Question: Case Study 01: Internationalization of Waymo Waymo (www.waymo.com), the Alphabet self-driving unit, originated in 2009 as a project of Google before it became a stand-alone

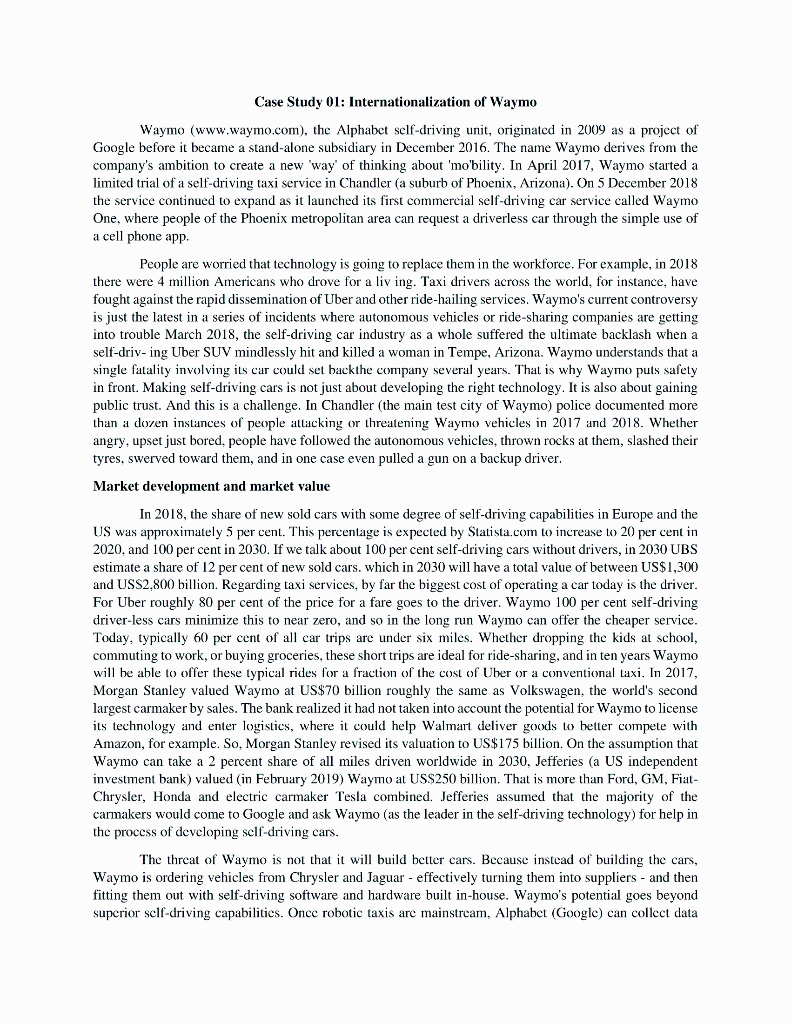

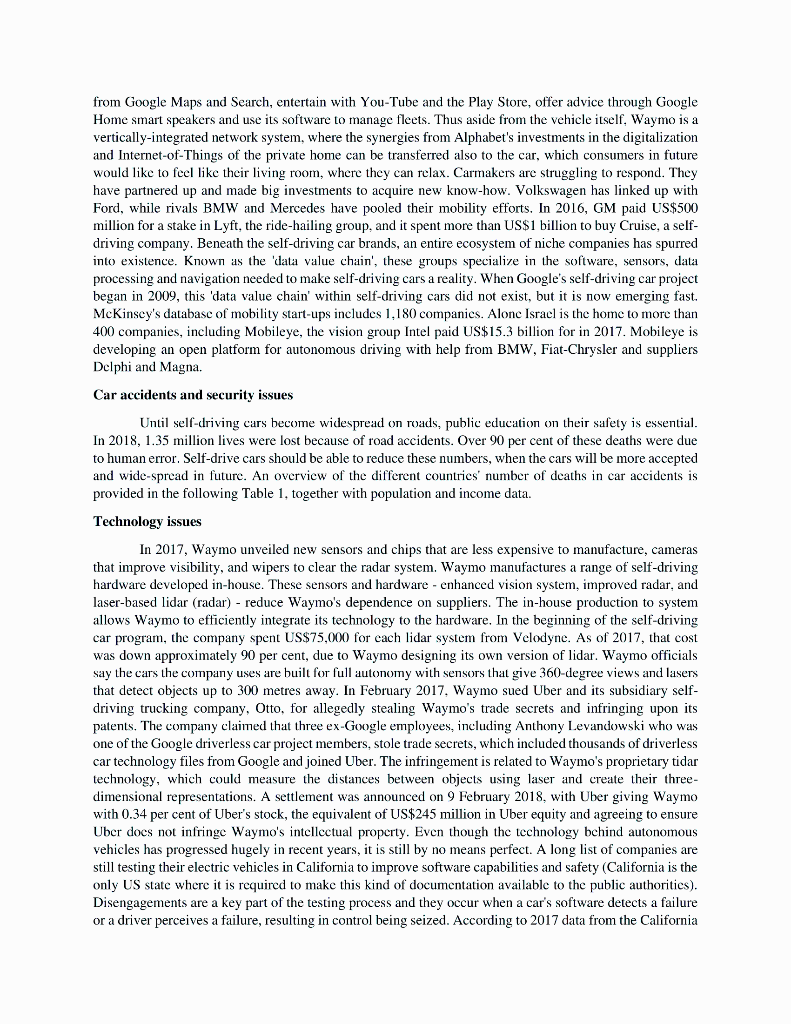

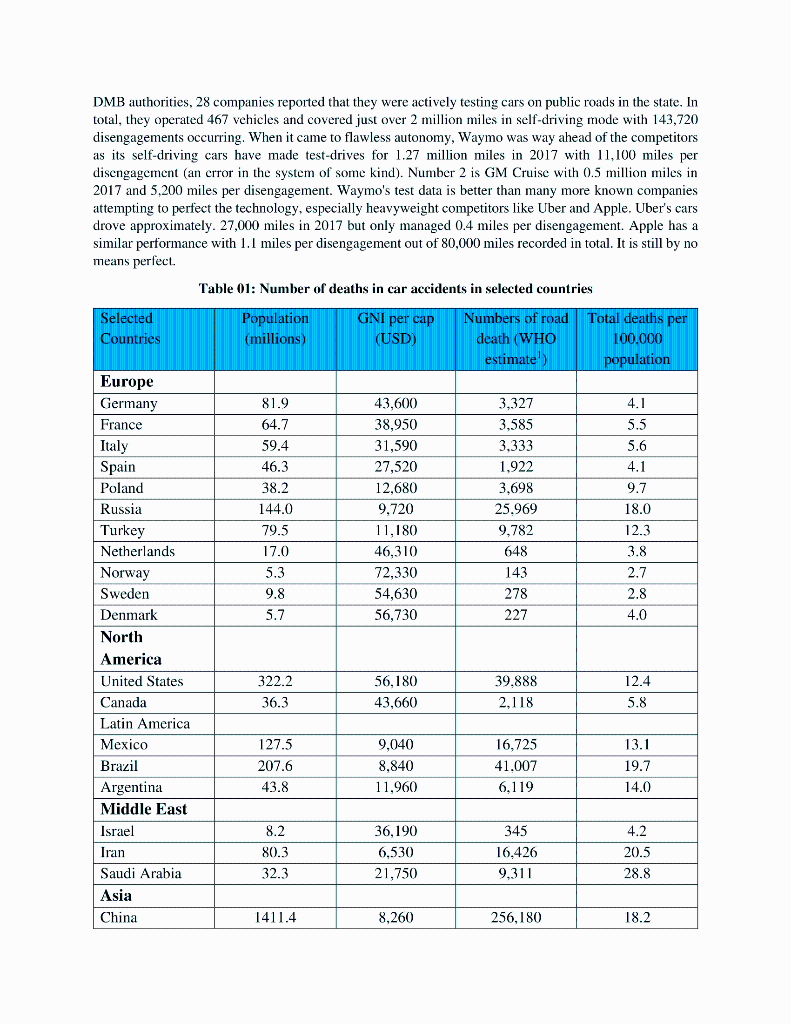

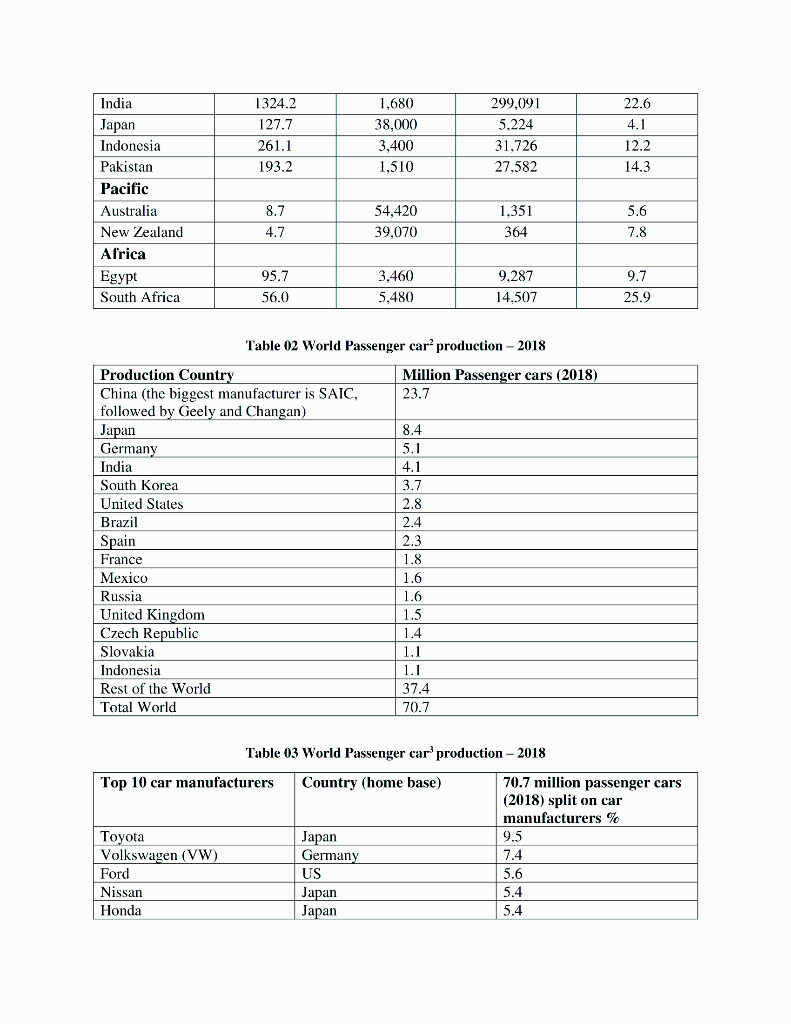

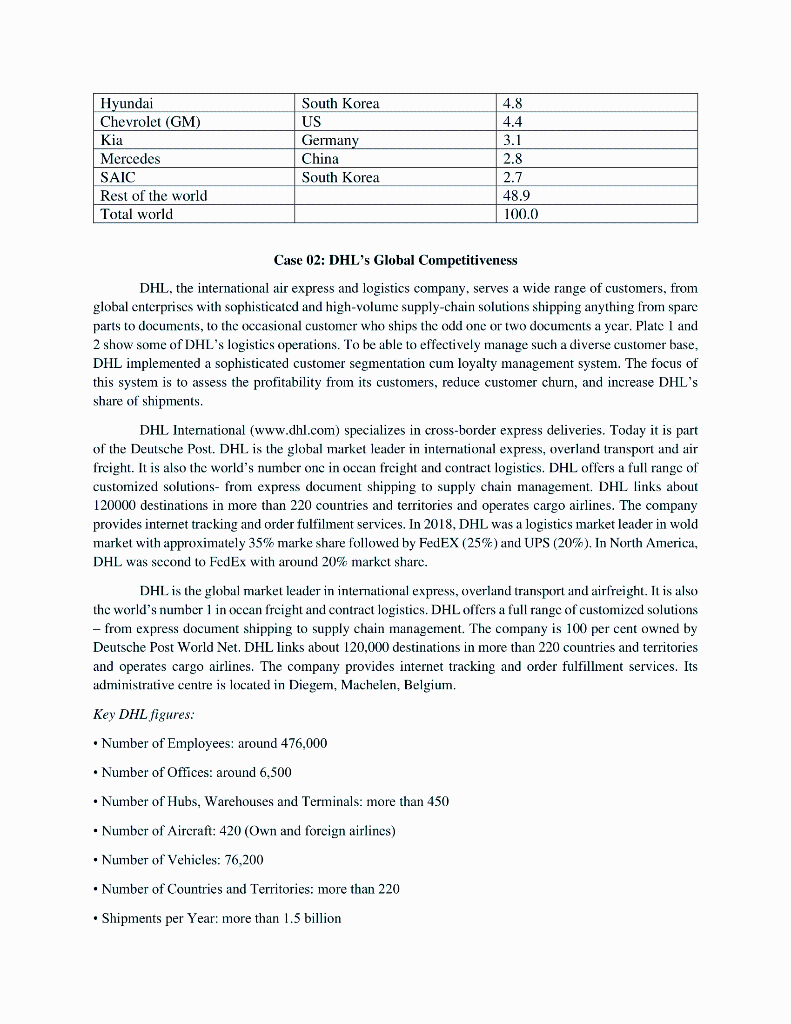

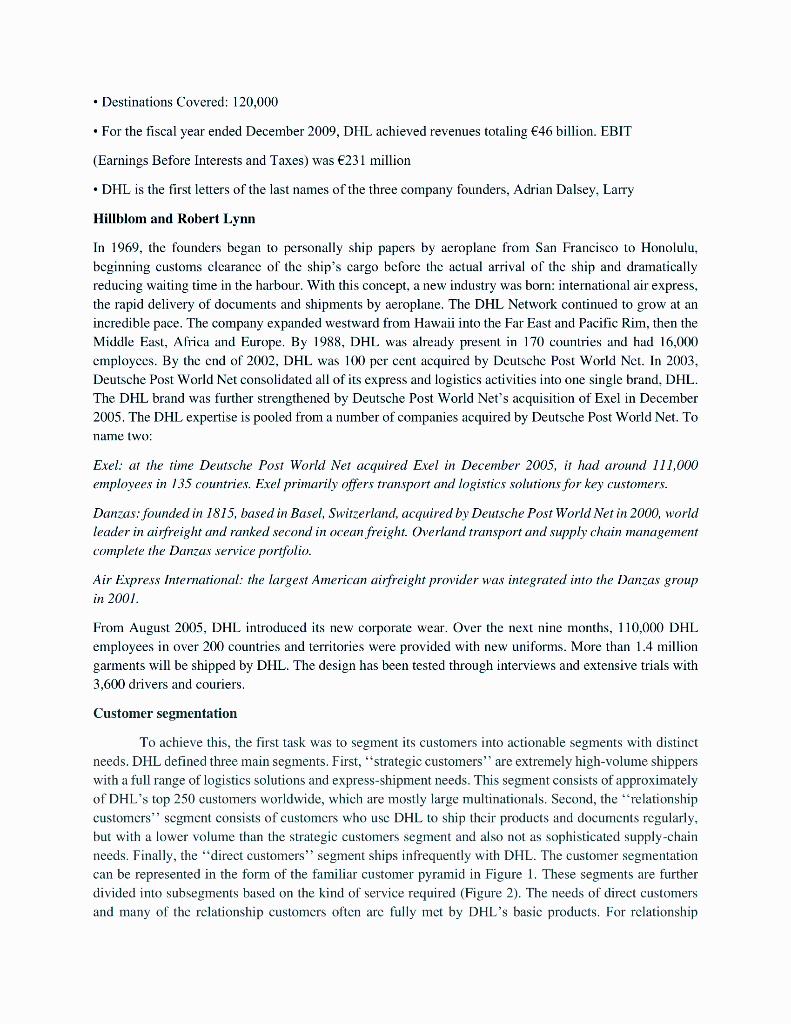

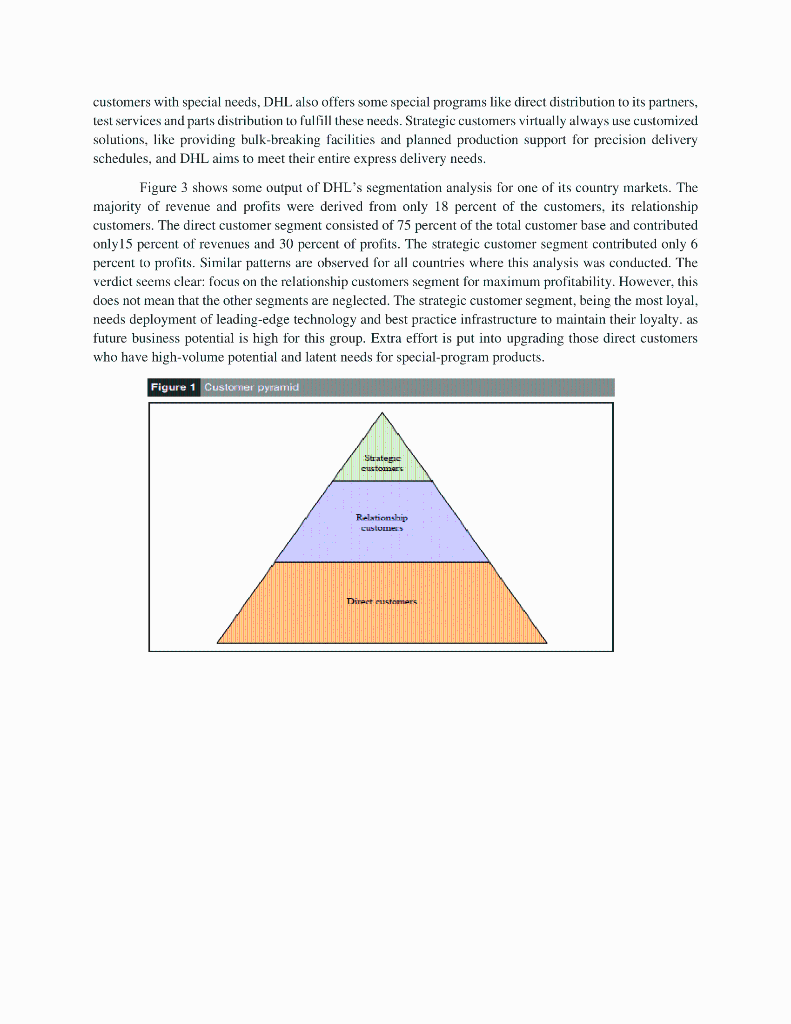

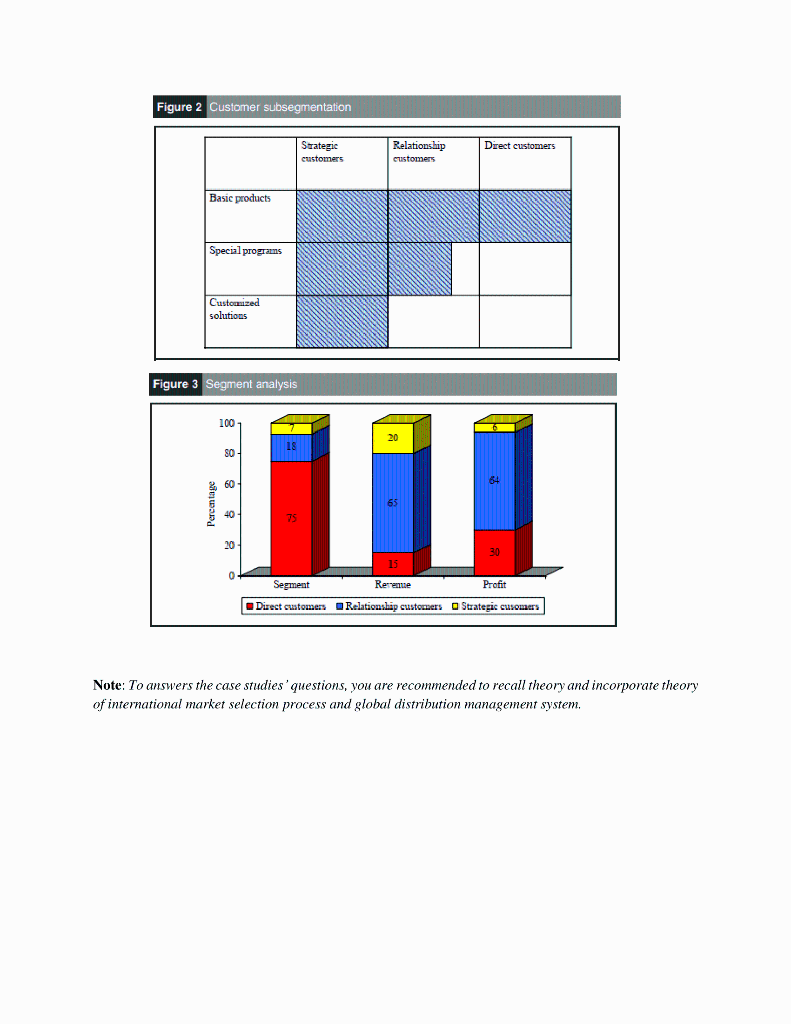

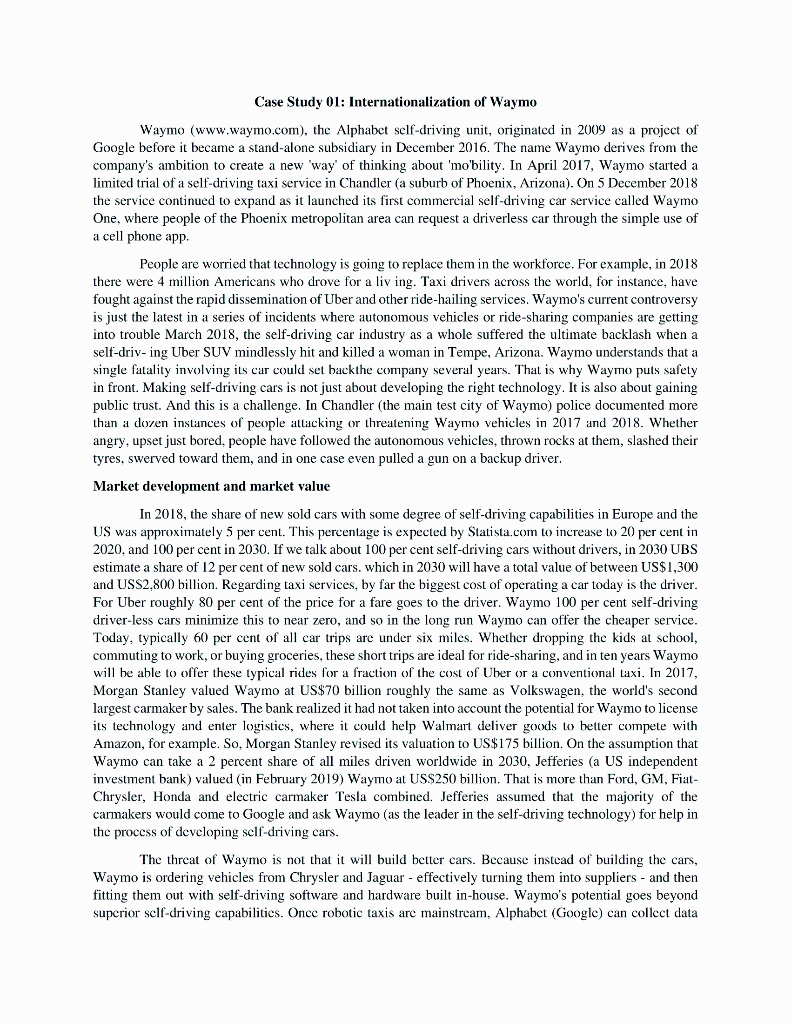

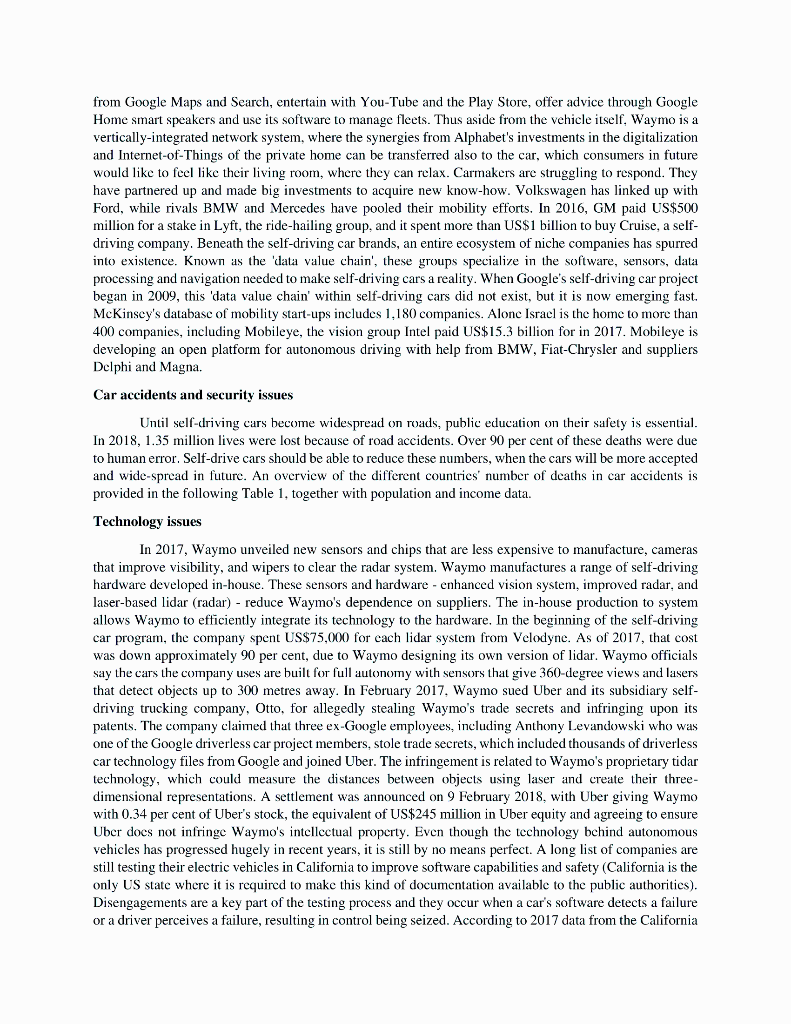

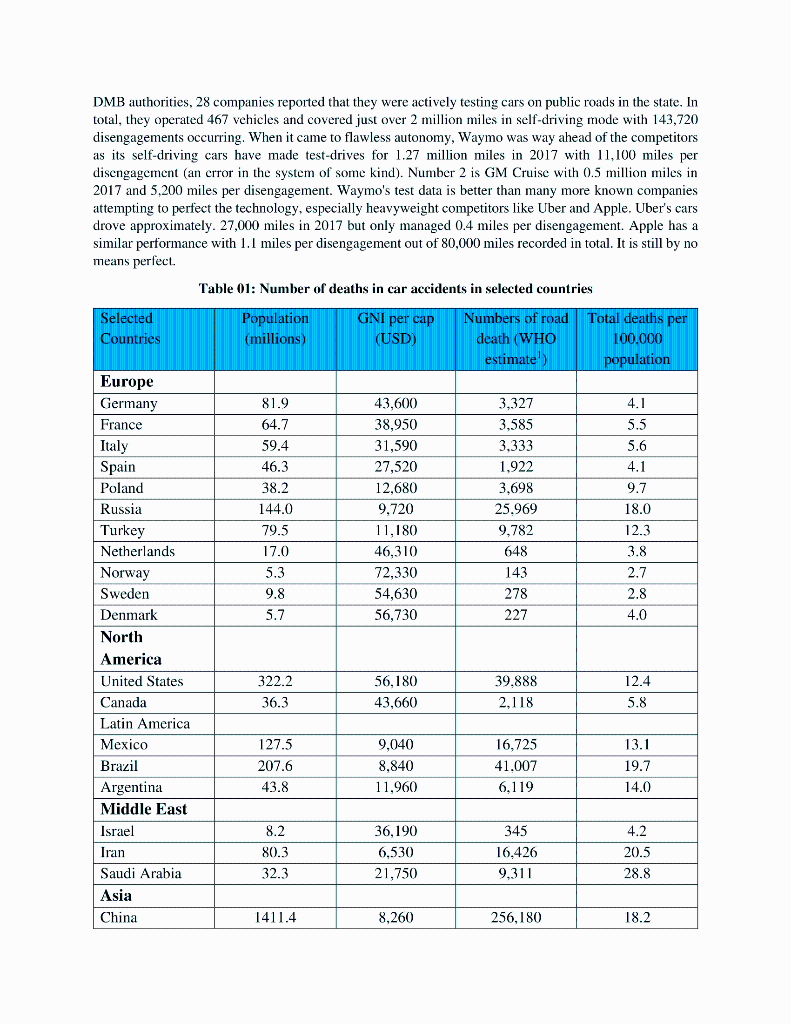

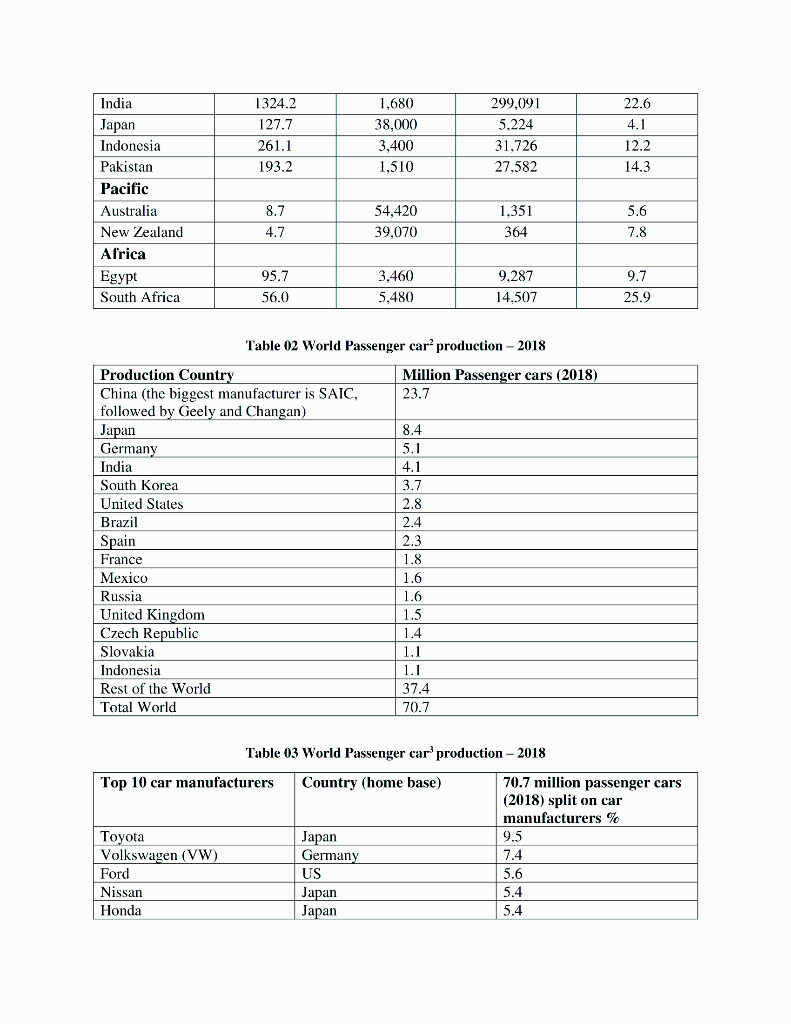

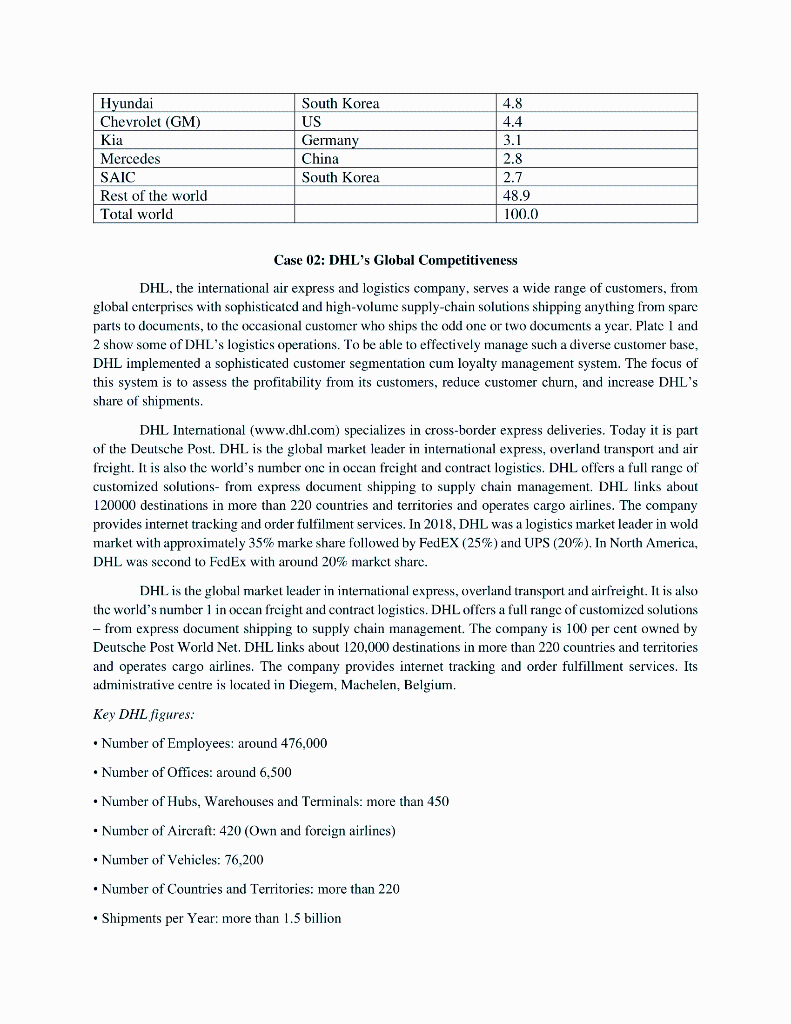

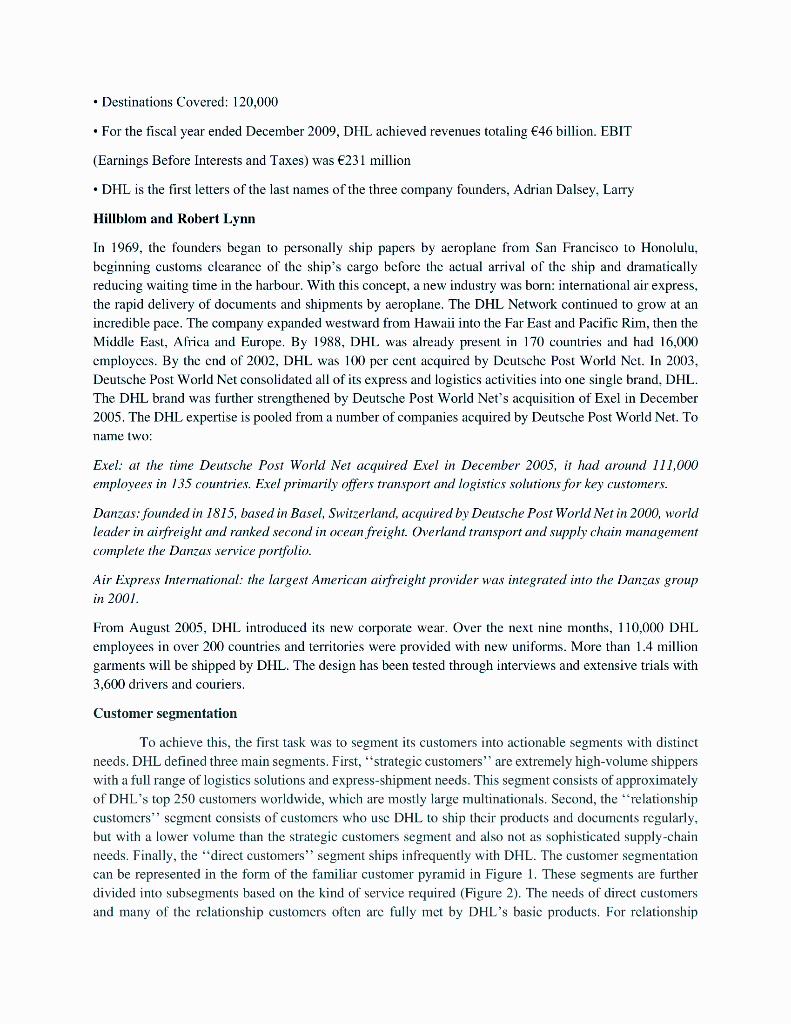

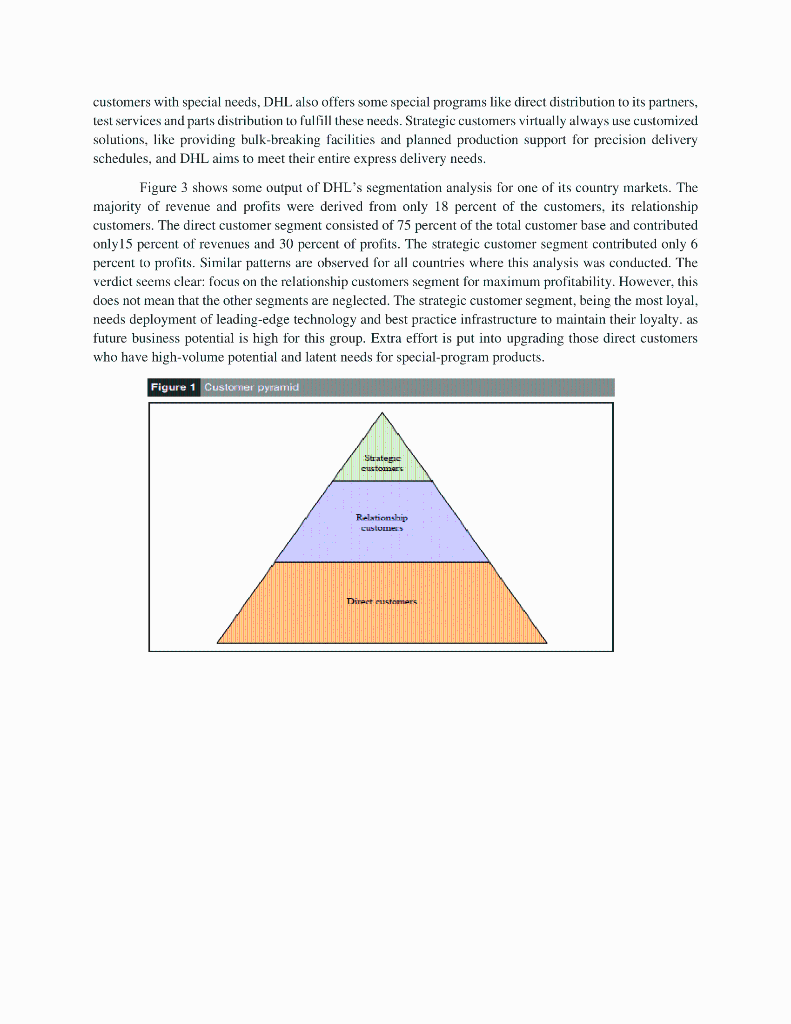

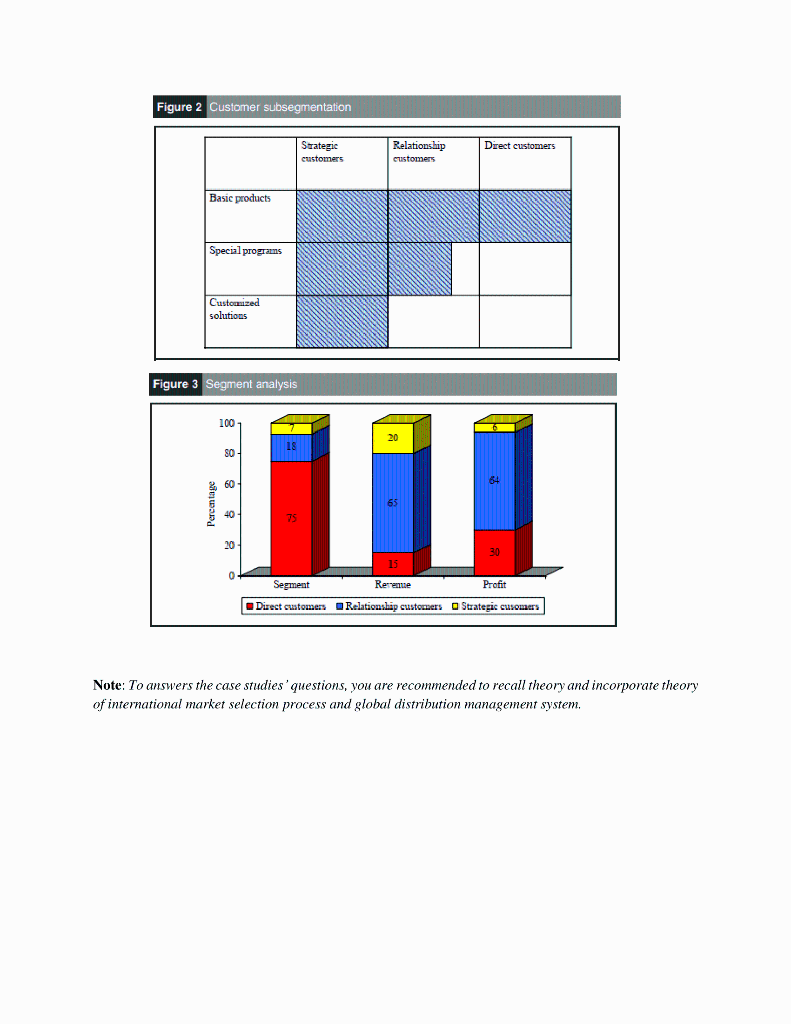

Case Study 01: Internationalization of Waymo Waymo (www.waymo.com), the Alphabet self-driving unit, originated in 2009 as a project of Google before it became a stand-alone subsidiary in December 2016. The name Waymo derives from the company's ambition to create a new 'way' of thinking about 'mo'bility. In April 2017, Waymo started a limited trial of a self-driving taxi service in Chandler (a suburb of Phoenix, Arizona). On 5 December 2018 the service continued to expand as it launched its first commercial self-driving car service called Waymo One, where people of the Phoenix metropolitan area can request a driverless car through the simple use of a cell phone app People are worried that technology is going to replace them in the workforce. For example, in 2018 there were 4 million Americans who drove for a living. Taxi drivers across the world, for instance, have fought against the rapid dissemination of Uber and other ride-hailing services. Waymo's current controversy is just the latest in a series of incidents where autonomous vehicles or ride-sharing companies are getting into trouble March 2018, the self-driving car industry as a whole suffered the ultimate backlash when a self-driv-ing Uber SUV mindlessly hit and killed a woman in Tempe, Arizona. Waymo understands that a single fatality involving its car could set hackthe company several years. That is why Waymo puts safety in front. Making self-driving cars is not just about developing the right technology. It is also about gaining public trust. And this is a challenge. In Chandler (the main test city of Waymo) police documented more than a dozen instances of people attacking or threatening Waymo vehicles in 2017 and 2018. Whether angry, upset just bored, people have followed the autonomous vehicles, thrown rocks at them, slashed their tyres, swerved toward them, and in one case even pulled a gun on a backup driver. Market development and market value In 2018, the share of new sold cars with some degree of self-driving capabilities in Europe and the US was approximately 5 per cent. This percentage is expected by Statista.com to increase to 20 per cent in 2020. and 100 per cent in 2030. If we talk about 100 per cent self-driving cars without drivers, in 2030 UBS estimate a share of 12 per cent of new sold cars, which in 2030 will have a total value of between US$1,300 and USS2.800 billion. Regarding taxi services, by far the biggest cost of operating a car today is the driver. For Uber roughly 80 per cent of the price for a fare goes to the driver. Waymo 100 per cent self-driving driver-less cars minimize this to near zero, and so in the long run Waymo can offer the cheaper service. Today, typically 60 per cent of all car trips are under six miles. Whether dropping the kids at school, commuting to work, or buying groceries, these short trips are ideal for ride-sharing, and in ten years Waymo will be able to offer these typical rides for a fraction of the cost of Uber or a conventional taxi. In 2017, Morgan Stanley valued Waymo at US$70 billion roughly the same as Volkswagen, the world's second largest carmaker by sales. The bank realized it had not taken into account the potential for Waymo to license its technology and enter logistics, where it could help Walmart deliver goods to better compete with Amazon, for example. So, Morgan Stanley revised its valuation to US$175 billion. On the assumption that Waymo can take a 2 percent share of all miles driven worldwide in 2030, Jefferies (a US independent investment bank) valued (in February 2019) Waymo at US$250 billion. That is more than Ford, GM, Fiat- Chrysler, Honda and electric carmaker Tesla combined. Jefferies assumed that the majority of the carmakers would come to Google and ask Waymo (as the leader in the self-driving technology) for help in the process of developing self-driving cars. The threat of Waymo is not that it will build better cars. Because instead of building the cars, Waymo is ordering vehicles from Chrysler and Jaguar - effectively turning them into suppliers - and then fitting them out with self-driving software and hardware built in-house. Waymo's potential goes beyond superior self-driving capabilities. Once robotic taxis are mainstream, Alphabet (Google) can collect data from Google Maps and Search, entertain with You-Tube and the Play Store, offer advice through Google Home smart speakers and use its software to manage fleets. Thus aside from the vehicle itself, Waymo is a vertically-integrated network system, where the synergies from Alphabet's investments in the digitalization and Internet-of-Things of the private home can be transferred also to the car, which consumers in future would like to feel like their living room, where they can relax. Carmakers are struggling to respond. They have partnered up and made big investments to acquire new know-how. Volkswagen has linked up with Ford, while rivals BMW and Mercedes have pooled their mobility efforts. In 2016, GM paid US$500 million for a stake in Lyft, the ride-hailing group, and it spent more than US$1 billion to buy Cruise, a self- driving company. Beneath the self-driving car brands, an entire ecosystem of niche companies has spurred into existence. Known as the 'data value chain', these groups specialize in the software, sensors, data processing and navigation needed to make self-driving cars a reality. When Google's self-driving car project began in 2009, this data value chain' within self-driving cars did not exist, but it is now emerging fast. McKinsey's database of mobility start-ups includes 1,180 companies. Alone Israel is the home to more than 400 companies, including Mobileye, the vision group Intel paid US$15.3 billion for in 2017. Mobileye is developing an open platform for autonomous driving with help from BMW, Fiat-Chrysler and suppliers Delphi and Magna. Car accidents and security issues Until self-driving cars become widespread on roads, public education on their safety is essential. In 2018, 1.35 million lives were lost because of road accidents. Over 90 per cent of these deaths were due to human error. Self-drive cars should be able to reduce these numbers, when the cars will be more accepted and wide-spread in future. An overview of the different countries' number of deaths in car accidents is provided in the following Table 1, together with population and income data. Technology issues In 2017, Waymo unveiled new sensors and chips that are less expensive to manufacture, cameras that improve visibility, and wipers to clear the radar system. Waymo manufactures a range of self-driving hardware developed in-house. These sensors and hardware - enhanced vision system, improved radar, and laser-based lidar (radar) - reduce Waymo's dependence on suppliers. The in-house production to system allows Waymo to efficiently integrate its technology to the hardware. In the beginning of the self-driving car program, the company spent US$75,000 for each lidar system from Velodyne. As of 2017, that cost was down approximately 90 per cent, due to Waymo designing its own version of lidar. Waymo officials say the cars the company uses are built for full autonomy with sensors that give 360-degree views and lasers that detect objects up to 300 metres away. In February 2017. Waymo sued Uber and its subsidiary self- driving trucking company, Otto, for allegedly stealing Waymo's trade secrets and infringing upon its patents. The company claimed that three ex-Google employees, including Anthony Levandowski who was one of the Google driverless car project members, stole trade secrets, which included thousands of driverless car technology files from Google and joined Uber. The infringement is related to Waymo's proprietary tidar technology, which could measure the distances between objects using laser and create their three- dimensional representations. A settlement was announced on 9 February 2018, with Uber giving Waymo with 0.34 per cent of Uber's stock, the equivalent of US$245 million in Uber equity and agreeing to ensure Uber does not infringe Waymo's intellectual property. Even though the technology behind autonomous vehicles has progressed hugely in recent years, it is still by no means perfect. A long list of companies are still testing their electric vehicles in California to improve software capabilities and safety (California is the only US state where it is required to make this kind of documentation available to the public authoritics). Disengagements are a key part of the testing process and they occur when a car's software detects a failure or a driver perceives a failure, resulting in control being seized. According to 2017 data from the California DMB authorities, 28 companies reported that they were actively testing cars on public roads in the state. In total, they operated 467 vehicles and covered just over 2 million miles in self-driving mode with 143,720 disengagements occurring. When it came to flawless autonomy, Waymo was way ahead of the competitors as its self-driving cars have made test-drives for 1.27 million miles in 2017 with 11,100 miles per disengagement an error in the system of some kind). Number 2 is GM Cruise with 0.5 million miles in 2017 and 5,200 miles per disengagement. Waymo's test data is better than many more known companies attempting to perfect the technology, especially heavyweight competitors like Uber and Apple. Uber's cars drove approximately. 27,000 miles in 2017 but only managed 0.4 miles per disengagement. Apple has a similar performance with 1.1 miles per disengagement out of 80,000 miles recorded in total. It is still by no means perfect Table 01: Number of deaths in car accidents in selected countries Selected Countries Population (millions) GNI per cap (USD) Numbers of road death (WHO estimate) Total deaths per 100,000 population 81.9 64.7 59.4 46.3 38.2 144.0 79.5 17.0 5.3 9.8 5.7 43,600 38,950 31,590 27,520 12,680 9,720 11,180 46,310 72,330 54,630 56,730 3,327 3,585 3.333 1,922 3,698 25.969 9,782 648 143 278 227 4.1 5.5 5.6 4.1 9.7 18.0 12.3 3.8 2.7 2.8 4.0 Europe Germany France Italy Spain Poland Russia Turkey Netherlands Norway Sweden Denmark North America United States Canada Latin America Mexico Brazil Argentina Middle East Israel Iran Saudi Arabia Asia China 322.2 36.3 56,180 43,660 39.888 2,118 12.4 5.8 127.5 207.6 43.8 9,040 8,840 16,725 41.007 6.119 13.1 19.7 14.0 11,960 8.2 80.3 36,190 6,530 21,750 345 16,426 9,311 4.2 20.5 28.8 32.3 1411.4 8,260 256,180 18.2 1324.2 127.7 261.1 193.2 1,680 38,000 3,400 1,510 299,091 5,224 31,726 27,582 22.6 4.1 12.2 14.3 India Japan Indonesia Pakistan Pacific Australia New Zealand Africa Egypt South Africa 8.7 4.7 54,420 39,070 1,351 364 5.6 7.8 95.7 56.0 3,460 5,480 9.287 14.507 9.7 25.9 Germany Table 02 World Passenger car production - 2018 Production Country Million Passenger cars (2018) China (the biggest manufacturer is SAIC, 23.7 followed by Geely and Changan) Japan 8.4 5.1 India 4.1 South Korea 3.7 United States 2.8 Brazil 2.4 Spain 2.3 France 1.8 Mexico 1.6 Russia 1.6 United Kingdom 1.5 Czech Republic 1.4 Slovakia 1.1 Indonesia 1.1 Rest of the World 37.4 Total World 70.7 Table 03 World Passenger car production - 2018 Top 10 car manufacturers Country (home base) Toyota Volkswagen (VW) Ford Nissan Honda Japan Germany US Japan Japan 70.7 million passenger cars (2018) split on car manufacturers % 9.5 7.4 5.6 5.4 5.4 Hyundai Chevrolet (GM) Kia Mercedes SAIC Rest of the world Total world South Korea US Germany China South Korea 4.8 4.4 3.1 2.8 2.7 48.9 100.0 Case 02: DHL's Global Competitiveness DHL, the international air express and logistics company, serves a wide range of customers, from global enterprises with sophisticated and high-volume supply-chain solutions shipping anything from spare parts to documents, to the occasional customer who ships the odd one or two documents a year. Plate 1 and 2 show some of DHL's logistics operations. To be able to effectively manage such a diverse customer base, DHL implemented a sophisticated customer segmentation cum loyalty management system. The focus of this system is to assess the profitability from its customers, reduce customer churn, and increase DHL's share of shipments. DHL International (www.dhl.com) specializes in cross-border express deliveries. Today it is part of the Deutsche Post. DHL is the global market leader in international express, overland transport and air freight. It is also the world's number one in occan freight and contract logistics. DHL offers a full range of customized solutions from express document shipping to supply chain management. DHL links about 120000 destinations in more than 220 countries and territories and operates cargo airlines. The company provides internet tracking and order fulfilment services. In 2018, DHL was a logistics market leader wold market with approximately 35% marke share followed by FedEX (25%) and UPS (20%), In North America, DHL was second to FedEx with around 20% market share. DHL is the global market leader in international express, overland transport and airfreight. It is also the world's number 1 in occan freight and contract logistics. DHL offers a full range of customized solutions from express document shipping to supply chain management. The company is 100 per cent owned by Deutsche Post World Net. DHL links about 120,000 destinations in more than 220 countries and territories and operates cargo airlines. The company provides internet tracking and order fulfillment services. Its administrative centre is located in Diegem, Machelen, Belgium. Key DHL figures: Number of Employees: around 476,000 Number of Offices: around 6,500 Number of Hubs, Warehouses and Terminals: more than 450 Number of Aircraft: 420 (Own and foreign airlines) Number of Vehicles: 76,200 Number of Countries and Territories: more than 220 Shipments per Year: more than 1.5 billion Destinations Covered: 120,000 . For the fiscal year ended December 2009, DHL achieved revenues totaling 46 billion. EBIT (Earnings Before Interests and Taxes) was 231 million DHL is the first letters of the last names of the three company founders, Adrian Dalsey, Larry Hillblom and Robert Lynn In 1969, the founders began to personally ship papers by aeroplane from San Francisco to Honolulu, beginning customs clearance of the ship's cargo before the actual arrival of the ship and dramatically reducing waiting time in the harbour. With this concept, a new industry was born: international air express, the rapid delivery of documents and shipments by aeroplane. The DHL Network continued to grow at an incredible pace. The company expanded westward from Hawaii into the Far East and Pacific Rim, then the Middle East, Africa and Europe. By 1988, DHL was already present in 170 countries and had 16,000 employees. By the end of 2002, DHL was 100 per cent acquired by Deutsche Post World Net. In 2003, Deutsche Post World Net consolidated all of its express and logistics activities into one single brand. DHL. The DHL brand was further strengthened by Deutsche Post World Net's acquisition of Exel in December 2005. The DHL expertise is pooled from a number of companies acquired by Deutsche Post World Net. To name two: Exel: at the time Deutsche Post World Net acquired Exel in December 2005, it had around 111,000 employees in 135 countries. Exel primarily offers transport and logistics solutions for key customers. Danzas: founded in 1815, based in Basel, Switzerland, acquired by Deutsche Post World Net in 2000, world leader in airfreight and ranked second in ocean freight. Overland transport and supply chain management complete the Danzas service portfolio. Air Express International: the largest American airfreight provider was integrated into the Danzas group in 2001. From August 2005, DHL introduced its new corporate wear. Over the next nine months, 110,000 DHL employees in over 200 countries and territories were provided with new uniforms. More than 1.4 million garments will be shipped by DHL. The design has been tested through interviews and extensive trials with 3,600 drivers and couriers. Customer segmentation To achieve this, the first task was to segment its customers into actionable segments with distinct needs. DHL defined three main segments. First, "strategic customers' are extremely high-volume shippers with a full range of logistics solutions and express-shipment needs. This segment consists of approximately of DHL's top 250 customers worldwide, which are mostly large multinationals. Second, the relationship customers" segment consists of customers who use DHL to ship their products and documents regularly, but with a lower volume than the strategic customers segment and also not as sophisticated supply-chain needs. Finally, the direct customers" segment ships infrequently with DHL. The customer segmentation represented in form of the familiar customer pyramid Figure 1. These segments are further divided into subsegments based on the kind of service required (Figure 2). The needs of direct customers and many of the relationship customers often are fully mct by DHL's basic products. For relationship can customers with special needs, DHL also offers some special programs like direct distribution to its partners, test services and parts distribution to fulfill these needs. Strategic customers virtually always use customized solutions, like providing bulk-breaking facilities and planned production support for precision delivery schedules, and DHL aims to meet their entire express delivery needs. Figure 3 shows some output of DHL's segmentation analysis for one of its country markets. The majority of revenue and profits were derived from only 18 percent of the customers, its relationship customers. The direct customer segment consisted of 75 percent of the total customer base and contributed only 15 percent of revenues and 30 percent of profits. The strategic customer segment contributed only 6 percent to profits. Similar patterns are observed for all countries where this analysis was conducted. The verdict seems clear: focus on the relationship customers segment for maximum profitability. However, this does not mean that the other segments are neglected. The strategic customer segment, being the most loyal, needs deployment of leading-edge technology and best practice infrastructure to maintain their loyalty. as future business potential is high for this group. Extra effort is put into upgrading those direct customers who have high-volume potential and latent needs for special-program products. Figure 1 Custorner Pyramid Strategie customers Relationship Cust Direct nustomers Figure 2 Customer subsegmentation Strategie customers Relationship customers Drect customers Basic products Special programs Customized solutions Figure 3 Segment analysis 100 80 Percentage 40 7 20 0 Segment Rememe Profit Direct customers Relationshap customers Strategic cusomers Note: To answers the case studies' questions, you are recommended to recall theory and incorporate theory of international market selection process and global distribution management system. Case Study 01: Internationalization of Waymo Waymo (www.waymo.com), the Alphabet self-driving unit, originated in 2009 as a project of Google before it became a stand-alone subsidiary in December 2016. The name Waymo derives from the company's ambition to create a new 'way' of thinking about 'mo'bility. In April 2017, Waymo started a limited trial of a self-driving taxi service in Chandler (a suburb of Phoenix, Arizona). On 5 December 2018 the service continued to expand as it launched its first commercial self-driving car service called Waymo One, where people of the Phoenix metropolitan area can request a driverless car through the simple use of a cell phone app People are worried that technology is going to replace them in the workforce. For example, in 2018 there were 4 million Americans who drove for a living. Taxi drivers across the world, for instance, have fought against the rapid dissemination of Uber and other ride-hailing services. Waymo's current controversy is just the latest in a series of incidents where autonomous vehicles or ride-sharing companies are getting into trouble March 2018, the self-driving car industry as a whole suffered the ultimate backlash when a self-driv-ing Uber SUV mindlessly hit and killed a woman in Tempe, Arizona. Waymo understands that a single fatality involving its car could set hackthe company several years. That is why Waymo puts safety in front. Making self-driving cars is not just about developing the right technology. It is also about gaining public trust. And this is a challenge. In Chandler (the main test city of Waymo) police documented more than a dozen instances of people attacking or threatening Waymo vehicles in 2017 and 2018. Whether angry, upset just bored, people have followed the autonomous vehicles, thrown rocks at them, slashed their tyres, swerved toward them, and in one case even pulled a gun on a backup driver. Market development and market value In 2018, the share of new sold cars with some degree of self-driving capabilities in Europe and the US was approximately 5 per cent. This percentage is expected by Statista.com to increase to 20 per cent in 2020. and 100 per cent in 2030. If we talk about 100 per cent self-driving cars without drivers, in 2030 UBS estimate a share of 12 per cent of new sold cars, which in 2030 will have a total value of between US$1,300 and USS2.800 billion. Regarding taxi services, by far the biggest cost of operating a car today is the driver. For Uber roughly 80 per cent of the price for a fare goes to the driver. Waymo 100 per cent self-driving driver-less cars minimize this to near zero, and so in the long run Waymo can offer the cheaper service. Today, typically 60 per cent of all car trips are under six miles. Whether dropping the kids at school, commuting to work, or buying groceries, these short trips are ideal for ride-sharing, and in ten years Waymo will be able to offer these typical rides for a fraction of the cost of Uber or a conventional taxi. In 2017, Morgan Stanley valued Waymo at US$70 billion roughly the same as Volkswagen, the world's second largest carmaker by sales. The bank realized it had not taken into account the potential for Waymo to license its technology and enter logistics, where it could help Walmart deliver goods to better compete with Amazon, for example. So, Morgan Stanley revised its valuation to US$175 billion. On the assumption that Waymo can take a 2 percent share of all miles driven worldwide in 2030, Jefferies (a US independent investment bank) valued (in February 2019) Waymo at US$250 billion. That is more than Ford, GM, Fiat- Chrysler, Honda and electric carmaker Tesla combined. Jefferies assumed that the majority of the carmakers would come to Google and ask Waymo (as the leader in the self-driving technology) for help in the process of developing self-driving cars. The threat of Waymo is not that it will build better cars. Because instead of building the cars, Waymo is ordering vehicles from Chrysler and Jaguar - effectively turning them into suppliers - and then fitting them out with self-driving software and hardware built in-house. Waymo's potential goes beyond superior self-driving capabilities. Once robotic taxis are mainstream, Alphabet (Google) can collect data from Google Maps and Search, entertain with You-Tube and the Play Store, offer advice through Google Home smart speakers and use its software to manage fleets. Thus aside from the vehicle itself, Waymo is a vertically-integrated network system, where the synergies from Alphabet's investments in the digitalization and Internet-of-Things of the private home can be transferred also to the car, which consumers in future would like to feel like their living room, where they can relax. Carmakers are struggling to respond. They have partnered up and made big investments to acquire new know-how. Volkswagen has linked up with Ford, while rivals BMW and Mercedes have pooled their mobility efforts. In 2016, GM paid US$500 million for a stake in Lyft, the ride-hailing group, and it spent more than US$1 billion to buy Cruise, a self- driving company. Beneath the self-driving car brands, an entire ecosystem of niche companies has spurred into existence. Known as the 'data value chain', these groups specialize in the software, sensors, data processing and navigation needed to make self-driving cars a reality. When Google's self-driving car project began in 2009, this data value chain' within self-driving cars did not exist, but it is now emerging fast. McKinsey's database of mobility start-ups includes 1,180 companies. Alone Israel is the home to more than 400 companies, including Mobileye, the vision group Intel paid US$15.3 billion for in 2017. Mobileye is developing an open platform for autonomous driving with help from BMW, Fiat-Chrysler and suppliers Delphi and Magna. Car accidents and security issues Until self-driving cars become widespread on roads, public education on their safety is essential. In 2018, 1.35 million lives were lost because of road accidents. Over 90 per cent of these deaths were due to human error. Self-drive cars should be able to reduce these numbers, when the cars will be more accepted and wide-spread in future. An overview of the different countries' number of deaths in car accidents is provided in the following Table 1, together with population and income data. Technology issues In 2017, Waymo unveiled new sensors and chips that are less expensive to manufacture, cameras that improve visibility, and wipers to clear the radar system. Waymo manufactures a range of self-driving hardware developed in-house. These sensors and hardware - enhanced vision system, improved radar, and laser-based lidar (radar) - reduce Waymo's dependence on suppliers. The in-house production to system allows Waymo to efficiently integrate its technology to the hardware. In the beginning of the self-driving car program, the company spent US$75,000 for each lidar system from Velodyne. As of 2017, that cost was down approximately 90 per cent, due to Waymo designing its own version of lidar. Waymo officials say the cars the company uses are built for full autonomy with sensors that give 360-degree views and lasers that detect objects up to 300 metres away. In February 2017. Waymo sued Uber and its subsidiary self- driving trucking company, Otto, for allegedly stealing Waymo's trade secrets and infringing upon its patents. The company claimed that three ex-Google employees, including Anthony Levandowski who was one of the Google driverless car project members, stole trade secrets, which included thousands of driverless car technology files from Google and joined Uber. The infringement is related to Waymo's proprietary tidar technology, which could measure the distances between objects using laser and create their three- dimensional representations. A settlement was announced on 9 February 2018, with Uber giving Waymo with 0.34 per cent of Uber's stock, the equivalent of US$245 million in Uber equity and agreeing to ensure Uber does not infringe Waymo's intellectual property. Even though the technology behind autonomous vehicles has progressed hugely in recent years, it is still by no means perfect. A long list of companies are still testing their electric vehicles in California to improve software capabilities and safety (California is the only US state where it is required to make this kind of documentation available to the public authoritics). Disengagements are a key part of the testing process and they occur when a car's software detects a failure or a driver perceives a failure, resulting in control being seized. According to 2017 data from the California DMB authorities, 28 companies reported that they were actively testing cars on public roads in the state. In total, they operated 467 vehicles and covered just over 2 million miles in self-driving mode with 143,720 disengagements occurring. When it came to flawless autonomy, Waymo was way ahead of the competitors as its self-driving cars have made test-drives for 1.27 million miles in 2017 with 11,100 miles per disengagement an error in the system of some kind). Number 2 is GM Cruise with 0.5 million miles in 2017 and 5,200 miles per disengagement. Waymo's test data is better than many more known companies attempting to perfect the technology, especially heavyweight competitors like Uber and Apple. Uber's cars drove approximately. 27,000 miles in 2017 but only managed 0.4 miles per disengagement. Apple has a similar performance with 1.1 miles per disengagement out of 80,000 miles recorded in total. It is still by no means perfect Table 01: Number of deaths in car accidents in selected countries Selected Countries Population (millions) GNI per cap (USD) Numbers of road death (WHO estimate) Total deaths per 100,000 population 81.9 64.7 59.4 46.3 38.2 144.0 79.5 17.0 5.3 9.8 5.7 43,600 38,950 31,590 27,520 12,680 9,720 11,180 46,310 72,330 54,630 56,730 3,327 3,585 3.333 1,922 3,698 25.969 9,782 648 143 278 227 4.1 5.5 5.6 4.1 9.7 18.0 12.3 3.8 2.7 2.8 4.0 Europe Germany France Italy Spain Poland Russia Turkey Netherlands Norway Sweden Denmark North America United States Canada Latin America Mexico Brazil Argentina Middle East Israel Iran Saudi Arabia Asia China 322.2 36.3 56,180 43,660 39.888 2,118 12.4 5.8 127.5 207.6 43.8 9,040 8,840 16,725 41.007 6.119 13.1 19.7 14.0 11,960 8.2 80.3 36,190 6,530 21,750 345 16,426 9,311 4.2 20.5 28.8 32.3 1411.4 8,260 256,180 18.2 1324.2 127.7 261.1 193.2 1,680 38,000 3,400 1,510 299,091 5,224 31,726 27,582 22.6 4.1 12.2 14.3 India Japan Indonesia Pakistan Pacific Australia New Zealand Africa Egypt South Africa 8.7 4.7 54,420 39,070 1,351 364 5.6 7.8 95.7 56.0 3,460 5,480 9.287 14.507 9.7 25.9 Germany Table 02 World Passenger car production - 2018 Production Country Million Passenger cars (2018) China (the biggest manufacturer is SAIC, 23.7 followed by Geely and Changan) Japan 8.4 5.1 India 4.1 South Korea 3.7 United States 2.8 Brazil 2.4 Spain 2.3 France 1.8 Mexico 1.6 Russia 1.6 United Kingdom 1.5 Czech Republic 1.4 Slovakia 1.1 Indonesia 1.1 Rest of the World 37.4 Total World 70.7 Table 03 World Passenger car production - 2018 Top 10 car manufacturers Country (home base) Toyota Volkswagen (VW) Ford Nissan Honda Japan Germany US Japan Japan 70.7 million passenger cars (2018) split on car manufacturers % 9.5 7.4 5.6 5.4 5.4 Hyundai Chevrolet (GM) Kia Mercedes SAIC Rest of the world Total world South Korea US Germany China South Korea 4.8 4.4 3.1 2.8 2.7 48.9 100.0 Case 02: DHL's Global Competitiveness DHL, the international air express and logistics company, serves a wide range of customers, from global enterprises with sophisticated and high-volume supply-chain solutions shipping anything from spare parts to documents, to the occasional customer who ships the odd one or two documents a year. Plate 1 and 2 show some of DHL's logistics operations. To be able to effectively manage such a diverse customer base, DHL implemented a sophisticated customer segmentation cum loyalty management system. The focus of this system is to assess the profitability from its customers, reduce customer churn, and increase DHL's share of shipments. DHL International (www.dhl.com) specializes in cross-border express deliveries. Today it is part of the Deutsche Post. DHL is the global market leader in international express, overland transport and air freight. It is also the world's number one in occan freight and contract logistics. DHL offers a full range of customized solutions from express document shipping to supply chain management. DHL links about 120000 destinations in more than 220 countries and territories and operates cargo airlines. The company provides internet tracking and order fulfilment services. In 2018, DHL was a logistics market leader wold market with approximately 35% marke share followed by FedEX (25%) and UPS (20%), In North America, DHL was second to FedEx with around 20% market share. DHL is the global market leader in international express, overland transport and airfreight. It is also the world's number 1 in occan freight and contract logistics. DHL offers a full range of customized solutions from express document shipping to supply chain management. The company is 100 per cent owned by Deutsche Post World Net. DHL links about 120,000 destinations in more than 220 countries and territories and operates cargo airlines. The company provides internet tracking and order fulfillment services. Its administrative centre is located in Diegem, Machelen, Belgium. Key DHL figures: Number of Employees: around 476,000 Number of Offices: around 6,500 Number of Hubs, Warehouses and Terminals: more than 450 Number of Aircraft: 420 (Own and foreign airlines) Number of Vehicles: 76,200 Number of Countries and Territories: more than 220 Shipments per Year: more than 1.5 billion Destinations Covered: 120,000 . For the fiscal year ended December 2009, DHL achieved revenues totaling 46 billion. EBIT (Earnings Before Interests and Taxes) was 231 million DHL is the first letters of the last names of the three company founders, Adrian Dalsey, Larry Hillblom and Robert Lynn In 1969, the founders began to personally ship papers by aeroplane from San Francisco to Honolulu, beginning customs clearance of the ship's cargo before the actual arrival of the ship and dramatically reducing waiting time in the harbour. With this concept, a new industry was born: international air express, the rapid delivery of documents and shipments by aeroplane. The DHL Network continued to grow at an incredible pace. The company expanded westward from Hawaii into the Far East and Pacific Rim, then the Middle East, Africa and Europe. By 1988, DHL was already present in 170 countries and had 16,000 employees. By the end of 2002, DHL was 100 per cent acquired by Deutsche Post World Net. In 2003, Deutsche Post World Net consolidated all of its express and logistics activities into one single brand. DHL. The DHL brand was further strengthened by Deutsche Post World Net's acquisition of Exel in December 2005. The DHL expertise is pooled from a number of companies acquired by Deutsche Post World Net. To name two: Exel: at the time Deutsche Post World Net acquired Exel in December 2005, it had around 111,000 employees in 135 countries. Exel primarily offers transport and logistics solutions for key customers. Danzas: founded in 1815, based in Basel, Switzerland, acquired by Deutsche Post World Net in 2000, world leader in airfreight and ranked second in ocean freight. Overland transport and supply chain management complete the Danzas service portfolio. Air Express International: the largest American airfreight provider was integrated into the Danzas group in 2001. From August 2005, DHL introduced its new corporate wear. Over the next nine months, 110,000 DHL employees in over 200 countries and territories were provided with new uniforms. More than 1.4 million garments will be shipped by DHL. The design has been tested through interviews and extensive trials with 3,600 drivers and couriers. Customer segmentation To achieve this, the first task was to segment its customers into actionable segments with distinct needs. DHL defined three main segments. First, "strategic customers' are extremely high-volume shippers with a full range of logistics solutions and express-shipment needs. This segment consists of approximately of DHL's top 250 customers worldwide, which are mostly large multinationals. Second, the relationship customers" segment consists of customers who use DHL to ship their products and documents regularly, but with a lower volume than the strategic customers segment and also not as sophisticated supply-chain needs. Finally, the direct customers" segment ships infrequently with DHL. The customer segmentation represented in form of the familiar customer pyramid Figure 1. These segments are further divided into subsegments based on the kind of service required (Figure 2). The needs of direct customers and many of the relationship customers often are fully mct by DHL's basic products. For relationship can customers with special needs, DHL also offers some special programs like direct distribution to its partners, test services and parts distribution to fulfill these needs. Strategic customers virtually always use customized solutions, like providing bulk-breaking facilities and planned production support for precision delivery schedules, and DHL aims to meet their entire express delivery needs. Figure 3 shows some output of DHL's segmentation analysis for one of its country markets. The majority of revenue and profits were derived from only 18 percent of the customers, its relationship customers. The direct customer segment consisted of 75 percent of the total customer base and contributed only 15 percent of revenues and 30 percent of profits. The strategic customer segment contributed only 6 percent to profits. Similar patterns are observed for all countries where this analysis was conducted. The verdict seems clear: focus on the relationship customers segment for maximum profitability. However, this does not mean that the other segments are neglected. The strategic customer segment, being the most loyal, needs deployment of leading-edge technology and best practice infrastructure to maintain their loyalty. as future business potential is high for this group. Extra effort is put into upgrading those direct customers who have high-volume potential and latent needs for special-program products. Figure 1 Custorner Pyramid Strategie customers Relationship Cust Direct nustomers Figure 2 Customer subsegmentation Strategie customers Relationship customers Drect customers Basic products Special programs Customized solutions Figure 3 Segment analysis 100 80 Percentage 40 7 20 0 Segment Rememe Profit Direct customers Relationshap customers Strategic cusomers Note: To answers the case studies' questions, you are recommended to recall theory and incorporate theory of international market selection process and global distribution management system