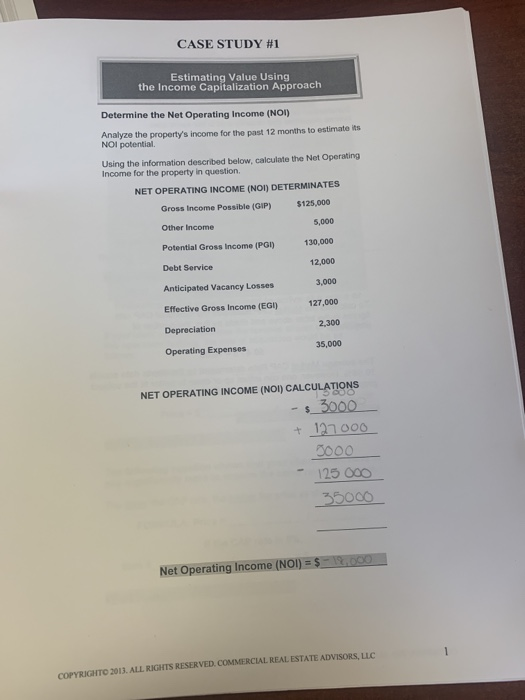

Question: CASE STUDY #1 Estimating Value Using the Income Capitalization Approach Determine the Net Operating Income (NOI) Analyze the property's income for the past 12 months

CASE STUDY #1 Estimating Value Using the Income Capitalization Approach Determine the Net Operating Income (NOI) Analyze the property's income for the past 12 months to estimate its NOI potential 5,000 Using the information described below, calculate the Net Operating Income for the property in question. NET OPERATING INCOME (NOI) DETERMINATES Gross Income Possible (GIP) Other Income Potential Gross Income (PGI) 130,000 Debt Service 12,000 Anticipated Vacancy Losses 3,000 Effective Gross Income (EGI) 127.000 Depreciation 2,300 Operating Expenses 35,000 NET OPERATING INCOME (NOI) CALCULATIONS - $ 3000 + 127 000 3000 - 125 000 35000 Net Operating Income (NOI) = $ - 19,000 COPYRIGHT 2013. ALL RIGHTS RESERVED. COMMERCIAL REAL ESTATE ADVISORS, LIGI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts