Question: Case problem #2 - related to chapter 11 Southern Textiles (marginal cost of capital and investment returns) Southem Textiles is in the process of expanding

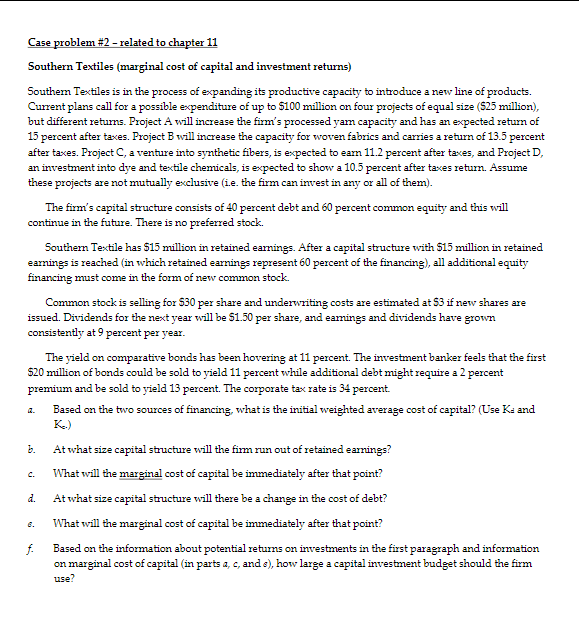

Case problem #2 - related to chapter 11 Southern Textiles (marginal cost of capital and investment returns) Southem Textiles is in the process of expanding its productive capacity to introduce a new line of products. Current plans call for a possible expenditure of up to $100 million on four projects of equal size ( 525 million), but different returns. Project A will increase the firm's processed yam capacity and has an expected return of 15 percent after taxes. Project B will increase the capacity for woven fabrics and carries a return of 13.5 percent after taxes. Project C, a venture into synthetic fibers, is expected to earn 11.2 percent after taxes, and Project D, an investment into dye and textile chemicals, is expected to show a 10.5 percent after taxes return. Assume these projects are not mutually exclusive (i.e. the firm can invest in any or all of them). The firm's capital structure consists of 40 percent debt and 60 percent common equity and this will continue in the future. There is no preferred stock. Southern Textile has $15 million in retained earnings. After a capital structure with $15 million in retained earnings is reached (in which retained earnings represent 60 percent of the financing), all additional equity financing must come in the form of new common stock. Common stock is selling for $30 per share and underwriting costs are estimated at $3 if new shares are issued. Dividends for the next year will be $1.50 per share, and eamings and dividends have grown consistently at 9 percent per year. The yield on comparative bonds has been hovering at 11 percent. The investment banker feels that the first \$20 million of bonds could be sold to yield 11 percent while additional debt might require a 2 percent premium and be sold to yield 13 percent. The corporate tax rate is 34 percent. a. Based on the two sources of financing, what is the initial weighted average cost of capital? (Use K and K..) b. At what size capital structure will the firm run out of retained earrings? c. What will the marginal cost of capital be immediately after that point? d. At what size capital structure will there be a change in the cost of debt? e. What will the marginal cost of capital be immediately after that point? f. Based on the information about potential returns on investments in the first paragraph and information on marginal cost of capital (in parts afc, and s ), how large a capital investment budget should the firm use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts