Question: Case Study: Apple, Einhorn, and iPrefs Assignment questions: 1. Based on the financial statements of Apple Inc., please figure out some findings to show the

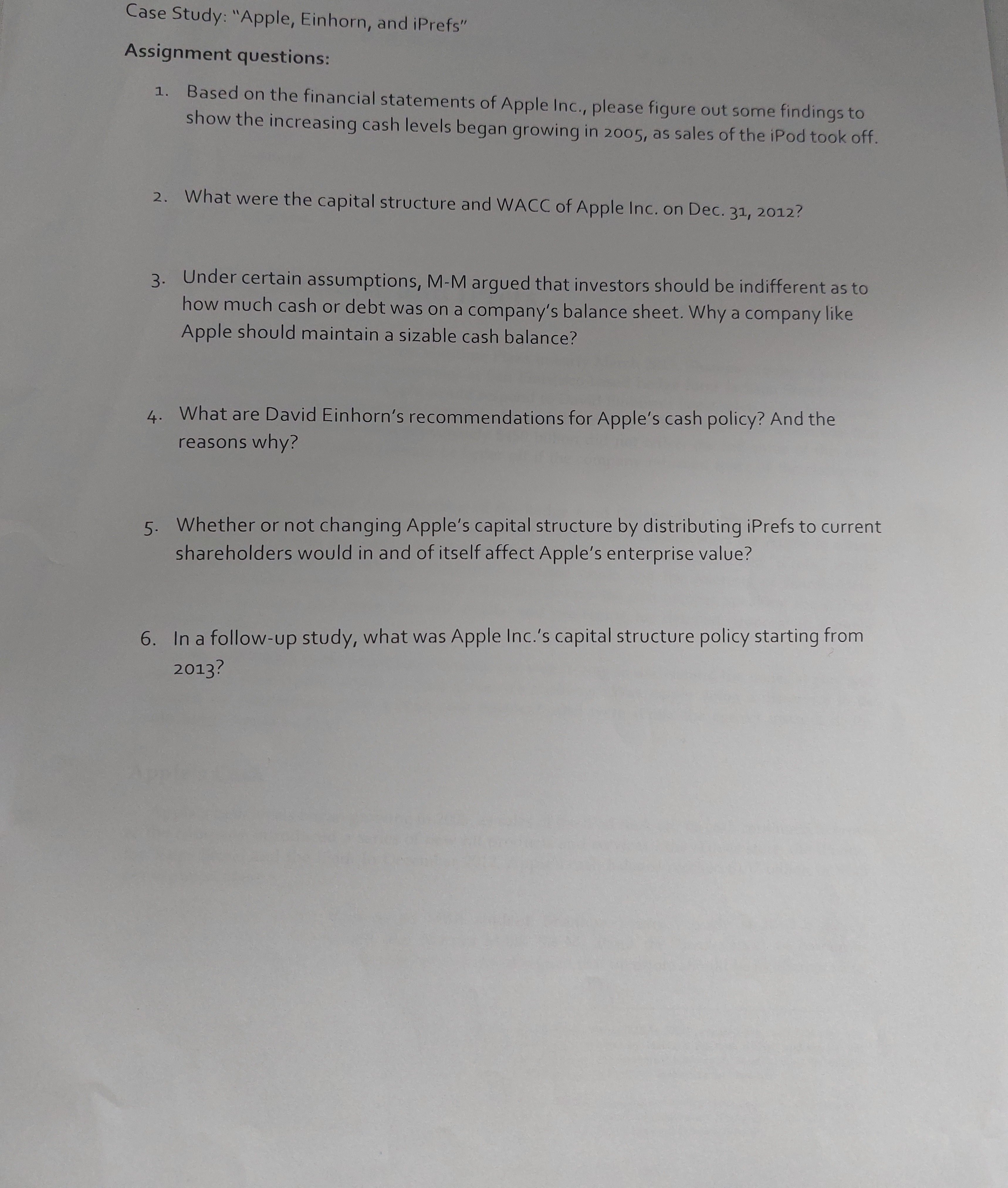

Case Study: "Apple, Einhorn, and iPrefs" Assignment questions: 1. Based on the financial statements of Apple Inc., please figure out some findings to show the increasing cash levels began growing in 2005, as sales of the ipod took off. 2. What were the capital structure and WACC of Apple Inc. on Dec. 31, 2012? 3. Under certain assumptions, M-M argued that investors should be indifferent as to how much cash or debt was on a company's balance sheet. Why a company like Apple should maintain a sizable cash balance? 4. What are David Einhorn's recommendations for Apple's cash policy? And the reasons why? 5. Whether or not changing Apple's capital structure by distributing iPrefs to current shareholders would in and of itself affect Apple's enterprise value? 6. In a follow-up study, what was Apple Inc.'s capital structure policy starting from 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts