Question: Case Study ArowTech Berhad is a Malaysia - based aerospace component manufacturer that recently announced plans to expand into international markets, particularly the United States,

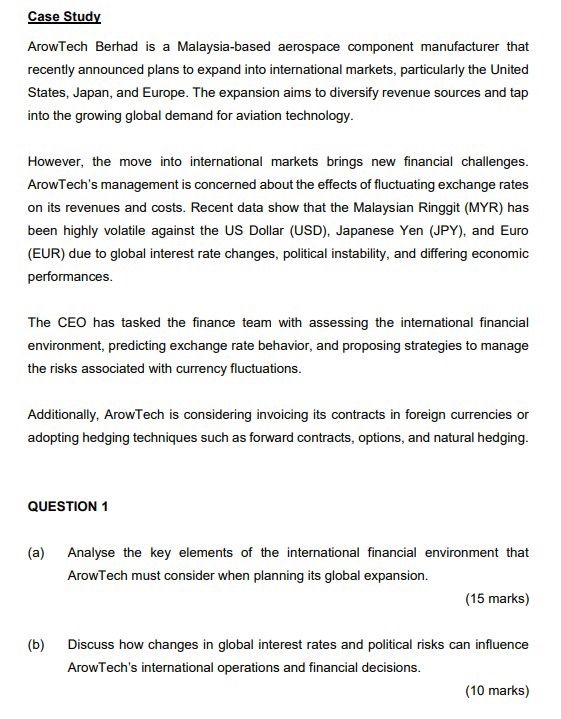

Case Study ArowTech Berhad is a Malaysiabased aerospace component manufacturer that recently announced plans to expand into international markets, particularly the United States, Japan, and Europe. The expansion aims to diversify revenue sources and tap into the growing global demand for aviation technology. However, the move into international markets brings new financial challenges. ArowTech's management is concerned about the effects of fluctuating exchange rates on its revenues and costs. Recent data show that the Malaysian Ringgit MYR has been highly volatile against the US Dollar USD Japanese Yen JPY and Euro EUR due to global interest rate changes, political instability, and differing economic performances. The CEO has tasked the finance team with assessing the intemational financial environment, predicting exchange rate behavior, and proposing strategies to manage the risks associated with currency fluctuations. Additionally, ArowTech is considering invoicing its contracts in foreign currencies or adopting hedging techniques such as forward contracts, options, and natural hedging. QUESTION a Analyse the key elements of the international financial environment that ArowTech must consider when planning its global expansion. b Discuss how changes in global interest rates and political risks can influence ArowTech's international operations and financial decisions. QUESTION

a Explain the factors that cause shortterm and longterm exchange rate fluctuations, with examples relevant to ArowTech's target markets US Japan, Europe

b Evaluate the impact of Ringgit depreciation versus appreciation on ArowTech's international revenue and costs.

QUESTION

a Define and differentiate the three main types of exchange rate risks faced by ArowTech.

b Illustrate with examples how each type of risk could affect ArowTech's financial performance.

QUESTION

a Propose three different strategies ArowTech could use to manage its exchange rate risks.

marks

b Critically assess the advantages and disadvantages of each strategy for a company like ArowTech.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock