Question: CASE STUDY 1: PLANNING FOR THE FUTURE AT EAST COAST BANK Paula Mason is one of three new assistant regional managers of East Coast Bank

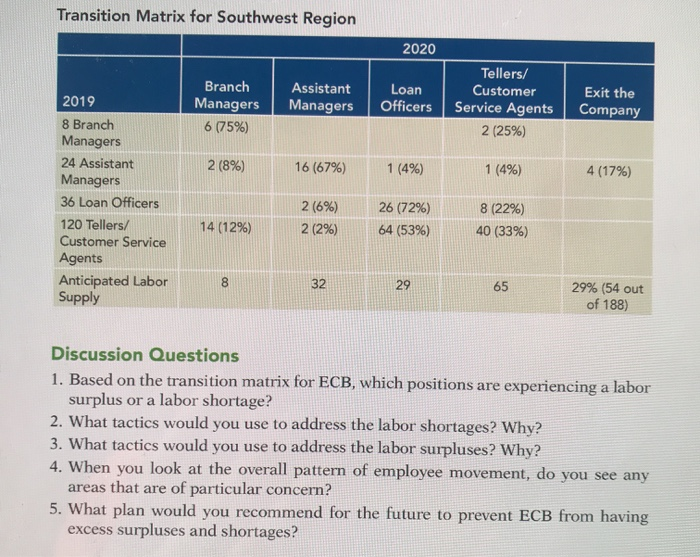

CASE STUDY 1: PLANNING FOR THE FUTURE AT EAST COAST BANK Paula Mason is one of three new assistant regional managers of East Coast Bank (ECB). Her position was recently created to provide administrative support and advice for the regional manager in charge of the southwest region, Ian Swartz. In their first meeting as a team, Paula and the two other assistant regional managers met with lan to discuss areas throughout their branches that might be addressed in order to lower costs and raise profitability. Each of the assistant managers was given different aspects to emphasize, and Paula was asked to focus on ways to reduce labor costs, increase labor productivity among employees, or both throughout the eight branches. In part, this request was a response to feedback from the branches regarding an increase in recruitment and training expenses as well as a decrease in employee morale. Paula's first course of action was to evaluate some direct and indirect labor costs related to turnover and retention, as well as areas of bloated labor (labor surpluses) through the southwest region. Based on her analysis, Paula arrived at some basic points of information for the branches. First, ECB is organized into several broad regions throughout New Jersey, Pennsylvania, and Delaware. Each region comprises 8-12 bank branches. Each branch consists of 4 primary jobs: branch manager, assistant manager, loan officer, and teller/customer service agent. On average, each bank has 1 branch manager, 3 assistant managers, 4 loan officers, and 15 tellers/ customer service agents. Beyond the average staffing levels, Paula also was able to gather some information regarding the movement of employees within and out of the organization. As shown in the following transition matrix, ECB averages 26% turnover, with turnover among the tellers/customer service agents slightly higher, at 33%, and turnover at the assistant manager level the lowest, at 17%. Transition Matrix for Southwest Region 2020 Branch Managers 6 (75%) Assistant Managers Loan Officers Tellers/ Customer Service Agents 2 (25%) Exit the Company 2 (8%) 16 (67%) 1 (4%) 1 (4%) 4 (17%) 2019 8 Branch Managers 24 Assistant Managers 36 Loan Officers 120 Tellers/ Customer Service Agents Anticipated Labor Supply 14 (12%) 2 (6%) 2 (2%) 26 (72%) 64 (53%) 8 (22%) 40 (33%) 8 32 29 65 29% (54 out of 188) Discussion Questions 1. Based on the transition matrix for ECB, which positions are experiencing a labor surplus or a labor shortage? 2. What tactics would you use to address the labor shortages? Why? 3. What tactics would you use to address the labor surpluses? Why? 4. When you look at the overall pattern of employee movement, do you see any areas that are of particular concern? 5. What plan would you recommend for the future to prevent ECB from having excess surpluses and shortages