Question: Case Study 220 marks Alan is planning to retire in 15 years and buy a vineyard in the Hunter Valley Region in NSW. The ineyard

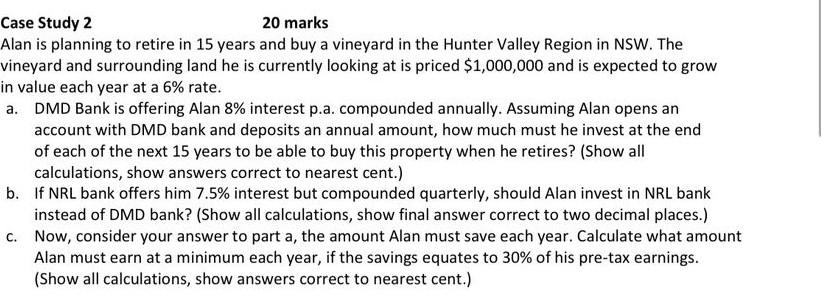

Case Study 220 marks Alan is planning to retire in 15 years and buy a vineyard in the Hunter Valley Region in NSW. The ineyard and surrounding land he is currently looking at is priced $1,000,000 and is expected to grow n value each year at a 6% rate. a. DMD Bank is offering Alan 8% interest p.a. compounded annually. Assuming Alan opens an account with DMD bank and deposits an annual amount, how much must he invest at the end of each of the next 15 years to be able to buy this property when he retires? (Show all calculations, show answers correct to nearest cent.) b. If NRL bank offers him 7.5% interest but compounded quarterly, should Alan invest in NRL bank instead of DMD bank? (Show all calculations, show final answer correct to two decimal places.) c. Now, consider your answer to part a, the amount Alan must save each year. Calculate what amount Alan must earn at a minimum each year, if the savings equates to 30% of his pre-tax earnings. (Show all calculations, show answers correct to nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts