Question: Case Study 2 - Budgeting Ahead On 1 April 2020, Kimin is attempting to budget cash flows through 30 June 2020 . On this latter

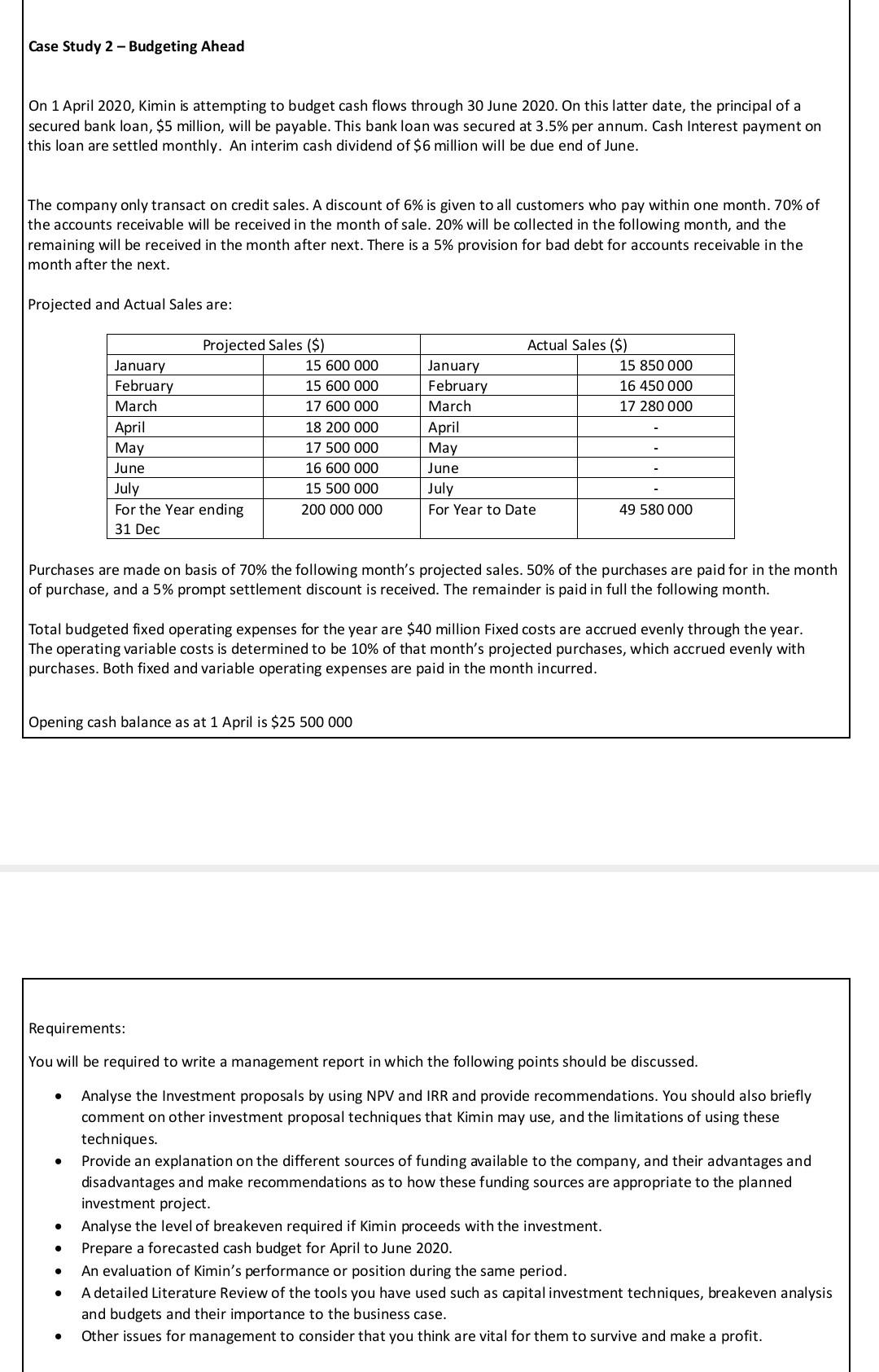

Case Study 2 - Budgeting Ahead On 1 April 2020, Kimin is attempting to budget cash flows through 30 June 2020 . On this latter date, the principal of a secured bank loan, $5 million, will be payable. This bank loan was secured at 3.5% per annum. Cash Interest payment on this loan are settled monthly. An interim cash dividend of $6 million will be due end of June. The company only transact on credit sales. A discount of 6% is given to all customers who pay within one month. 70% of the accounts receivable will be received in the month of sale. 20% will be collected in the following month, and the remaining will be received in the month after next. There is a 5% provision for bad debt for accounts receivable in the month after the next. Projected and Actual Sales are: Purchases are made on basis of 70% the following month's projected sales. 50% of the purchases are paid for in the month of purchase, and a 5% prompt settlement discount is received. The remainder is paid in full the following month. Total budgeted fixed operating expenses for the year are $40 million Fixed costs are accrued evenly through the year. The operating variable costs is determined to be 10% of that month's projected purchases, which accrued evenly with purchases. Both fixed and variable operating expenses are paid in the month incurred. Opening cash balance as at 1 April is $25500000 Requirements: You will be required to write a management report in which the following points should be discussed. - Analyse the Investment proposals by using NPV and IRR and provide recommendations. You should also briefly comment on other investment proposal techniques that Kimin may use, and the limitations of using these techniques. - Provide an explanation on the different sources of funding available to the company, and their advantages and disadvantages and make recommendations as to how these funding sources are appropriate to the planned investment project. - Analyse the level of breakeven required if Kimin proceeds with the investment. - Prepare a forecasted cash budget for April to June 2020. - An evaluation of Kimin's performance or position during the same period. - A detailed Literature Review of the tools you have used such as capital investment techniques, breakeven analysis and budgets and their importance to the business case. - Other issues for management to consider that you think are vital for them to survive and make a profit. Case Study 2 - Budgeting Ahead On 1 April 2020, Kimin is attempting to budget cash flows through 30 June 2020 . On this latter date, the principal of a secured bank loan, $5 million, will be payable. This bank loan was secured at 3.5% per annum. Cash Interest payment on this loan are settled monthly. An interim cash dividend of $6 million will be due end of June. The company only transact on credit sales. A discount of 6% is given to all customers who pay within one month. 70% of the accounts receivable will be received in the month of sale. 20% will be collected in the following month, and the remaining will be received in the month after next. There is a 5% provision for bad debt for accounts receivable in the month after the next. Projected and Actual Sales are: Purchases are made on basis of 70% the following month's projected sales. 50% of the purchases are paid for in the month of purchase, and a 5% prompt settlement discount is received. The remainder is paid in full the following month. Total budgeted fixed operating expenses for the year are $40 million Fixed costs are accrued evenly through the year. The operating variable costs is determined to be 10% of that month's projected purchases, which accrued evenly with purchases. Both fixed and variable operating expenses are paid in the month incurred. Opening cash balance as at 1 April is $25500000 Requirements: You will be required to write a management report in which the following points should be discussed. - Analyse the Investment proposals by using NPV and IRR and provide recommendations. You should also briefly comment on other investment proposal techniques that Kimin may use, and the limitations of using these techniques. - Provide an explanation on the different sources of funding available to the company, and their advantages and disadvantages and make recommendations as to how these funding sources are appropriate to the planned investment project. - Analyse the level of breakeven required if Kimin proceeds with the investment. - Prepare a forecasted cash budget for April to June 2020. - An evaluation of Kimin's performance or position during the same period. - A detailed Literature Review of the tools you have used such as capital investment techniques, breakeven analysis and budgets and their importance to the business case. - Other issues for management to consider that you think are vital for them to survive and make a profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts