Question: Case study and questions Case Study 5 Mr. Lee wants to venture into a project this year (2021) that requires an initial investment of $100

Case study and questions

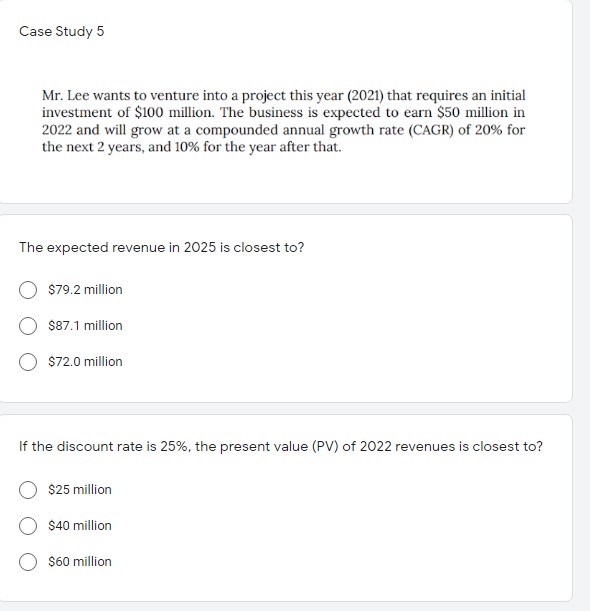

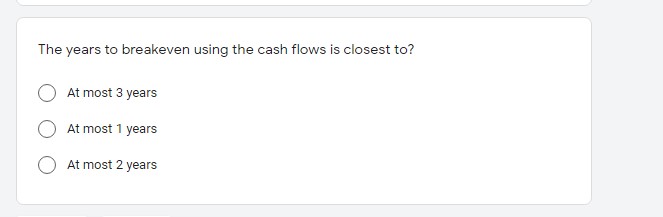

Case Study 5 Mr. Lee wants to venture into a project this year (2021) that requires an initial investment of $100 million. The business is expected to earn $50 million in 2022 and will grow at a compounded annual growth rate (CAGR) of 20% for the next 2 years, and 10% for the year after that. The expected revenue in 2025 is closest to? O $79.2 million O $87.1 million )$72.0 million If the discount rate is 25%, the present value (PV) of 2022 revenues is closest to? O $25 million O $40 million O $60 millionThe years to breakeven using the cash flows is closest to? O M must 3 years 0 At most 1 years 0 At most 2 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts