Question: Case Problem Gary Goldberg asks your advice concerning a perplexing situation. Having recently read a book about how someone turned $1,000 into $2 million in

Case Problem Gary Goldberg asks your advice concerning a perplexing situation. Having recently read a book about how someone turned $1,000 into $2 million in real estate in his spare time, Goldberg is anxious to participate in this bonanza. His job as an executive assistant in a major commodities brokerage firm is secure but offers no opportunity for advancement. Goldberg feels, therefore, that real estate investment is his best chance to build a personal fortune. Goldberg talked with three real estate brokers, each of whom presented him with a different investment opportunity. Because his funds are limited to $500,000 recently presented to him by a relative, he cannot accept all of these alternatives. He, therefore, discussed all three ventures with each broker and became extremely confused. Although they used the same financial data and operating projections, the brokers drew conflicting conclusions about probable rates of return on the investments.

THE INVESTOR

Further questioning reveals that Goldberg is employed by his father under a long-term contract at a salary that puts him in the 28% marginal income tax bracket (his state income tax is expected to go up as the federal rate comes down, thereby keeping him in the 28% bracket). His employment contract (which requires him to stay away from his fathers place of business, to avoid public identification with the firm, and to remain unmarried throughout the contract period) provides for no salary increases, so Goldberg expects that his income from sources other than real estate will remain essentially unchanged for the next 10 years. Goldberg tells you he is interested in a tax shelter, cash flow, capital appreciation, and security of principal. He asks you to study data concerning the three investment opportunities. He would like you to reconcile conflicting yield expectations reported by different brokers and to make a definitive recommendation concerning his best course of action.

THE PROPERTIES

Industrial Building The first broker offered a three-year-old, 35,000-square-foot industrial building for which the owner is asking $35 per square foot, or $1,225,000. The broker feels the property can be acquired for $1 million, or just under $30 per square foot. The building is under lease to a Class A tenant for $3.50 per square foot, or $122,500 per year, on a net lease basis. Based partly on the tenants financial standing, a lender will provide a mortgage loan for 80% of the purchase price. The loan will be interest-only (at 8.5%), payable monthly, with the principal amount due in 10 years. Seven years remain on a ten-year lease. The tenant has an option to buy the property for $1.2 million when the lease expires and is expected to do so. The building accounts for 90% of total property value. Apartment Building Broker number two recommended a 55-unit apartment building that currently generates a gross income of $297,000. The property is listed at $25,000 per unit, for a total price of $1,375,000. The owners are desperate, however, and the broker reports the property can almost certainly be acquired for $1.2 million. Of this amount, $960,000 is attributable to the improvements. Operating expenses and vacancy losses are currently running about 50% of gross income. Both gross income and expenses are expected to remain constant over the (anticipated) seven-year holding period. At the end of the seventh year, the property is expected to have a market value of $1.2 million. A 25-year, 8% mortgage loan is available for 75% of the purchase price. There will be no origination fee or prepayment penalty. Level payments will be made monthly. Office Building The final alternative is a 20,000-square-foot office building that is advertised for sale at $60 per square foot ($1.2 million total), but can probably be bought for $1.1 million. Buildings and other improvements account for 90% of the propertys total value. During the first year of the prospective holding period, this property should yield gross rent of $10 per square foot and incur operating expenses of about $4 per square foot. Both gross revenue and operating expenses are expected to increase thereafter at a compound annual rate of 5%. If the building is acquired, Goldberg will probably hold it for seven years. At that time, he should be able to sell it for about $1.25 million. A lender has indicated willingness to make a 25-year, 8% mortgage loan for 75% of Goldbergs purchase price (with a 10-year call provision). There will be no origination fee and no prepayment penalty. Payments must be made monthly.

THE ANALYSIS

For each investment opportunity, develop an after-tax cash-flow projection for the anticipated seven-year holding period using this template download Minimize File Preview . Project after-tax cash proceeds from disposal at the end of the holding period. Which of these propositions, if any, seems appropriate for Goldberg? What property will you advise him to acquire? What considerations should be made? (In your analysis, assume that expected purchase prices include transaction costs and that expected sales prices are net of transaction costs. Assume the purchase is in January of Year 1 and sale in December of Year 7.)

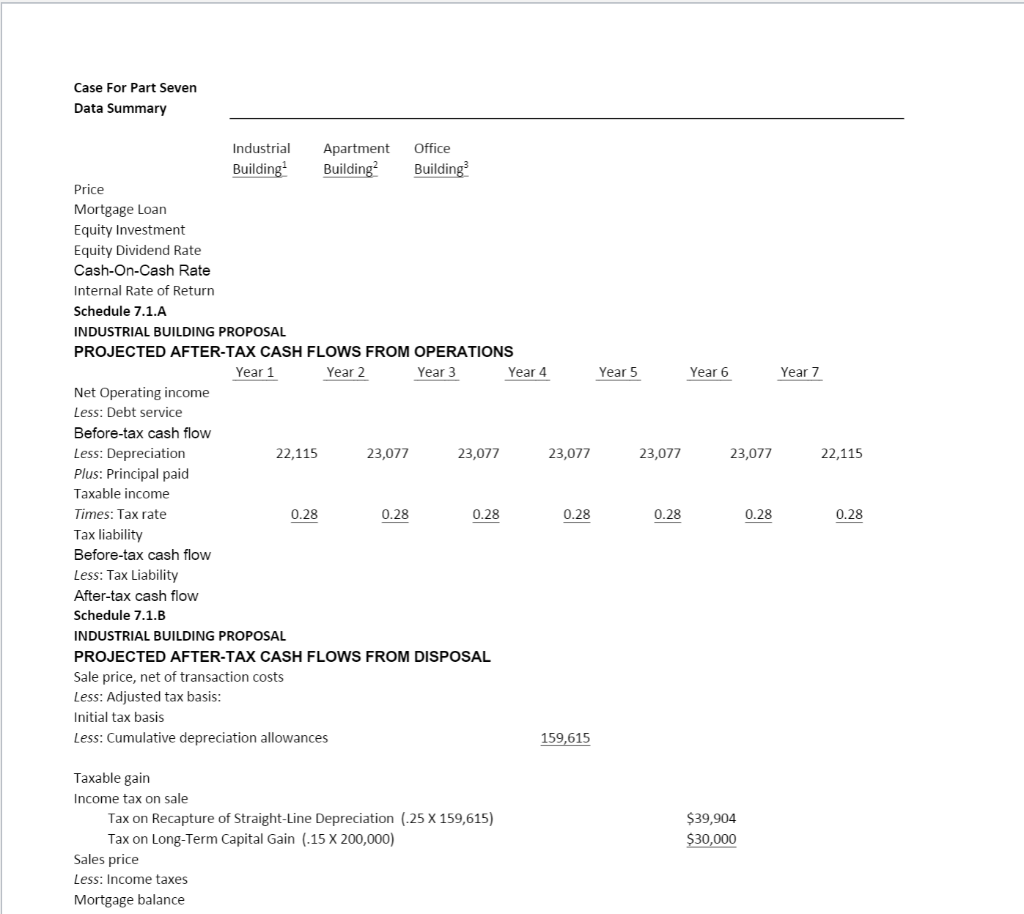

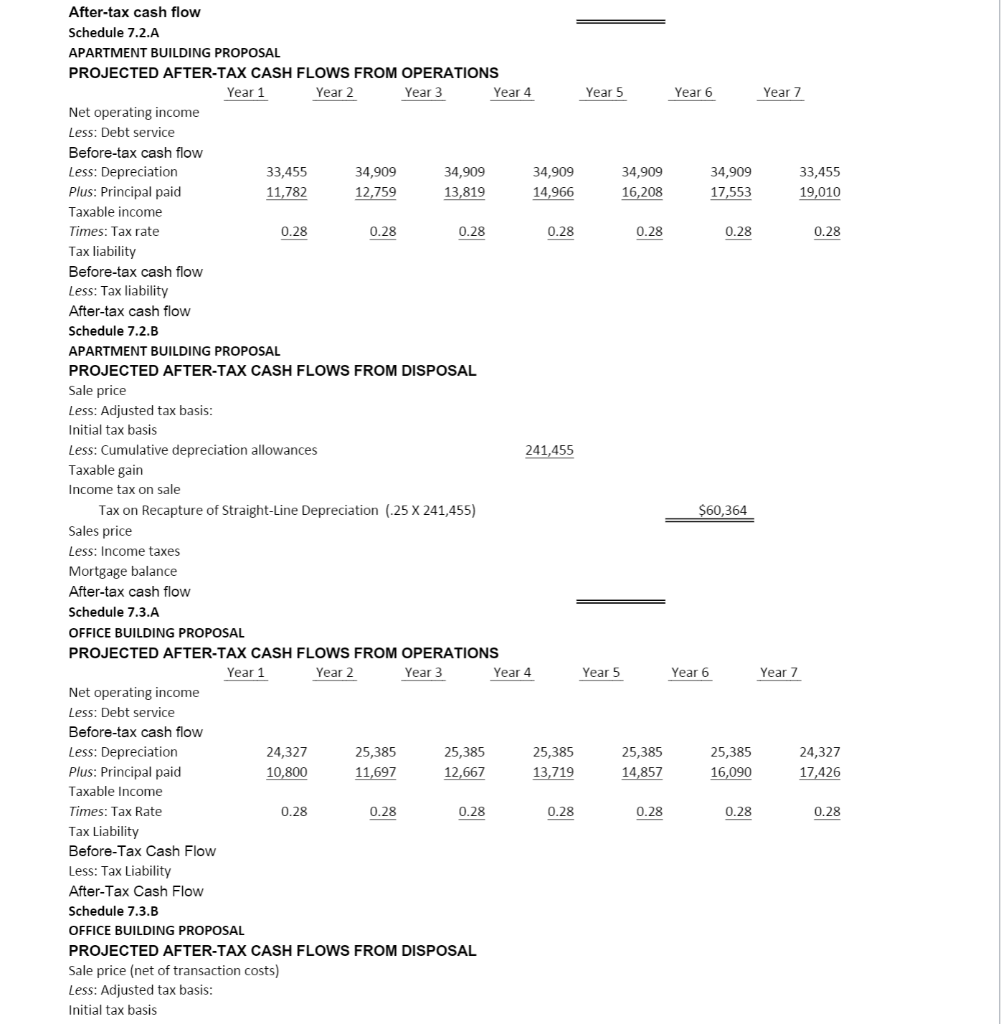

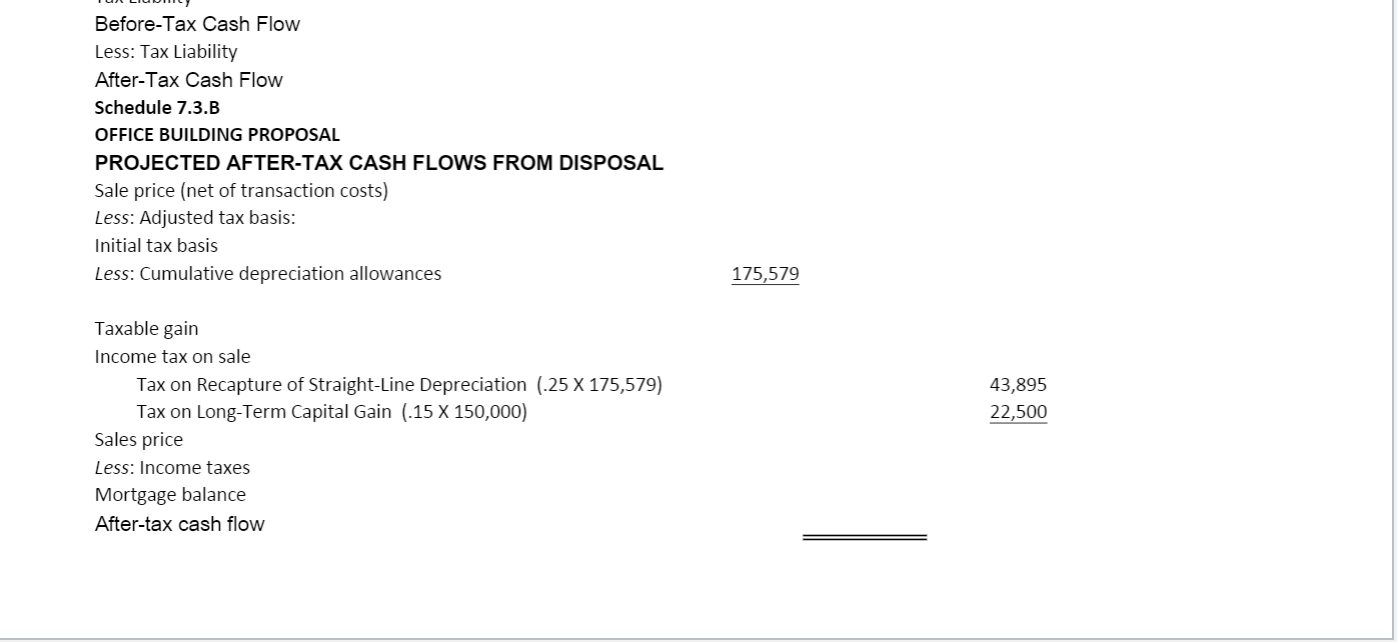

Case For Part Seven Data Summary Year 5 Year 6 Year 7 Industrial Apartment Office Building Building Building Price Mortgage Loan Equity Investment Equity Dividend Rate Cash-On-Cash Rate Internal Rate of Return Schedule 7.1.A INDUSTRIAL BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM OPERATIONS Year 1 Year 2 Year 3 Year 4 Net Operating income Less: Debt service Before-tax cash flow Less: Depreciation 22,115 23,077 23,077 23,077 Plus: Principal paid Taxable income Times: Tax rate 0.28 0.28 0.28 0.28 Tax liability Before-tax cash flow Less: Tax Liability After-tax cash flow Schedule 7.1.B INDUSTRIAL BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL Sale price, net of transaction costs Less: Adjusted tax basis: Initial tax basis Less: Cumulative depreciation allowances 159,615 23,077 23,077 22,115 0.28 0.28 0.28 Taxable gain Income tax on sale Tax on Recapture of Straight-Line Depreciation (.25 X 159,615) Tax on Long-Term Capital Gain (15 X 200,000) Sales price Less: Income taxes Mortgage balance $39,904 $30,000 Year 5 Year 6 Year 7 After-tax cash flow Schedule 7.2.A APARTMENT BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM OPERATIONS Year 1 Year 2 Year 3 Year 4 Net operating income Less: Debt service Before-tax cash flow Less: Depreciation 33,455 34,909 34,909 34,909 Plus: Principal paid 11,782 12,759 14,966 Taxable income Times: Tax rate 0.28 0.28 0.28 0.28 Tax liability Before-tax cash flow Less: Tax liability After-tax cash flow Schedule 7.2.B APARTMENT BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL 34,909 16,208 34,909 17,553 33,455 19,010 13,819 0.28 0.28 0.28 Sale price $60,364 Year 5 Year 6 Year 7 Less: Adjusted tax basis: Initial tax basis Less: Cumulative depreciation allowances 241,455 Taxable gain Income tax on sale Tax on Recapture of Straight-Line Depreciation (25 X 241,455) Sales price Less: Income taxes Mortgage balance After-tax cash flow Schedule 7.3.A OFFICE BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM OPERATIONS Year 1 Year 2 Year 3 Year 4 Net operating income Less: Debt service Before-tax cash flow Less: Depreciation 24,327 25,385 25,385 25,385 Plus: Principal paid 10,800 11,697 12,667 13,719 Taxable income Times: Tax Rate 0.28 0.28 0.28 0.28 Tax Liability Before-Tax Cash Flow Less: Tax Liability After-Tax Cash Flow Schedule 7.3.B OFFICE BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL Sale price (net of transaction costs) Less: Adjusted tax basis: Initial tax basis 25,385 14,857 25,385 16,090 24,327 17,426 0.28 0.28 0.28 Before-Tax Cash Flow Less: Tax Liability After-Tax Cash Flow Schedule 7.3.B OFFICE BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL Sale price (net of transaction costs) Less: Adjusted tax basis: Initial tax basis Less: Cumulative depreciation allowances 175,579 43,895 22,500 Taxable gain Income tax on sale Tax on Recapture of Straight-Line Depreciation (.25 X 175,579) Tax on Long-Term Capital Gain (15 X 150,000) Sales price Less: Income taxes Mortgage balance After-tax cash flow Case For Part Seven Data Summary Year 5 Year 6 Year 7 Industrial Apartment Office Building Building Building Price Mortgage Loan Equity Investment Equity Dividend Rate Cash-On-Cash Rate Internal Rate of Return Schedule 7.1.A INDUSTRIAL BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM OPERATIONS Year 1 Year 2 Year 3 Year 4 Net Operating income Less: Debt service Before-tax cash flow Less: Depreciation 22,115 23,077 23,077 23,077 Plus: Principal paid Taxable income Times: Tax rate 0.28 0.28 0.28 0.28 Tax liability Before-tax cash flow Less: Tax Liability After-tax cash flow Schedule 7.1.B INDUSTRIAL BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL Sale price, net of transaction costs Less: Adjusted tax basis: Initial tax basis Less: Cumulative depreciation allowances 159,615 23,077 23,077 22,115 0.28 0.28 0.28 Taxable gain Income tax on sale Tax on Recapture of Straight-Line Depreciation (.25 X 159,615) Tax on Long-Term Capital Gain (15 X 200,000) Sales price Less: Income taxes Mortgage balance $39,904 $30,000 Year 5 Year 6 Year 7 After-tax cash flow Schedule 7.2.A APARTMENT BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM OPERATIONS Year 1 Year 2 Year 3 Year 4 Net operating income Less: Debt service Before-tax cash flow Less: Depreciation 33,455 34,909 34,909 34,909 Plus: Principal paid 11,782 12,759 14,966 Taxable income Times: Tax rate 0.28 0.28 0.28 0.28 Tax liability Before-tax cash flow Less: Tax liability After-tax cash flow Schedule 7.2.B APARTMENT BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL 34,909 16,208 34,909 17,553 33,455 19,010 13,819 0.28 0.28 0.28 Sale price $60,364 Year 5 Year 6 Year 7 Less: Adjusted tax basis: Initial tax basis Less: Cumulative depreciation allowances 241,455 Taxable gain Income tax on sale Tax on Recapture of Straight-Line Depreciation (25 X 241,455) Sales price Less: Income taxes Mortgage balance After-tax cash flow Schedule 7.3.A OFFICE BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM OPERATIONS Year 1 Year 2 Year 3 Year 4 Net operating income Less: Debt service Before-tax cash flow Less: Depreciation 24,327 25,385 25,385 25,385 Plus: Principal paid 10,800 11,697 12,667 13,719 Taxable income Times: Tax Rate 0.28 0.28 0.28 0.28 Tax Liability Before-Tax Cash Flow Less: Tax Liability After-Tax Cash Flow Schedule 7.3.B OFFICE BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL Sale price (net of transaction costs) Less: Adjusted tax basis: Initial tax basis 25,385 14,857 25,385 16,090 24,327 17,426 0.28 0.28 0.28 Before-Tax Cash Flow Less: Tax Liability After-Tax Cash Flow Schedule 7.3.B OFFICE BUILDING PROPOSAL PROJECTED AFTER-TAX CASH FLOWS FROM DISPOSAL Sale price (net of transaction costs) Less: Adjusted tax basis: Initial tax basis Less: Cumulative depreciation allowances 175,579 43,895 22,500 Taxable gain Income tax on sale Tax on Recapture of Straight-Line Depreciation (.25 X 175,579) Tax on Long-Term Capital Gain (15 X 150,000) Sales price Less: Income taxes Mortgage balance After-tax cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts