Question: Suppose that the central bank has the following tools: 1- Interest Rates 2- Reserve Requirements 13 Open Murket Operations- 4- Quantitative Easing Can you

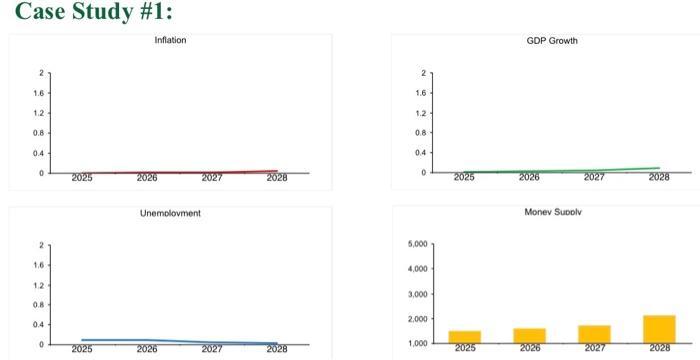

Suppose that the central bank has the following tools: 1- Interest Rates 2- Reserve Requirements 13 Open Murket Operations- 4- Quantitative Easing Can you briefly describe the state of the economy? What are the possible key drivers that may have resulted in such conditions? Do you think the central bank should take actions? What are the suggested policy actions and why? What is the expected impact on exchange rate and trade? Case Study #1: 1.6 1.2 0.8 0.4 0 2 1.6 1.2 0.8 0.4 0 2025 2025 Inflation 2026 2027 Unemployment 2026 2027 2028 2028 2 1.6 1.2 0.8 0.4 0 5,000 4,000 3,000 2.000 1,000 2025 2025 GDP Growth 2026 Monev Supolv 2026 2027 2027 2028 2028

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

step ... View full answer

Get step-by-step solutions from verified subject matter experts