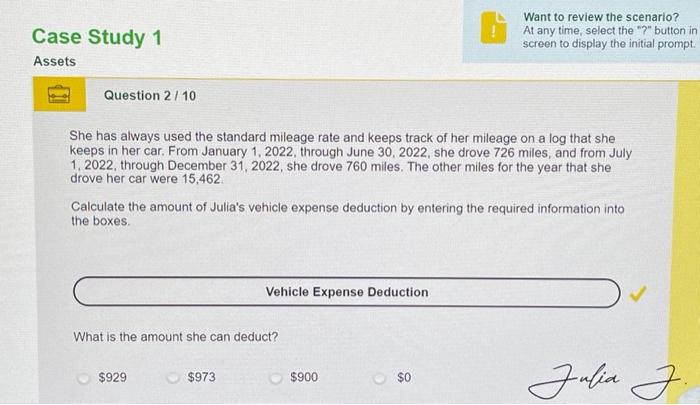

Question: Case Study 1 Assets Question 2 / 10 She has always used the standard mileage rate and keeps track of her mileage on a log

Want to review the scenario? se Study 1 At any time, select the "?" button in screen to display the initial prompt. Question 2/10 She has always used the standard mileage rate and keeps track of her mileage on a log that she keeps in her car. From January 1,2022, through June 30,2022 , she drove 726 miles, and from July 1,2022 , through December 31,2022 , she drove 760 miles. The other miles for the year that she drove her car were 15,462 . Calculate the amount of Julia's vehicle expense deduction by entering the required information into the boxes. What is the amount she can deduct? $929 $973 $900 $0 Hufia 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts