Question: Case study 1: Measuring Returns for Equity On year 2015, you bought BRK at $280/ share. You have tracked down the price of this stock

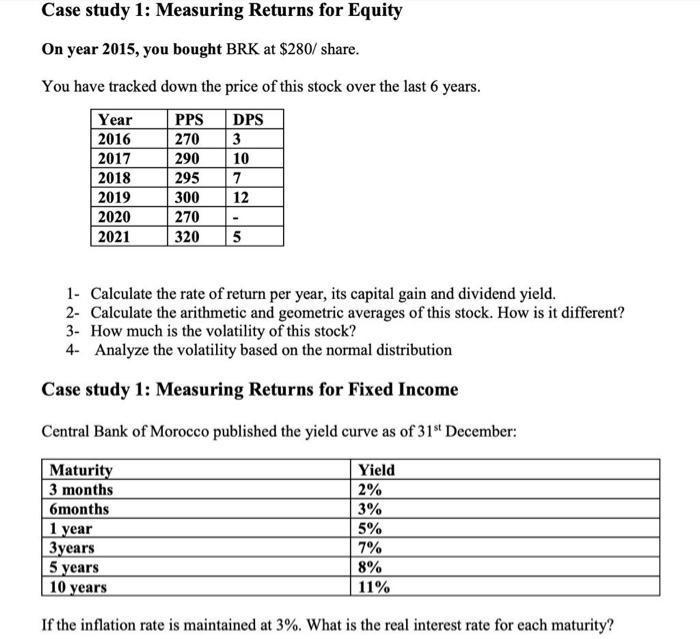

Case study 1: Measuring Returns for Equity On year 2015, you bought BRK at $280/ share. You have tracked down the price of this stock over the last 6 years. Year PPS DPS 2016 270 3 2017 290 10 2018 295 7 2019 300 12 2020 270 2021 320 5 1- Calculate the rate of return per year, its capital gain and dividend yield. 2- Calculate the arithmetic and geometric averages of this stock. How is it different? 3- How much is the volatility of this stock? 4- Analyze the volatility based on the normal distribution Case study 1: Measuring Returns for Fixed Income Central Bank of Morocco published the yield curve as of 31st December: Maturity 3 months 6months 1 year 3 years 5 years 10 years Yield 2% 3% 5% 7% 8% 11% If the inflation rate is maintained at 3%. What is the real interest rate for each maturity? Case study 1: Measuring Returns for Equity On year 2015, you bought BRK at $280/ share. You have tracked down the price of this stock over the last 6 years. Year PPS DPS 2016 270 3 2017 290 10 2018 295 7 2019 300 12 2020 270 2021 320 5 1- Calculate the rate of return per year, its capital gain and dividend yield. 2- Calculate the arithmetic and geometric averages of this stock. How is it different? 3- How much is the volatility of this stock? 4- Analyze the volatility based on the normal distribution Case study 1: Measuring Returns for Fixed Income Central Bank of Morocco published the yield curve as of 31st December: Maturity 3 months 6months 1 year 3 years 5 years 10 years Yield 2% 3% 5% 7% 8% 11% If the inflation rate is maintained at 3%. What is the real interest rate for each maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts