Question: Case Study 1: DEF Ltd is a global leader in the manufacture, integration and support of networking and telecommunications systems. The company sells broadband wireless

Case Study 1:

DEF Ltd is a global leader in the manufacture, integration and support of networking and telecommunications systems. The company sells broadband wireless products and a line of handset equipment to operators in emerging and established telecommunications markets worldwide. The auditor reported material weaknesses in the company's internal controls to the audit committee. Significant deficiencies related to revenue and deferred revenue accounts and the associated cost of sales were noted. These material weaknesses were evidenced by the identification of six separate transactions aggregating approximately $5 million in which revenue was initially included in the Company's financial statements before all criteria for revenue recognition were met. In addition, there were other transactions for which there was insufficient initial documentation for revenue recognition purposes, but which did not result in any adjustments to the Company's financial statements. If unremediated, these significant deficiencies have the potential of misstating revenue in future financial periods. The Company's planned remediation measures reported to the audit committee include the following:

a. The Company plans to design a contract review process in China requiring financial and legal staff to provide input during the contract negotiation process to ensure timely identification and accurate accounting treatment of nonstandard contracts. b. The Company conducted a training seminar regarding revenue recognition, including identification of nonstandard contracts, in Australia and a similar seminar in China. The Company plans to conduct additional training seminars in various international locations regarding revenue recognition and the identification of nonstandard contracts. c. The Company will begin requiring centralized retention of documentation evidencing proof of delivery and final acceptance for revenue recognition purposes.

Required: 1. Using the disclosures above as a starting point, brainstorm about the challenges regarding internal controls and that a company may face in doing business internationally? 2. The company has disclosed its planned remediation efforts. How might the auditor use that information during the next year's audit in terms of audit planning? 3. Considering potential analytical procedures relevant to the revenue cycle, identify what types of analytics might be applied in the next year's audit to provide evidence that the problems detected have been remedied. 4. Considering potential substantive tests of revenue, identify procedures that might be applied in the next year's audit to provide evidence that the problems detected have been remedied.

Case Study 2:

Paul Mincin is the auditor of Raleigh Ltd. Mincin is considering the audit work to be performed in the accounts payable area for the current-year engagement. The prior-year documentation shows that confirmation requests were mailed to 100 of Raleigh's 1000 suppliers. The selected suppliers were based on Mincin's sample that was designed to select accounts with large dollar balances. Mincin and Raleigh staff spent a substantial number of hours resolving relatively minor differences between the confirmation replies and Raleigh's accounting records. Alternative audit procedures were used for those suppliers who did not respond to the confirmation requests.

Required: 1. Identify the accounts payable audit objectives that Mincin must consider in determining the audit procedures to be followed. 2. Identify situations in which Mincin should use accounts payable confirmations and discuss whether he is required to use them. 3. Discuss why the use of large dollar balances as the basis for selecting accounts payable for confirmation might not be the most effective approach and indicate what more effective procedures could be followed when selecting accounts payable for confirmation.

Case Study 3:

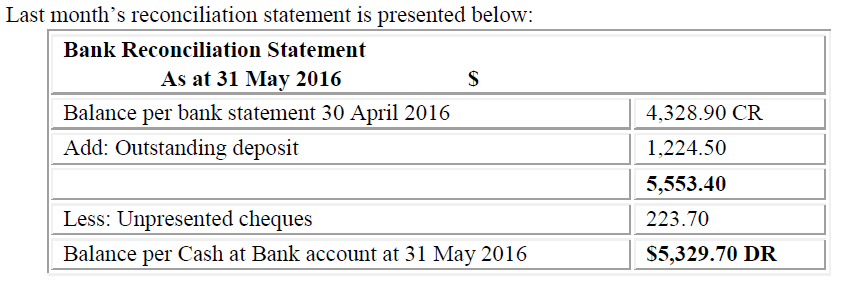

The owner of Riverside Hardware of Ba has completed a bank reconciliation and cannot get the bank's records to agree with the cash records of his business. He concludes that internal control has somehow failed and cash is being misappropriated. He asks you to audit the records and confirm or otherwise his suspicions. He supplies the reconciliation statement at the end of last month, his cash records, and the most recent bank statement. Last month's reconciliation statement is presented below:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts