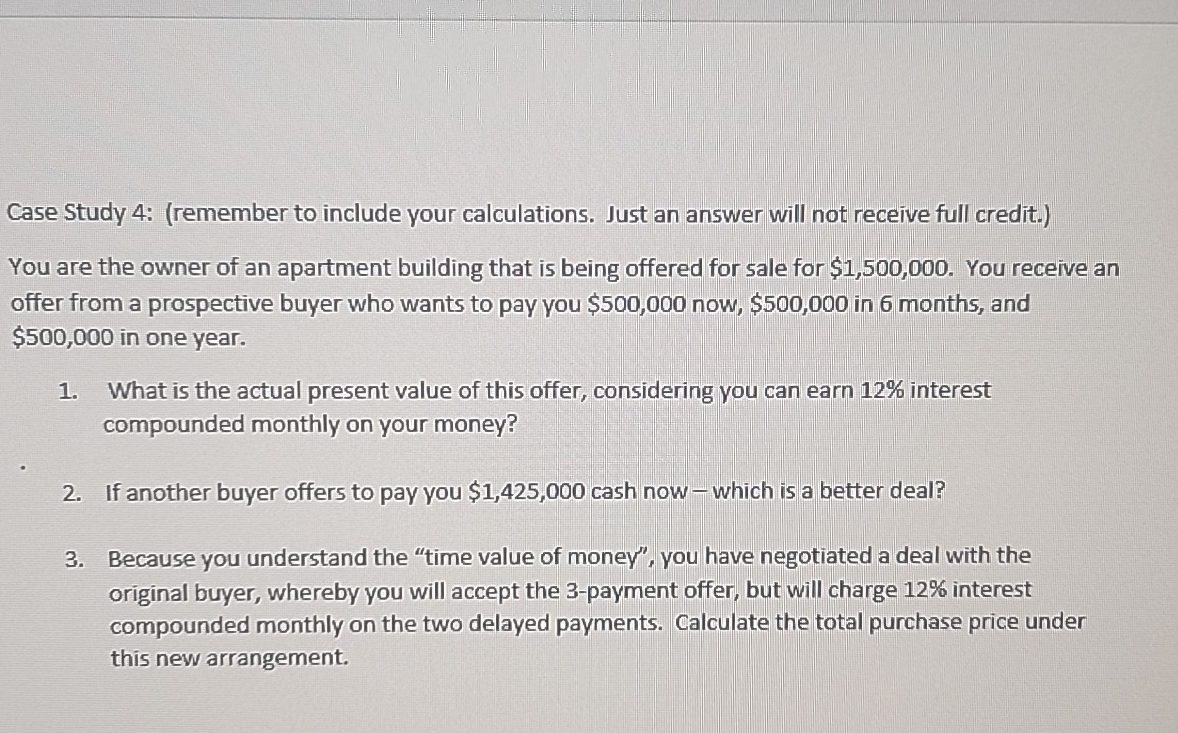

Question: Case Study 4 : ( remember to include your calculations. Just an answer will not receive full credit. ) You are the owner of an

Case Study : remember to include your calculations. Just an answer will not receive full credit.

You are the owner of an apartment building that is being offered for sale for $ You receive an

offer from a prospective buyer who wants to pay you $ now, $ in months, and

$ in one year.

What is the actual present value of this offer, considering you can earn interest

compounded monthly on your money?

If another buyer offers to pay you $ cash now which is a better deal?

Because you understand the "time value of money", you have negotiated a deal with the

original buyer, whereby you will accept the payment offer, but will charge interest

compounded monthly on the two delayed payments. Calculate the total purchase price under

this new arrangement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock