Question: Case Study 4: K is for Katrina (due 4/25, Individual submission, 5 points) Hurricane Katrina devastated New Orleans in 2005. After Katrina, the US Army

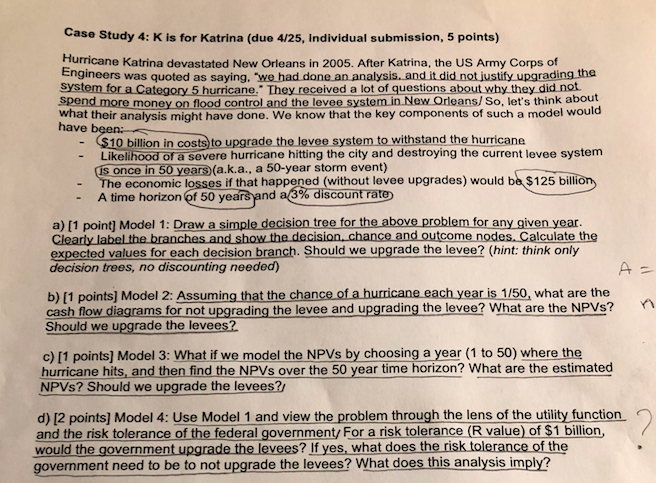

Case Study 4: K is for Katrina (due 4/25, Individual submission, 5 points) Hurricane Katrina devastated New Orleans in 2005. After Katrina, the US Army Corps of Engineers was quoted as saying, "we had done an analysis. and it did not justify upgrading the system for a Category 5 hurricane, They received a lot of questions about why they did not spend more money on flood control and the levee system in Now Orleans/ So, let's think about what their analysis might have done. We know that the key components of such a model would have been: $10 billion in costs to upgrade the levee system to withstand the hurricane Likelihood of a severe hurricane hitting the city and destroying the current levee systenm is once in 50 years (a.k.a., a 50-year storm event) he economic losses if that happened (without levee upgrades) would be $125 billion A time horizon of 50 years and a 3% discountrate a)[1 point) Model 1: Draw a simple decision tree for the above problem for any given year Clearly label the branches and show the decision,chance and outcome nodes. Calculate the expected values for each decision branch. Should we upgrade the levee? (hint: think only decision trees, no discounting needed) b) [1 points] Model 2: Assuming that the chance of a hurricane each year is 1/50, what are the cash flow diagrams for not upgrading the levee and upgrading the levee? What are the NPVS? Should we upgrade the levees? NPVs? c) [1 points] Model 3: What if we model the NPVs by choosing a year (1 to 50) where the hurricane hits, and then find the NPVs over the 50 year time horizon? What are the estimated NPVs? Should we upgrade the levees?/ d) [2 points] Model 4: Use Model 1 and view the problem through the lens of the utility function and the risk tolerance of the federal governmenty For a risk tolerance (R value) of $1 billion would the government upgrade the levees? If yes, what does the risk tolerance of the govenment need to be to not upgrade the levees? What does this analysis imply? Case Study 4: K is for Katrina (due 4/25, Individual submission, 5 points) Hurricane Katrina devastated New Orleans in 2005. After Katrina, the US Army Corps of Engineers was quoted as saying, "we had done an analysis. and it did not justify upgrading the system for a Category 5 hurricane, They received a lot of questions about why they did not spend more money on flood control and the levee system in Now Orleans/ So, let's think about what their analysis might have done. We know that the key components of such a model would have been: $10 billion in costs to upgrade the levee system to withstand the hurricane Likelihood of a severe hurricane hitting the city and destroying the current levee systenm is once in 50 years (a.k.a., a 50-year storm event) he economic losses if that happened (without levee upgrades) would be $125 billion A time horizon of 50 years and a 3% discountrate a)[1 point) Model 1: Draw a simple decision tree for the above problem for any given year Clearly label the branches and show the decision,chance and outcome nodes. Calculate the expected values for each decision branch. Should we upgrade the levee? (hint: think only decision trees, no discounting needed) b) [1 points] Model 2: Assuming that the chance of a hurricane each year is 1/50, what are the cash flow diagrams for not upgrading the levee and upgrading the levee? What are the NPVS? Should we upgrade the levees? NPVs? c) [1 points] Model 3: What if we model the NPVs by choosing a year (1 to 50) where the hurricane hits, and then find the NPVs over the 50 year time horizon? What are the estimated NPVs? Should we upgrade the levees?/ d) [2 points] Model 4: Use Model 1 and view the problem through the lens of the utility function and the risk tolerance of the federal governmenty For a risk tolerance (R value) of $1 billion would the government upgrade the levees? If yes, what does the risk tolerance of the govenment need to be to not upgrade the levees? What does this analysis imply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts