Question: Case study 1: Carlos (straightforward) This case study requires the preparation of accounts from the opening of a business to a trial balance. Carlos opened

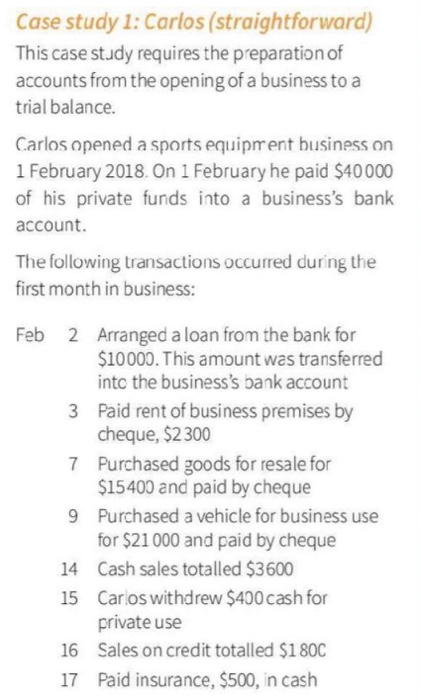

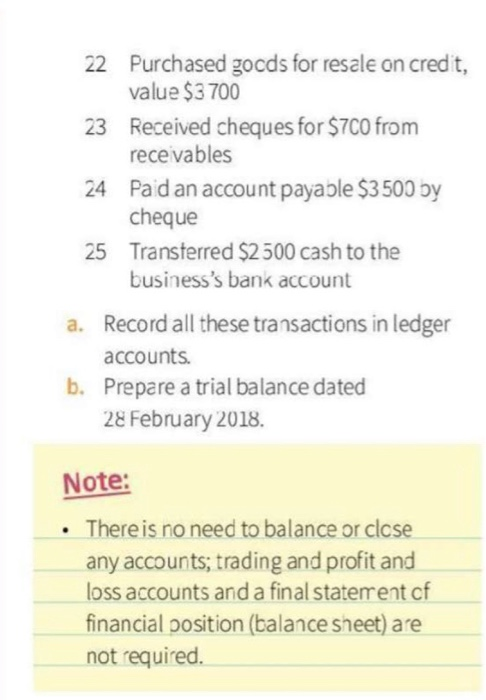

Case study 1: Carlos (straightforward) This case study requires the preparation of accounts from the opening of a business to a trial balance. Carlos opened a sports equipment business on 1 February 2018. On 1 February he paid $40000 of his private funds into a business's bank account. The following transactions occurred during the first month in business: Feb 2 Arranged a loan from the bank for $10000. This amount was transferred into the business's bank account 3 Paid rent of business premises by cheque, $2 300 7 Purchased goods for resale for $15400 and paid by cheque 9 Purchased a vehicle for business use for $21000 and paid by cheque 14 Cash sales totalled $3600 15 Carlos withdrew $400 cash for private use 16 Sales on credit totalled $180C 17 Paid insurance, $500, in cash 22 Purchased gocds for resale on credit, value $3700 23 Received cheques for $700 from recevables 24 Paid an account payable $3500 by cheque 25 Transferred $2500 cash to the business's bank account a. Record all these transactions in ledger accounts. b. Prepare a trial balance dated 28 February 2018 Note: There is no need to balance or close any accounts; trading and profit and loss accounts and a final statement of financial position (balance sheet) are not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts