Question: . Case Scenario - Data Dan is a 29 year old professional. He has accumulated debt through multiple sources: 1) Visa credit card : total

.

.

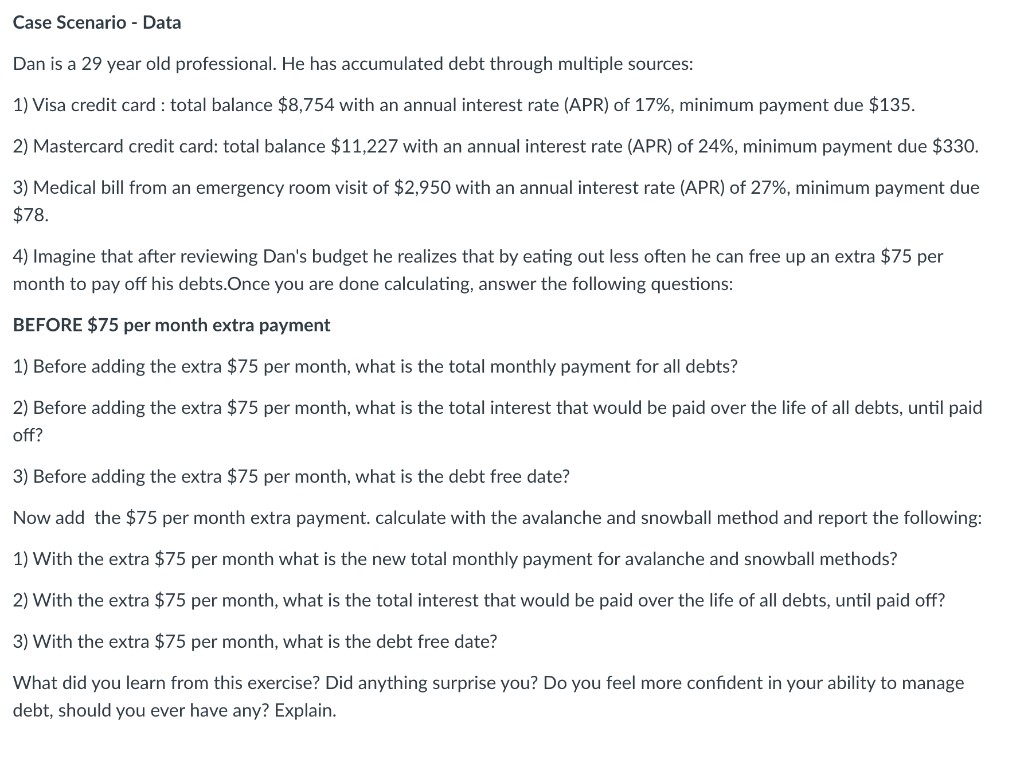

Case Scenario - Data Dan is a 29 year old professional. He has accumulated debt through multiple sources: 1) Visa credit card : total balance $8,754 with an annual interest rate (APR) of 17%, minimum payment due $135. 2) Mastercard credit card: total balance $11,227 with an annual interest rate (APR) of 24%, minimum payment due $330. 3) Medical bill from an emergency room visit of $2,950 with an annual interest rate (APR) of 27%, minimum payment due $78. 4) Imagine that after reviewing Dan's budget he realizes that by eating out less often he can free up an extra $75 per month to pay off his debts. Once you are done calculating, answer the following questions: BEFORE $75 per month extra payment 1) Before adding the extra $75 per month, what is the total monthly payment for all debts? 2) Before adding the extra $75 per month, what is the total interest that would be paid over the life of all debts, until paid off? 3) Before adding the extra $75 per month, what is the debt free date? Now add the $75 per month extra payment. calculate with the avalanche and snowball method and report the following: 1) With the extra $75 per month what is the new total monthly payment for avalanche and snowball methods? 2) With the extra $75 per month, what is the total interest that would be paid over the life of all debts, until paid off? 3) With the extra $75 per month, what is the debt free date? What did you learn from this exercise? Did anything surprise you? Do you feel more confident in your ability to manage debt, should you ever have any? Explain. Case Scenario - Data Dan is a 29 year old professional. He has accumulated debt through multiple sources: 1) Visa credit card : total balance $8,754 with an annual interest rate (APR) of 17%, minimum payment due $135. 2) Mastercard credit card: total balance $11,227 with an annual interest rate (APR) of 24%, minimum payment due $330. 3) Medical bill from an emergency room visit of $2,950 with an annual interest rate (APR) of 27%, minimum payment due $78. 4) Imagine that after reviewing Dan's budget he realizes that by eating out less often he can free up an extra $75 per month to pay off his debts. Once you are done calculating, answer the following questions: BEFORE $75 per month extra payment 1) Before adding the extra $75 per month, what is the total monthly payment for all debts? 2) Before adding the extra $75 per month, what is the total interest that would be paid over the life of all debts, until paid off? 3) Before adding the extra $75 per month, what is the debt free date? Now add the $75 per month extra payment. calculate with the avalanche and snowball method and report the following: 1) With the extra $75 per month what is the new total monthly payment for avalanche and snowball methods? 2) With the extra $75 per month, what is the total interest that would be paid over the life of all debts, until paid off? 3) With the extra $75 per month, what is the debt free date? What did you learn from this exercise? Did anything surprise you? Do you feel more confident in your ability to manage debt, should you ever have any? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts