Question: Case Study 1 - 2 PepsiCo: Communicating Financial Performance * The Chairman's letter to the shareholders from PepsiCo's 2 0 0 7 Annual Report is

Case Study

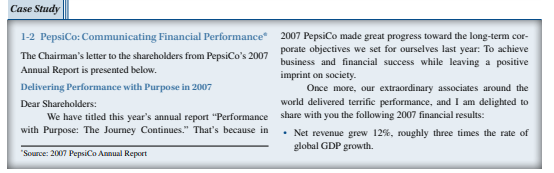

PepsiCo: Communicating Financial Performance

The Chairman's letter to the shareholders from PepsiCo's

Annual Report is presented below.

Delivering Performance with Purpose in

Dear Shareholders:

We have titled this year's annual report "Performance

with Purpose: The Journey Continues." That's because in

Source: PepsiCo Annual Report

PepsiCo made great progress toward the longterm cor

porate objectives we set for ourselves last year: To achieve

business and financial success while leaving a positive

imprint on society.

Once more, our extraordinary associates around the

world delivered terrific performance, and I am delighted to

share with you the following financial results:

Net revenue grew roughly three times the rate of

global GDP growth. Division operating profit grew

Earnings per share grew

Total return to shareholders was

Return on invested capital was

Cash flow from operations was $ billion.

In PepsiCo took important steps to support future growth.

What makes me particularly proud is that our performance was strong not just measured by these shortterm metrics but also with the longterm equally in mind:

We increased capital expenditures in plant and equipment worldwide to enable growth of core brands and expand into new platforms such as baked and crispbread snacks and noncarbonated beverages.

We added several tuckin acquisitions in key markets and segments, and we further expanded our successful coffee and tea joint ventures.

We created the Chief Scientific Officer position to ensure our technical capabilities keep pace with increasingly sophisticated consumer demand; and we funded incremental investment to explore breakthrough R&D opportunities.

We maintained focus on building nextgeneration IT capabilities with Project One Up to support our longterm growth prospects worldwide.

Our brands once again demonstrated competitive strength. On the ground, in cities and towns around the world, good brand strategies were implemented with operational excellence. Id like to share a few notable examples of the big marketplace wins we enjoyed in :

Our carbonated soft drink and savory snack brands gained market share in the United States and in many of our top international markets.

In the United Kingdom, Baked Walkers crisps was named "New Product of the Year" by Marketing Week magazine.

SunChips snacks delivered doubledigit growth in the United States as a result of great, innovative marketing and instore execution.

UP HOh was our fastestgrowing brand in value and volume share in Brazil in its launch year.

Pepsi Max came of age as a global brand, with outstanding performance in the United States as Diet Pepsi Max, after successes in Northern Europe and Australia and launches across Asia.

PepsiCo beverage brands crossed the $ billion mark in Russia retail sales.

We posted doubledigit volume growth in China beverages and highsingledigit beverage volume growth in India

And we did all of this while battling increased commodity inflation and more macroeconomic volatility than in previous years.

Required

In her review of PepsiCo's performance in Indra Nooyi, PepsiCo's Chairman and CEO, claims that, "Net revenue grew by roughly three times the rate of global GDP growth." What message is she trying to convey in this statement? After reviewing the disclosure "Results of Operation Division Review," which is found in the notes to the financial statements, do you agree with Mrs Nooyi's assertions about PepsiCo's growth?

Consolidated Statement of Income

PepsiCo, Inc. and Subsidiaries: Fiscal years ended December December and December

Net Income per Common

Share

Basic

Diluted

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock