Question: Case study 2 (Risk and return): (50 marks) This case requires you to perform calculation on risk and return using company data for the company

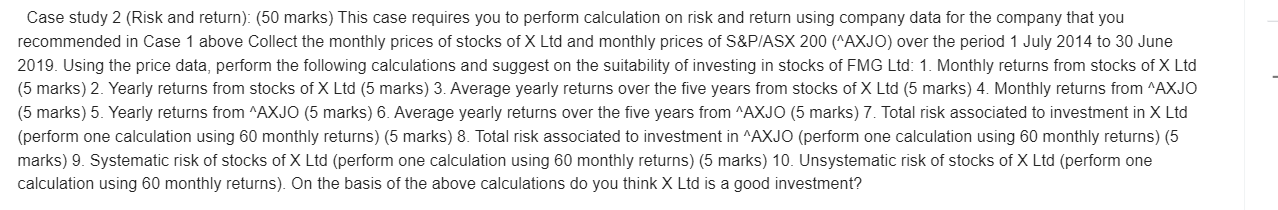

Case study 2 (Risk and return): (50 marks) This case requires you to perform calculation on risk and return using company data for the company that you recommended in Case 1 above Collect the monthly prices of stocks of X Ltd and monthly prices of S&P/ASX 200 (AXJO) over the period 1 July 2014 to 30 June 2019. Using the price data, perform the following calculations and suggest on the suitability of investing in stocks of FMG Ltd: 1. Monthly returns from stocks of X Ltd (5 marks) 2. Yearly returns from stocks of X Ltd (5 marks) 3. Average yearly returns over the five years from stocks of X Ltd (5 marks) 4. Monthly returns from "AXJO (5 marks) 5. Yearly returns from "AXJO (5 marks) 6. Average yearly returns over the five years from "AXJO (5 marks) 7. Total risk associated to investment in X Ltd (perform one calculation using 60 monthly returns) (5 marks) 8. Total risk associated to investment in AXJO (perform one calculation using 60 monthly returns) (5 marks) 9. Systematic risk of stocks of X Ltd (perform one calculation using 60 monthly returns) (5 marks) 10. Unsystematic risk of stocks of X Ltd (perform one calculation using 60 monthly returns). On the basis of the above calculations do you think X Ltd is a good investment? Case study 2 (Risk and return): (50 marks) This case requires you to perform calculation on risk and return using company data for the company that you recommended in Case 1 above Collect the monthly prices of stocks of X Ltd and monthly prices of S&P/ASX 200 (AXJO) over the period 1 July 2014 to 30 June 2019. Using the price data, perform the following calculations and suggest on the suitability of investing in stocks of FMG Ltd: 1. Monthly returns from stocks of X Ltd (5 marks) 2. Yearly returns from stocks of X Ltd (5 marks) 3. Average yearly returns over the five years from stocks of X Ltd (5 marks) 4. Monthly returns from "AXJO (5 marks) 5. Yearly returns from "AXJO (5 marks) 6. Average yearly returns over the five years from "AXJO (5 marks) 7. Total risk associated to investment in X Ltd (perform one calculation using 60 monthly returns) (5 marks) 8. Total risk associated to investment in AXJO (perform one calculation using 60 monthly returns) (5 marks) 9. Systematic risk of stocks of X Ltd (perform one calculation using 60 monthly returns) (5 marks) 10. Unsystematic risk of stocks of X Ltd (perform one calculation using 60 monthly returns). On the basis of the above calculations do you think X Ltd is a good investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts