Question: Case Problem 1: To Drill or not Drill? To Search or Not-Search for Oil Texas Oil hired your team to serve as a Management Science

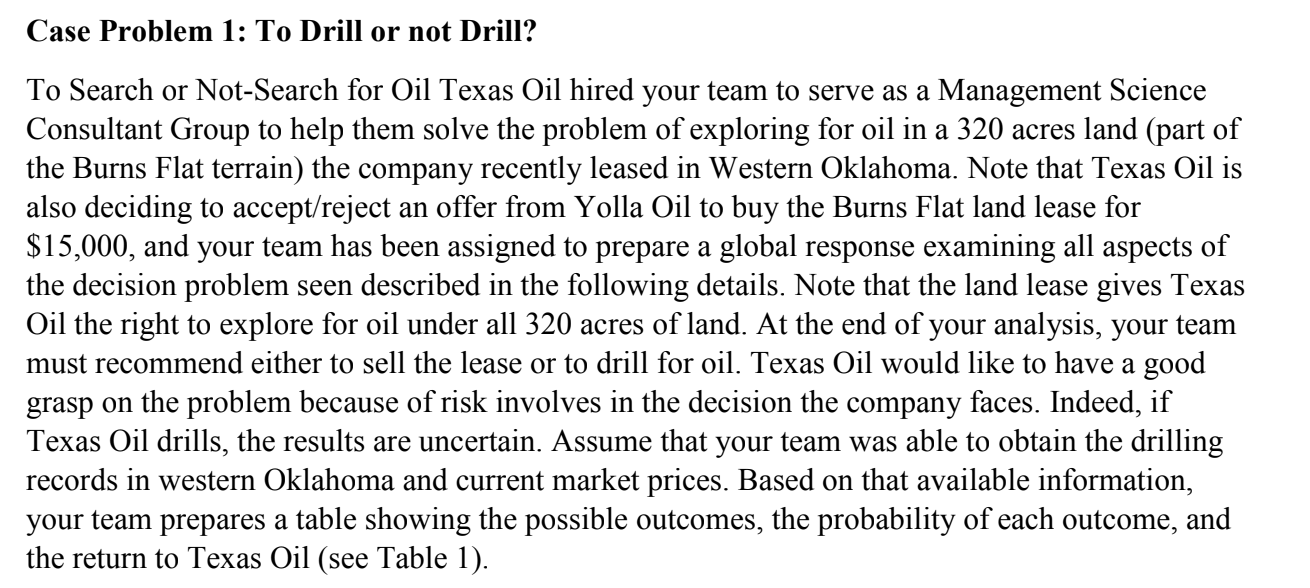

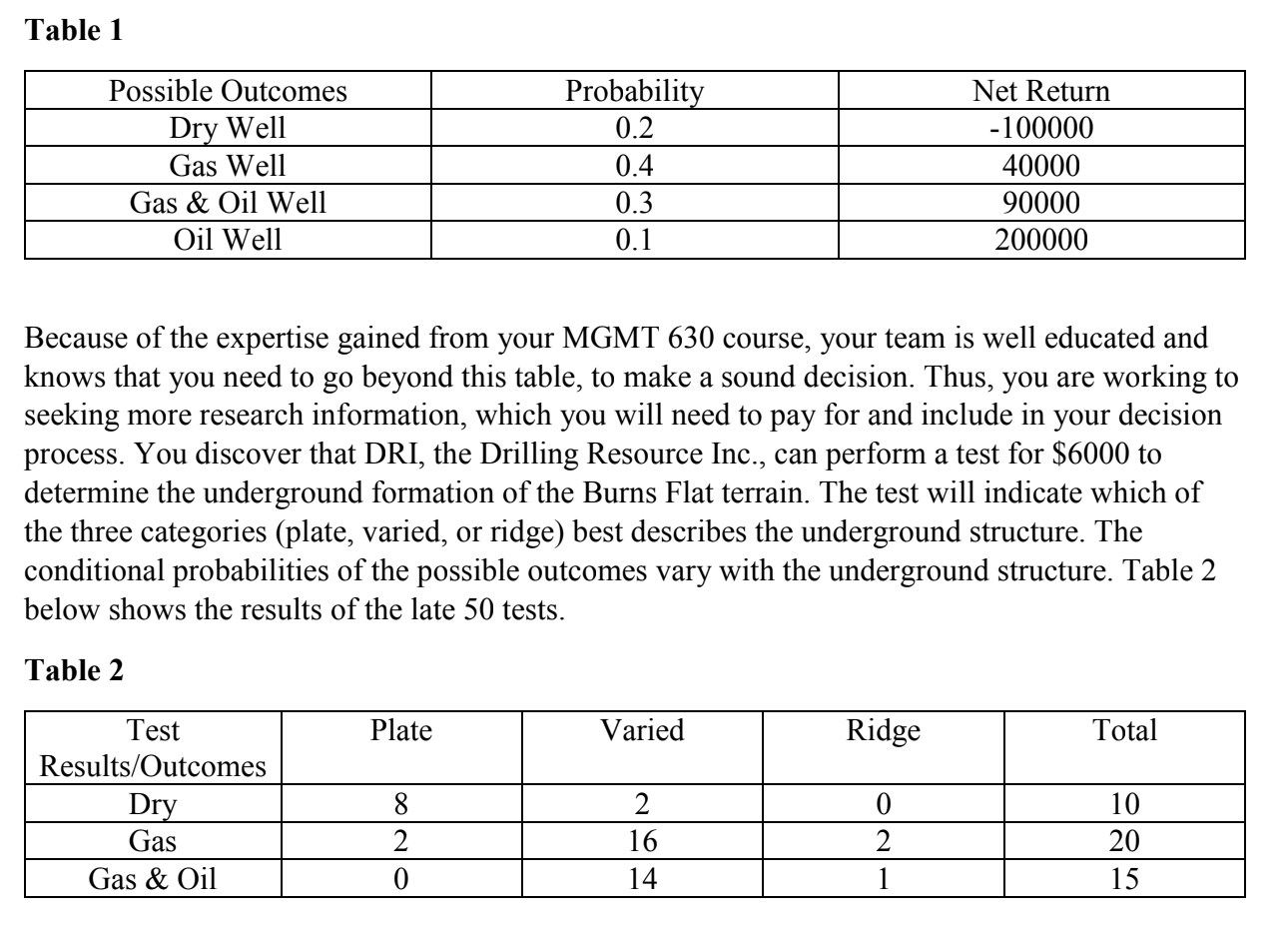

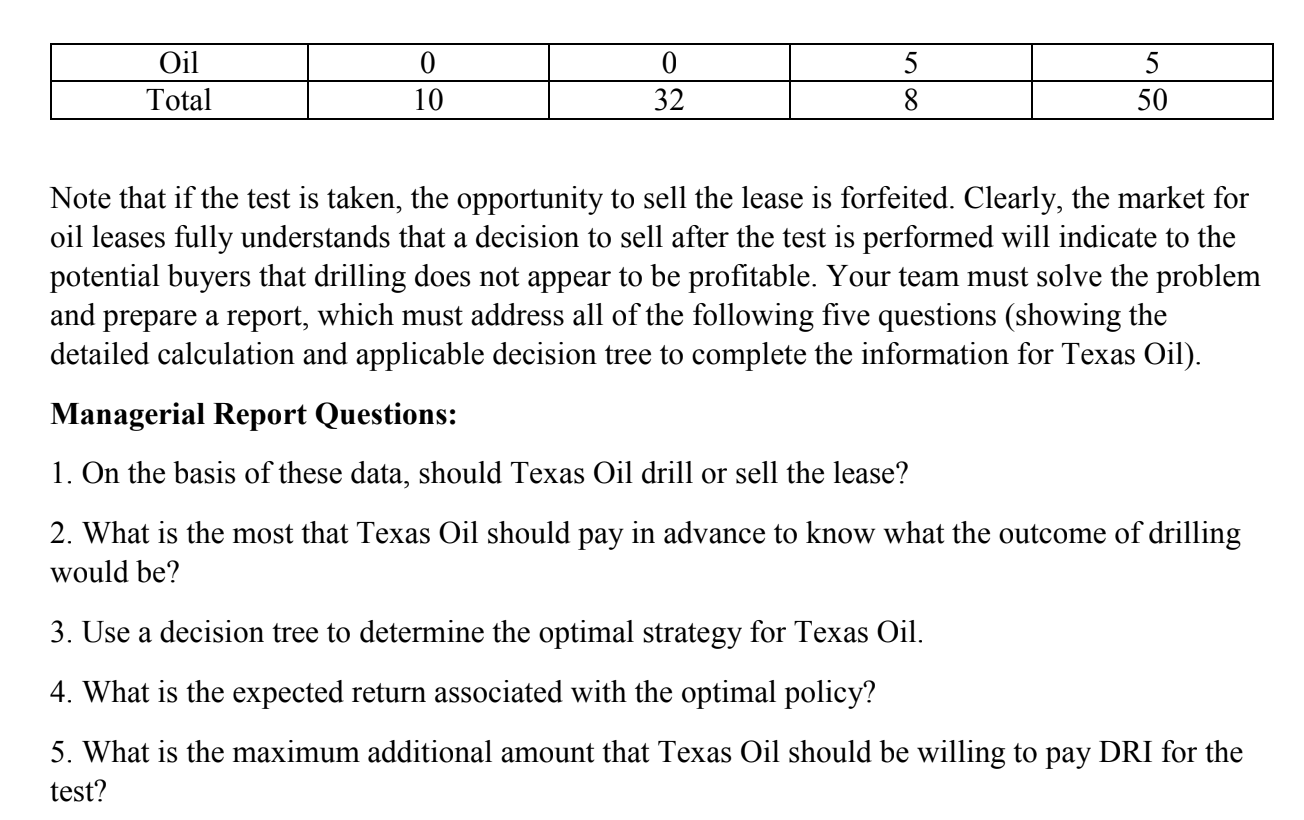

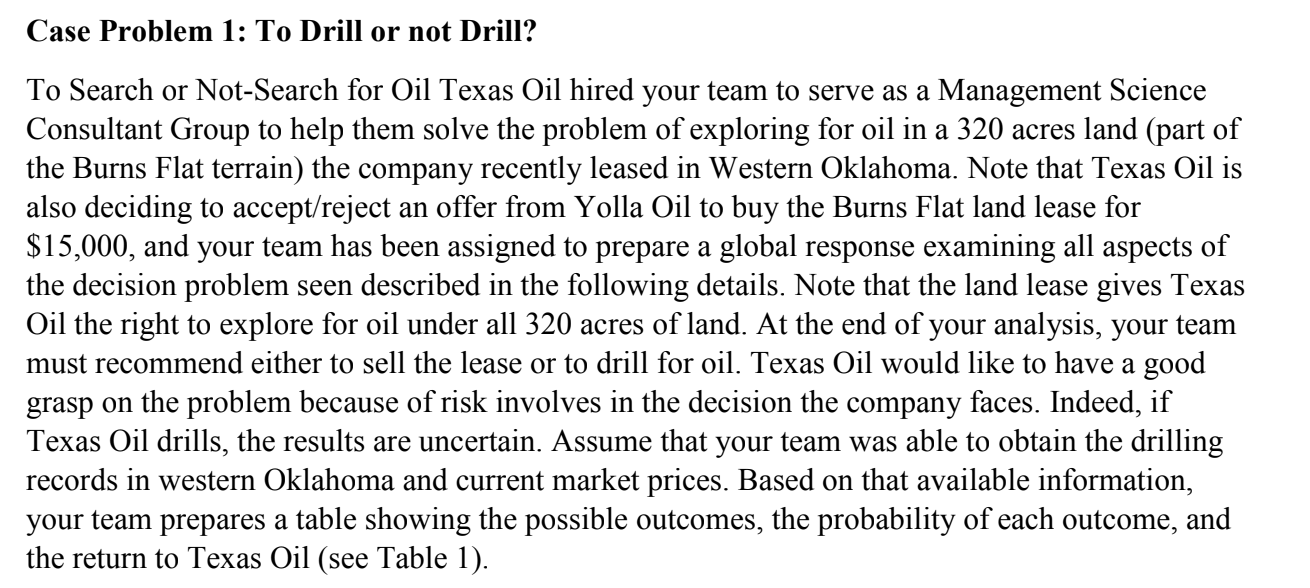

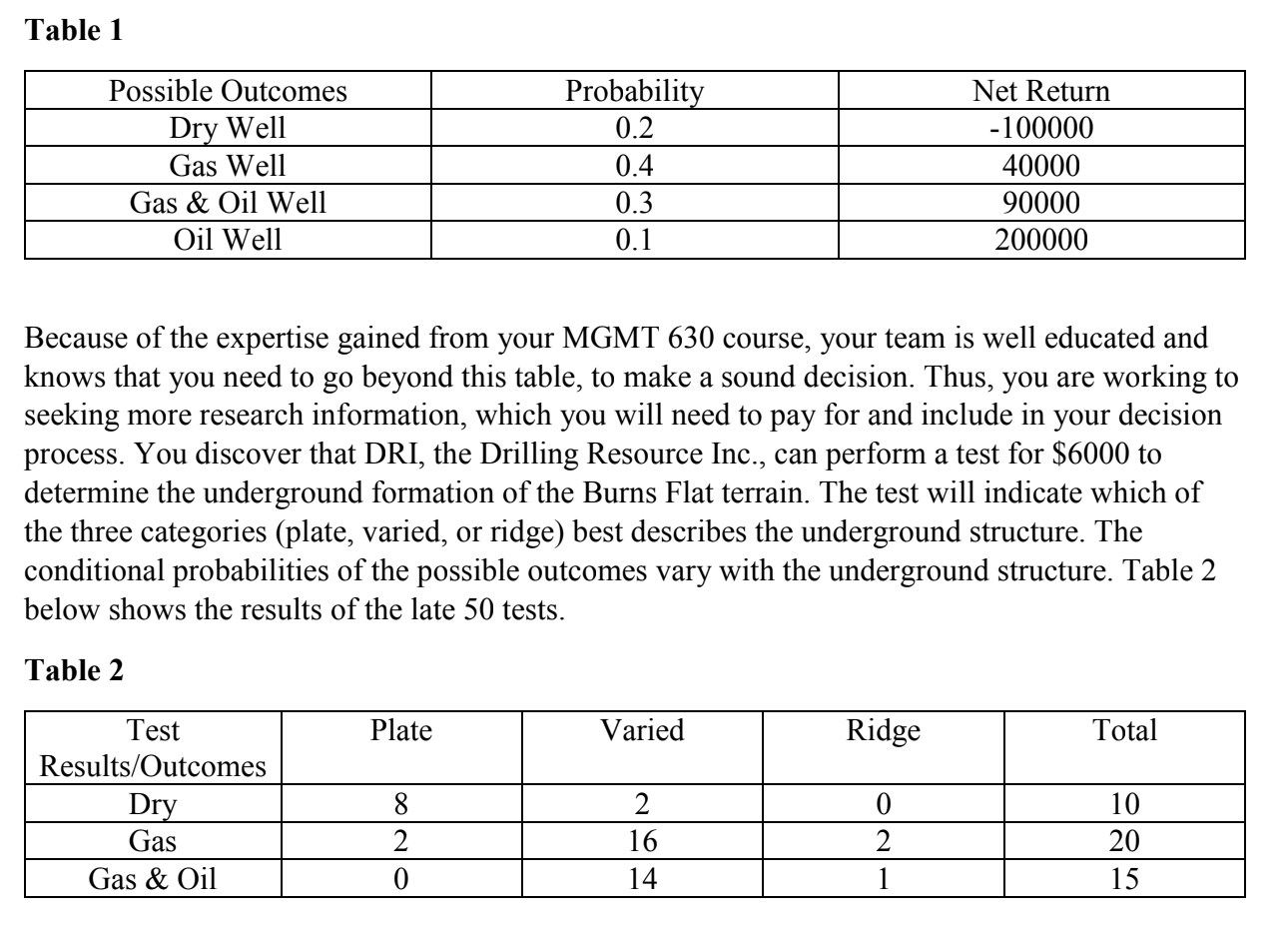

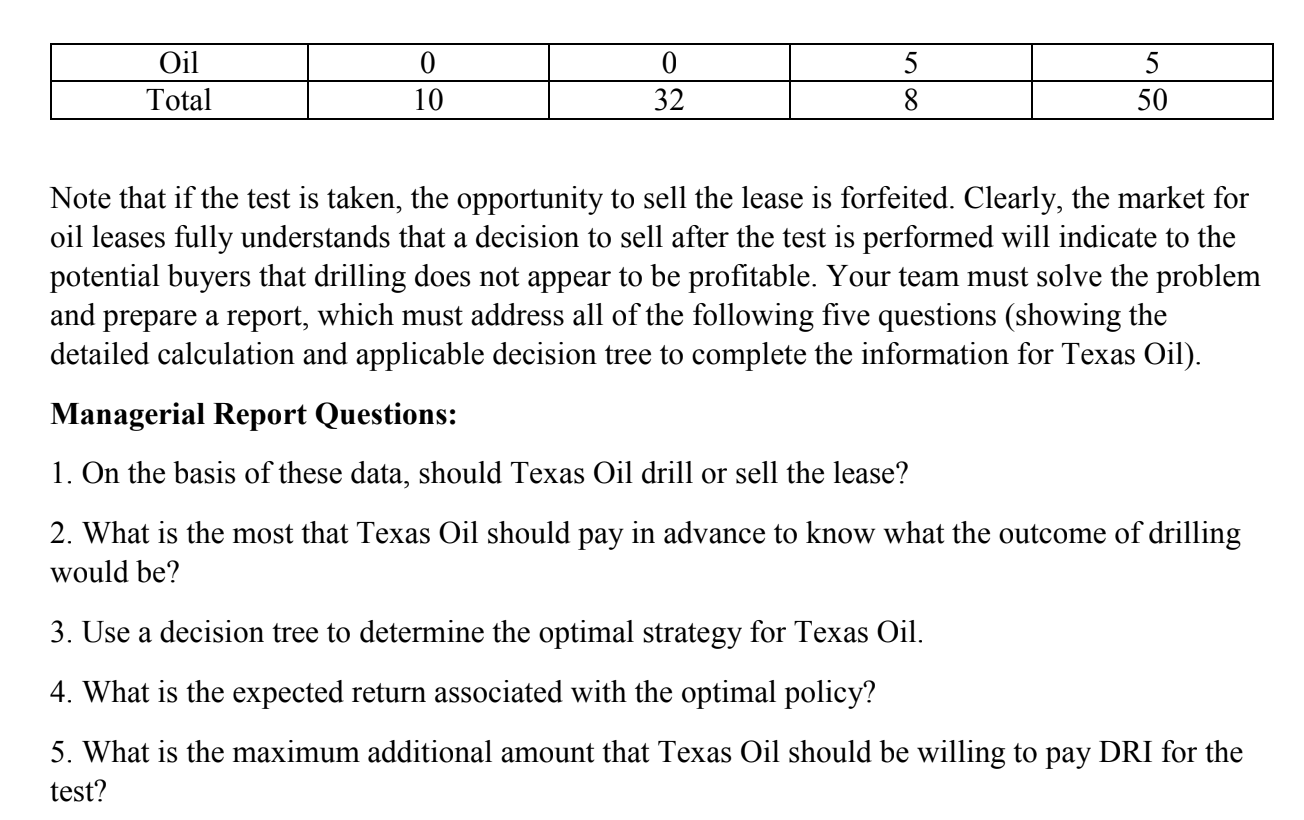

Case Problem 1: To Drill or not Drill? To Search or Not-Search for Oil Texas Oil hired your team to serve as a Management Science Consultant Group to help them solve the problem of exploring for oil in a 320 acres land (part of the Burns Flat terrain) the company recently leased in Western Oklahoma. Note that Texas Oil is also deciding to accept/reject an offer from Yolla Oil to buy the Burns Flat land lease for $15,000, and your team has been assigned to prepare a global response examining all aspects of the decision problem seen described in the following details. Note that the land lease gives Texas Oil the right to explore for oil under all 320 acres of land. At the end of your analysis, your team must recommend either to sell the lease or to drill for oil. Texas Oil would like to have a good grasp on the problem because of risk involves in the decision the company faces. Indeed, if Texas Oil drills, the results are uncertain. Assume that your team was able to obtain the drilling records in western Oklahoma and current market prices. Based on that available information, your team prepares a table showing the possible outcomes, the probability of each outcome, and the return to Texas Oil (see Table 1). Table 1 Because of the expertise gained from your MGMT 630 course, your team is well educated and knows that you need to go beyond this table, to make a sound decision. Thus, you are working to seeking more research information, which you will need to pay for and include in your decision process. You discover that DRI, the Drilling Resource Inc., can perform a test for $6000 to determine the underground formation of the Burns Flat terrain. The test will indicate which of the three categories (plate, varied, or ridge) best describes the underground structure. The conditional probabilities of the possible outcomes vary with the underground structure. Table 2 below shows the results of the late 50 tests. Table 2 Note that if the test is taken, the opportunity to sell the lease is forfeited. Clearly, the market for oil leases fully understands that a decision to sell after the test is performed will indicate to the potential buyers that drilling does not appear to be profitable. Your team must solve the problem and prepare a report, which must address all of the following five questions (showing the detailed calculation and applicable decision tree to complete the information for Texas Oil). Managerial Report Questions: 1. On the basis of these data, should Texas Oil drill or sell the lease? 2. What is the most that Texas Oil should pay in advance to know what the outcome of drilling would be? 3. Use a decision tree to determine the optimal strategy for Texas Oil. 4. What is the expected return associated with the optimal policy? 5. What is the maximum additional amount that Texas Oil should be willing to pay DRI for the test