Question: CASE STUDY 1 - Matheson Electronics (NPV, IRR) Matheson Electronics has just developed a new electronic device which, when mounted on an automobile, will tell

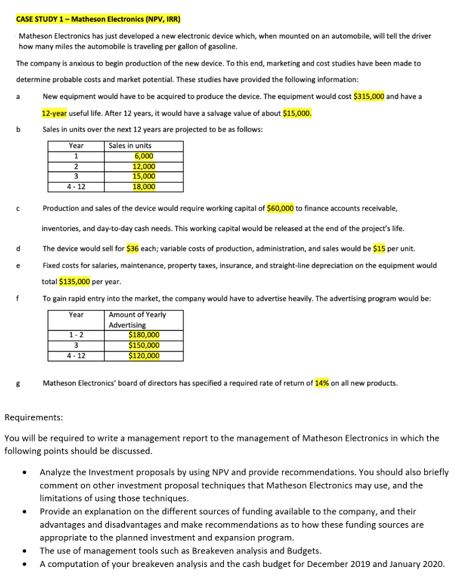

CASE STUDY 1 - Matheson Electronics (NPV, IRR) Matheson Electronics has just developed a new electronic device which, when mounted on an automobile, will tell the driver how many miles the automobiles traveling per gallon of gasoline The company is nous to begin production of the new device. To this end, marketing and cost studies have been made to determine probable costs and market potential. These studies have provided the following information: New equipment would have to be acquired to produce the device. The equipment would cost $315.000 and have 12-year useful life. After 12 years, it would have a salvage value of about $15.000 Sales in units over the next 12 years are projected to be as follows: Year Sales in unit Production and sales of the device would require working capital of $60,000 to finance accounts receivable, inventories, and day to day cash needs. This working capital would be released at the end of the project's life The device would sell for $36 each; variable costs of production, administration, and sales would be $15 per unit. Fixed costs for salaries, maintenance, property taxes, insurance, and straight line depreciation on the equipment would total $135,000 per year. To gain rapid entry into the market, the company would have to advertise heavily. The advertising program would be Amount of Yearly Advertising $180.000 310000 5120100 Matheson Electronics' board of directors has specified a required rate of return of 14% on all new products Requirements: You will be required to write a management report to the management of Matheson Electronics in which the following points should be discussed. Analyze the Investment proposals by using NPV and provide recommendations. You should also briefly comment on other investment proposal techniques that Matheson Electronics may use, and the limitations of using those techniques. Provide an explanation on the different sources of funding available to the company, and their advantages and disadvantages and make recommendations as to how these funding sources are appropriate to the planned investment and expansion program. The use of management tools such as Breakeven analysis and Budgets. A computation of your breakeven analysis and the cash budget for December 2019 and January 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts