Question: Case Study 8: Al Shaba LLC is been operating in Muscat since 2005. During the past several years company is been able to create good

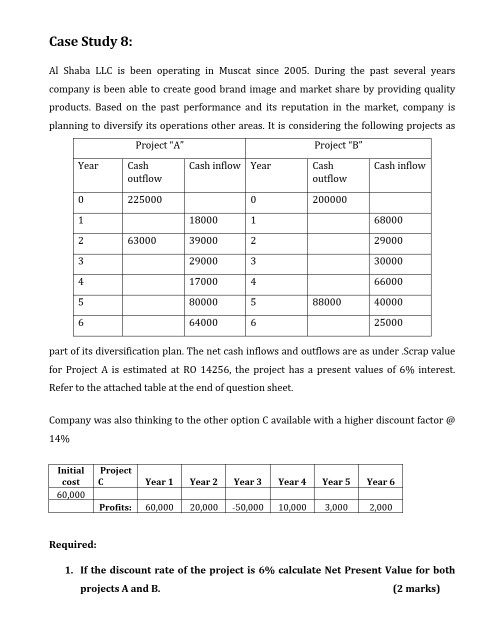

Case Study 8: Al Shaba LLC is been operating in Muscat since 2005. During the past several years company is been able to create good brand image and market share by providing quality products. Based on the past performance and its reputation in the market, company is planning to diversify its operations other areas. It is considering the following projects as Project "A" Project "B" Cash inflow Year Cash inflow outflow outflow Year Cash Cash 0 225000 0 200000 1 18000 1 68000 2 63000 39000 2 29000 3 29000 3 30000 4 17000 4 66000 5 80000 5 88000 40000 6 64000 6 25000 part of its diversification plan. The net cash inflows and outflows are as under Scrap value for Project A is estimated at RO 14256, the project has a present values of 6% interest. Refer to the attached table at the end of question sheet. Company was also thinking to the other option available with a higher discount factor @ 14% Initial cost 60,000 Project Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Profits: 60,000 20,000 -50,000 10,000 3,000 2,000 Required: 1. If the discount rate of the project is 6% calculate Net Present Value for both projects A and B. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts