Question: Case Study 5.1 - Multiple cash flow options, which is best 5.2 - Rebased budget & comparison are required. Due Date: week of 12 May

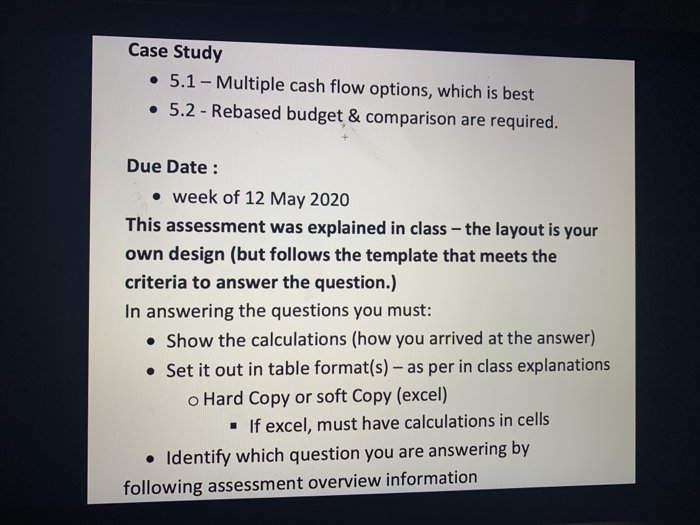

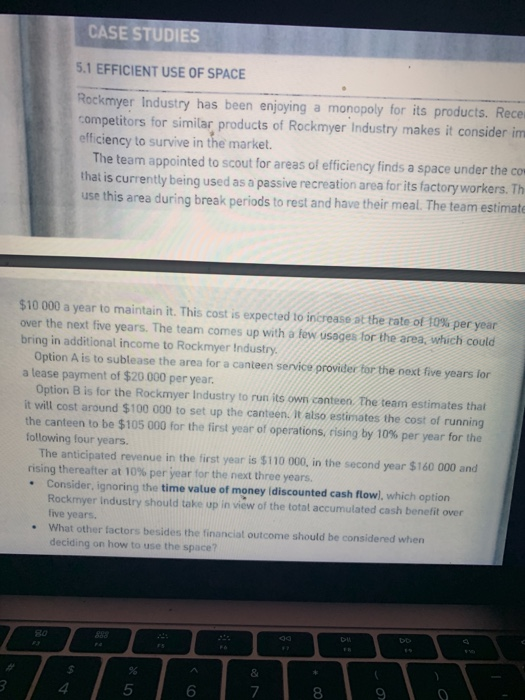

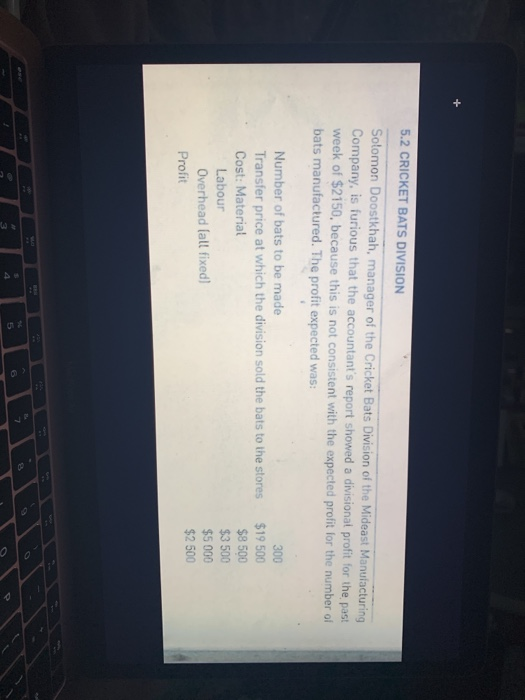

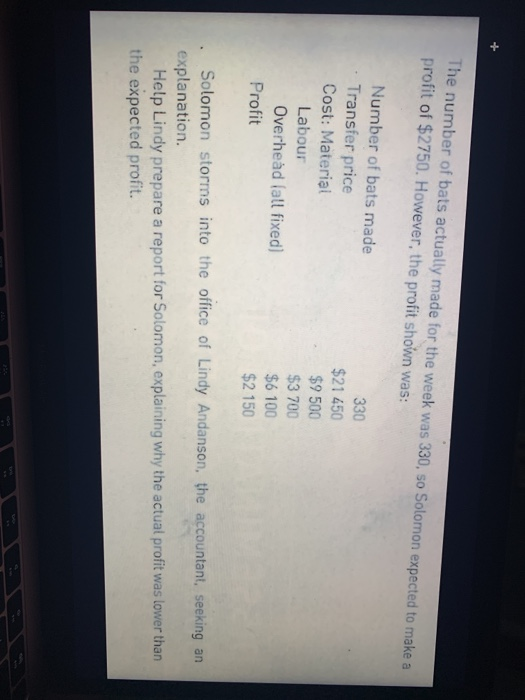

Case Study 5.1 - Multiple cash flow options, which is best 5.2 - Rebased budget & comparison are required. Due Date: week of 12 May 2020 This assessment was explained in class - the layout is your own design (but follows the template that meets the criteria to answer the question.) In answering the questions you must: Show the calculations (how you arrived at the answer) Set it out in table format(s) as per in class explanations o Hard Copy or soft Copy (excel) If excel, must have calculations in cells Identify which question you are answering by following assessment overview information CASE STUDIES 5.1 EFFICIENT USE OF SPACE Rockmyer Industry has been enjoying a monopoly for its products. Rece competitors for similar products of Rockmyer Industry makes it consider im efficiency to survive in the market. The team appointed to scout for areas of efficiency finds a space under the com that is currently being used as a passive recreation area for its factory workers. Th use this area during break periods to rest and have their meal. The team estimate $10 000 a year to maintain it. This cost is expected to increase at the rate of 10% per year over the next five years. The team comes up with a few usages for the area, which could bring in additional income to Rockmyer Industry. Option A is to sublease the area for a canteen service provider for the next five years for a lease payment of $20.000 per year. Option B is for the Rockmyer Industry to run its own canteen. The team estimates that it will cost around $100 000 to set up the canteen. It also estimates the cost of running the canteen to be $105 000 for the first year of operations, rising by 10% per year for the following four years. The anticipated revenue in the first year is $110 000, in the second year $160 000 and rising thereafter at 10% per year for the next three years. Consider, ignoring the time value of money discounted cash flowl, which option Rockmyer Industry should take up in view of the total accumulated cash benefit over five years What other factors besides the financial outcome should be considered when deciding on how to use the space? 5.2 CRICKET BATS DIVISION Solomon Doostkhah, manager of the Cricket Bats Division of the Mideast Manufacturing Company, is furious that the accountant's report showed a divisional profit for the past week of $2150, because this is not consistent with the expected profit for the number of bats manufactured. The profit expected was: Number of bats to be made Transfer price at which the division sold the bats to the stores Cost: Material Labour Overhead (all fixed) Profit 300 $19 500 $8500 $3 500 $5 000 $2 500 The number of bats actually made for the week was 330, so Solomon expected to make a profit of $2750. However, the profit shown was: Number of bats made Transfer price Cost: Material Labour Overhead (all fixed) Profit 330 $21 450 $9 500 $3 700 $6 100 $2 150 Solomon storms into the office of Lindy Andanson, the accountant, seeking an explanation. Help Lindy prepare a report for Solomon, explaining why the actual profit was lower than the expected profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts