOUR STATE, ZIP FATCA filing 11 Exemp 12 SP not been reported. 0 Account number (see instructions) 13 State |14 statelendcation no. 15 State tax withheld Form 1099-DIV (keep for your records) www.irs.gov/Form1099DIV Department of the Treas CORRECTED FILER'S name, street address. city of town. state or pro ace. country. ZIP or 1 Payme 1 Payment code and related OMB No. 1545-1574 expenses RUBBLE UNIVERSITY 8,700.00 2022 Tuition 900 COLLEGE BLVD Statement YOUR CITY, YOUR STATE, ZIP Form 1098-T FILER'S employer identification no. STUDENT'S TIN Copy B 89-700XXXX 129-00-XXXX STUDENT'S name For Student 4 Adjustments made for a 5 Scholarships or grants prior year NATHAN CLINE 6.800.00 and is being Street address (including apt. no.) Adjustments to 7 Checked if the amount 100 STONE STREET scholarships or grants for a prior year in BON HOLES IRS. This form City of town, state or province, country, and ZIP or foreign postal code academic period plete Form 8863 YOUR CITY, YOUR STATE, ZIP March 2023 Service Provider/Acct. No. (see inst.) 8 Checked if at least Checked if a graduate 10 Ins. contract reimbirefund prepare the tax return. Form 1098-T keep for your records) www.irs.gowF Department of the Treasury - Internal Revenue Q Rechercher 99+ W X 17:21 26/11/202322222 a Employee's social security number 000-00-0002 OMB No. 1545-0006 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 35-600XXXX 42000 2700 c Employer's name, address, and ZIP code 3 Social security wages Social security tax withheld 42000 2604 6 Medicare wages and tips 6 Medicare tax withhold STONE ST MARKET 42000 609 500 PEBBLES 7 Social security tips 8 Allocated tips YOUR CITY, YOUR STATE, ZIP 42000 d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans DD 2300 14 Other TANNER CLINE 100 STONE ST YOUR CITY, YOUR STATE, ZIP 1 Employee's address and ZIP code 16 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality ram YS 35-600XXXX_ 42000 Form W-2 Wage and Tax Statement 2022 Department of the Treasury-Internal Revenue S Copy 1-For State, City, or Local Tax Department CORRECTED (if checked PAYER'S name, street address, city or town, state or province, Gross distribution OMB No. 1545-01 19 Distributions From country, ZIP or foreign postal code, and telephone no. Pensions, Annuities, 10,000.00 Retirement or BRADFORD INC. 2a Taxable amount 2022 Profit-Sharing Plans, 2605 STATE STREET IRAs, Insurance 10,000.00 Form 1099-R Contracts, etc. YOUR CITY, YOUR STATE, ZIP 2b Taxable amount Total Copy B not determined distribution Report this PAYER'S TIN RECIPIENT'S TIN Capital gain (included in Federal income tax box 2a) withheld income on your federal tax return. If this 40-100XXXX 000-00-0001 $2,500.00 form shows RECIPIENT'S name Employee contributions/ 6 Net unrealized federal income Designated Roth appreciation in employer's securities tax withheld in contributions or JESSE CLINE insurance premiums box 4, attach this copy to Street address (including apt. no.) 7 Distribution 8 Other your return. code(s) 100 STONE STREET This information is being furnished to City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 90 Total employee cor the IRS YOUR CITY, YOUR STATE, ZIP distribution 10 Amount allocable to IRR 11 1st year of design 12 FATCA filin 14 State tax withheld 16 State/Payer's state 16 State distribution within 5 years Roth contrib Account number (see instructions) 13 Date of 18 Name of locality 19 Local distribution payment Form 1099-R www.irs.gow/Form 1099 Department of the Treasury - Internal Revenue Service$ 1040 U.S. Individual Income Tax Return 20 OMB No. 1545-0074 |IF Use Only - Do not write or staple in this space. Filing Status ] Single x] Married filing jointly ( Married filing separately (MFS) ( Head of household (HOH) Qualifying surviving Check only spouse (QSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: Your first name and middle initial Last name Your social security number JESSE CLINE eeepeee If joint return, spouse's first name and middle initial Last name Spouse's social security number TANNER CLINE edepeee2 Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign 100 Stone ST Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 Hartsville SC 29550 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code | your tax or refund. NA X You Spouse Digital At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, Assets exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) ( Yes x] No Standard Someone can claim: x] You as a dependent ] Your spouse as a dependent Deduction Spouse itemizes on a separate r arate return or you were a dual-status alien Age/Blindness You: x] Were born before January 2, 1958 ] Are blind Spouse: Was born before January 2, 1958 ] Is blind Dependents (see instructions): (2) Social security 3) Relationship (4) Check the box if qualifies for (see instructions): (1) First name Last name number to you If more Child tax credit Credit for other dependents than four NATHAN CLINE .... e : SON dependents, see instructions and check here Income a Total amount from Form(s) W-2, box 1 (see instructions) 1a 10000 b Household employee wages not reported on Form(s) W-2 . 1b Attach Form(s) C ted on line 1a (see inst W-2 here. Also 1c attach Forms d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) 1d W-2G and 1099-R if ta Taxable dependent care benefits from Form 2441. line 26 was withheld. f Employer-provided adoption benefits from Form 8839, line 29 if If you did not g Wages from Form 8919, line 6 . 1g get a Form h Other earned income (see instructions) 1h W-2, see instructions Nontaxable combat pay election (see instructions) . Z Add lines 1a through 1h Attach Sch. B 2a Tax-exempt interest . b Taxable interest f required. 3a Qualified dividends b Ordinary dividends 4a b Taxable amount . Standard 5a Pensions and annuities b Taxable amount Deduction for- 6a Social security benefits b Taxable amount . . Singled c If you elect to use the lump-sum election method, check here (see instructions) separately. 412,950 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here 7 Married fling Other income from Schedule 1, line 10 8 Qualifying Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 9 surviving spouse $96 900 10 Adjustments to income from Schedule 1, line 26 10 11 Subtract line 10 from line 9. This is your adjusted gross income household 11 $19.400 12 Standard deduction or itemized deductions (from Schedule A) 12 If you checked 13 any box under Qualified business income deduction from Form 8995 or Form 8995-A 13 Standard 14 Add lines 12 and 13 . 14 Deduction, 15 15 see Instructions. Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see eparate instructions. Cat. No. 113208 Form 1040 (2022)Form 1040 (2022) Page 2 Tax and 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 | 4972 3 16 Credits 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 . 18 Child tax credit or credit for other dependents from Schedule 8812 19 20 Amount from Schedule 3, line 8 20 21 Add lines 19 and 20 . . 21 Subtract line 21 from line 18. If zero or less, enter -0- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 24 Payments 25 Federal income tax withheld from: a Form(s) W-2 25a Form(s) 1099 . 25b c Other forms (see instructions) 25c d Add lines 25a through 25c. 25d 26 If you have a 26 2022 estimated tax payments and amount applied from 2021 return . qualifying child, 27 Earned income credit (EIC) . 27 attach Sch. FIC. Additional child tax credit from Schedule 8812 28 American opportunity credit from Form 8863, line 8 . 29 Reserved for future use . 30 31 Amount from Schedule 3, line 15 31 32 Add lines 27, 28, 29, and 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct deposit? b Routing number c Type: Checking Savings See instructions. d Account number 36 Amount of line 34 you want applied to your 2023 estimated tax 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe. You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions 37 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here (see inst.) Joint return? See instructions. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter it here your records. (see inst.) Phone no. Email address Preparer's name Preparer's signature Date PTIN Check if: Paid Self-employed Preparer Use Only Firm's name Phone no Firm's address Firm's EIN Go to www.irs.gov/Form1040 for instructions and the latest information. Form 1040 (2022)CFP 304/314 - 1040 Case Study - Jessee & Tanner Cline (2022 Tax Year) FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT 2022: . PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME. . SEE THE REVERSE FOR MORE INFORMATION. Box 1. Name Box 2. Beneficiary's Social Security Number JESSE CLINE 000-00-0001 Box 3. Benefits Paid in 2022 Box 4. Benefits Repaid to SSA in 2022 Box 5. Net Benefits for 2022 (Box aminu 9.000 9.000 DESCRIPTION OF AMOUNT IN BOX 3 DESCRIPTION OF AMOUNT IN BOX 4 Box 6. Voluntary Federal Income Tax Withheld 900 Box 7. Address Box 8. Claim Number (Use this number if you need to contact SSA.) Form SSA-1099-SM (1-2022) DO NOT RETURN THIS FORM TO SSA OR IRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts