Question: Case Study 2-B- Download Case Study 8, complete the financial model for Company XYZ, and answer the following 7 questions, 9 What is the weighted

Case Study 2-B-

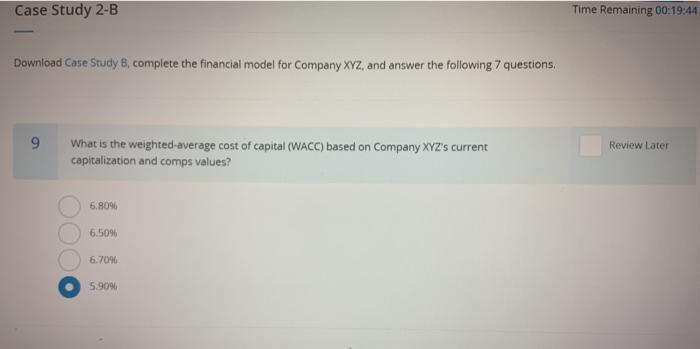

Download Case Study 8, complete the financial model for Company XYZ, and answer the following 7 questions, 9 What is the weighted average cost of capital (WACC) based on Company XYZ's current capitalization and comps values? Review Later 6.8096 6.509 6.709 5.909

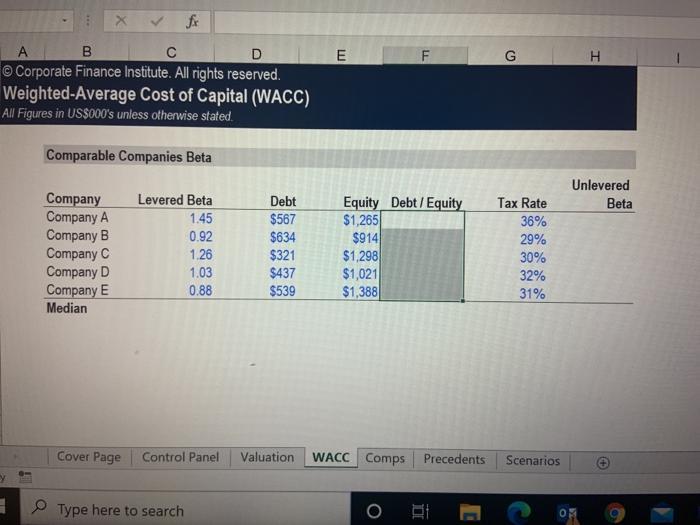

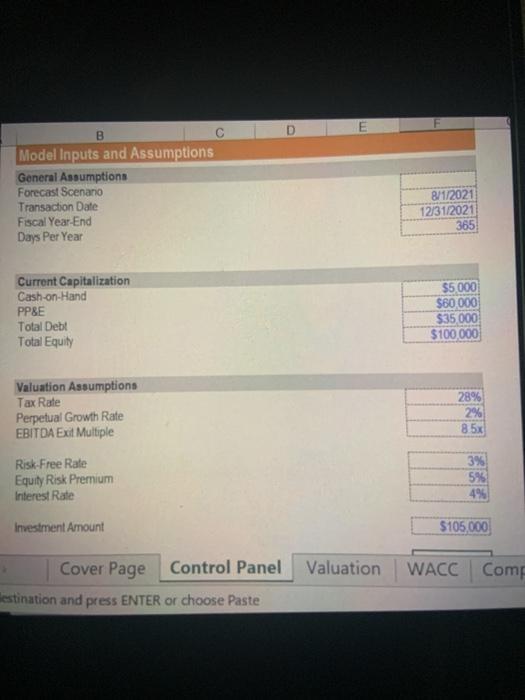

E F G H D Corporate Finance Institute. All rights reserved. Weighted-Average Cost of Capital (WACC) All Figures in US$000's unless otherwise stated. Comparable Companies Beta Unlevered Beta Company Company A Company B Company C Company D Company E Median Levered Beta 1.45 0.92 1.26 1.03 0.88 Debt $567 $634 $321 $437 $539 Equity Debt / Equity $1,265 $914 $1,298 $1,021 $1,388 Tax Rate 36% 29% 30% 32% 31% Cover Page Control Panel Valuation WACC Comps Precedents Scenarios Type here to search Case Study 2-B Time Remaining 00:19:44 Download Case Study 8, complete the financial model for Company XYZ, and answer the following 7 questions, 9 What is the weighted average cost of capital (WACC) based on Company XYZ's current capitalization and comps values? Review Later 6.8096 6.509 6.709 5.909 c D B Model Inputs and Assumptions General Assumptions Forecast Scenario Transaction Date Fiscal Year-End Days Per Year 8/1/2021 12/31/2021 365 Current Capitalization Cash-on-Hand PP&E Total Debt Total Equity $5 000 $60.000 $35.000 $100.000 Valuation Assumptions Tax Rate Perpetual Growth Rate EBITDA Exit Multiple 28% 2% 85x Risk Free Rate Equity Risk Premium Interest Rate 3% 5% 496 Investment Amount $105,000 Valuation WACC Comp Cover Page Control Panel lestination and press ENTER or choose Paste E F G H D Corporate Finance Institute. All rights reserved. Weighted-Average Cost of Capital (WACC) All Figures in US$000's unless otherwise stated. Comparable Companies Beta Unlevered Beta Company Company A Company B Company C Company D Company E Median Levered Beta 1.45 0.92 1.26 1.03 0.88 Debt $567 $634 $321 $437 $539 Equity Debt / Equity $1,265 $914 $1,298 $1,021 $1,388 Tax Rate 36% 29% 30% 32% 31% Cover Page Control Panel Valuation WACC Comps Precedents Scenarios Type here to search Case Study 2-B Time Remaining 00:19:44 Download Case Study 8, complete the financial model for Company XYZ, and answer the following 7 questions, 9 What is the weighted average cost of capital (WACC) based on Company XYZ's current capitalization and comps values? Review Later 6.8096 6.509 6.709 5.909 c D B Model Inputs and Assumptions General Assumptions Forecast Scenario Transaction Date Fiscal Year-End Days Per Year 8/1/2021 12/31/2021 365 Current Capitalization Cash-on-Hand PP&E Total Debt Total Equity $5 000 $60.000 $35.000 $100.000 Valuation Assumptions Tax Rate Perpetual Growth Rate EBITDA Exit Multiple 28% 2% 85x Risk Free Rate Equity Risk Premium Interest Rate 3% 5% 496 Investment Amount $105,000 Valuation WACC Comp Cover Page Control Panel lestination and press ENTER or choose Paste

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts