Question: Case study assigned. With the tables and information from the text (attached below), I was able to build or calculate the revenue. Question 1 requires

Case study assigned. With the tables and information from the text (attached below), I was able to build or calculate the revenue. Question 1 requires me to make a balance sheet and a statement of operations for the fiscal year 2020. I am trying to understand what numbers to do I use to calculate the net accounts receivable for the balance sheet under Current Assets. Do I add all the net that I calculated? Or is this what I would put in under revenues in my statement of operations for net patient services revenue? I do not understand the difference to enter the data to complete Question 1.

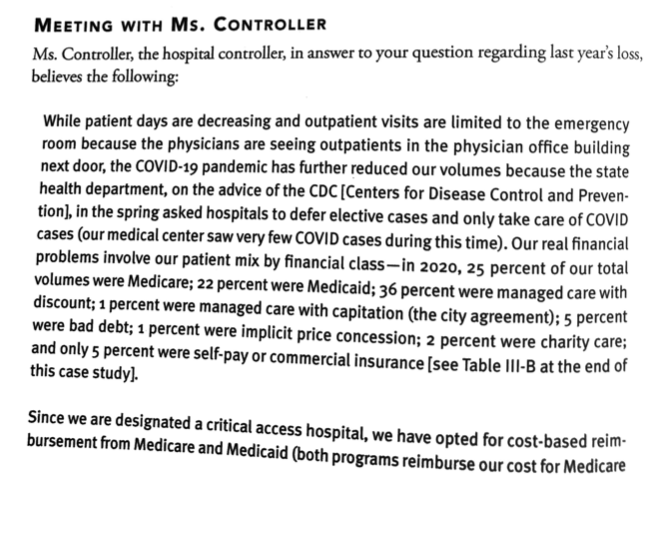

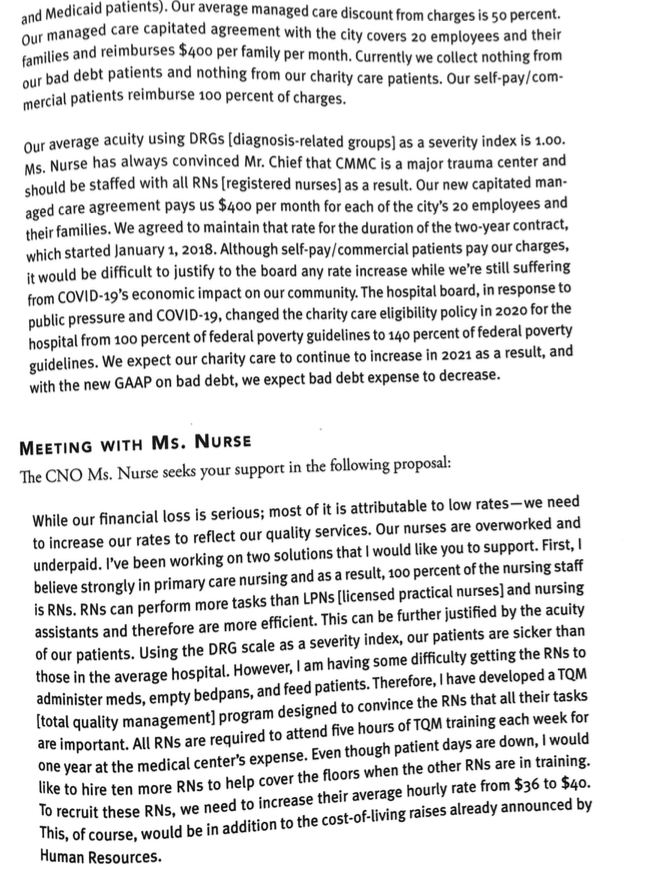

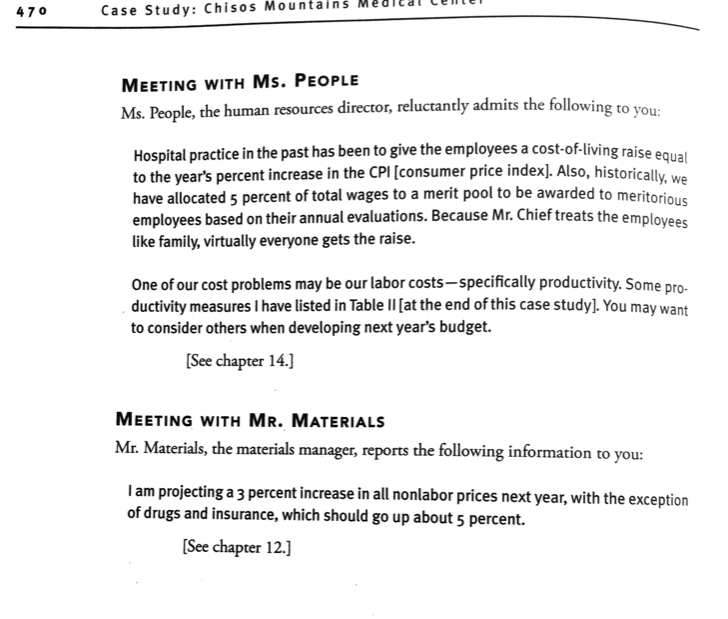

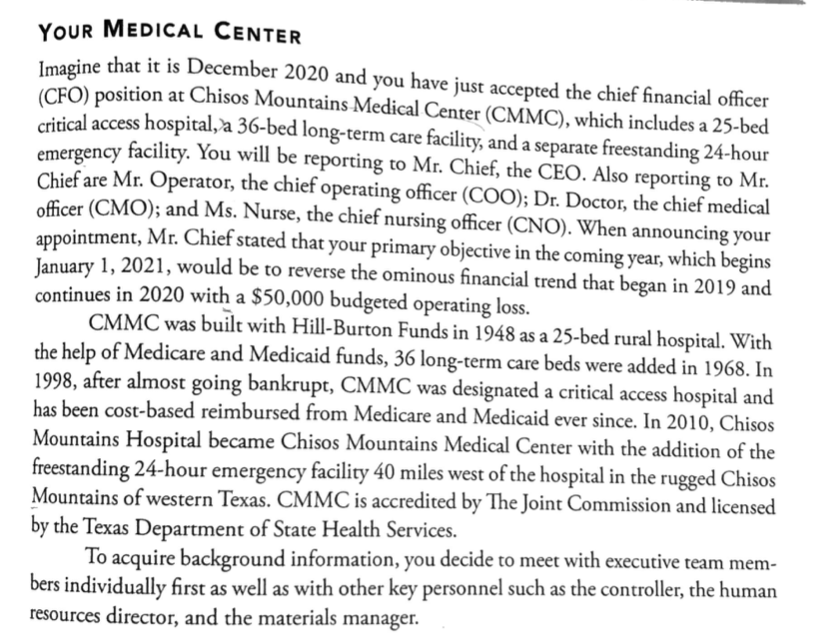

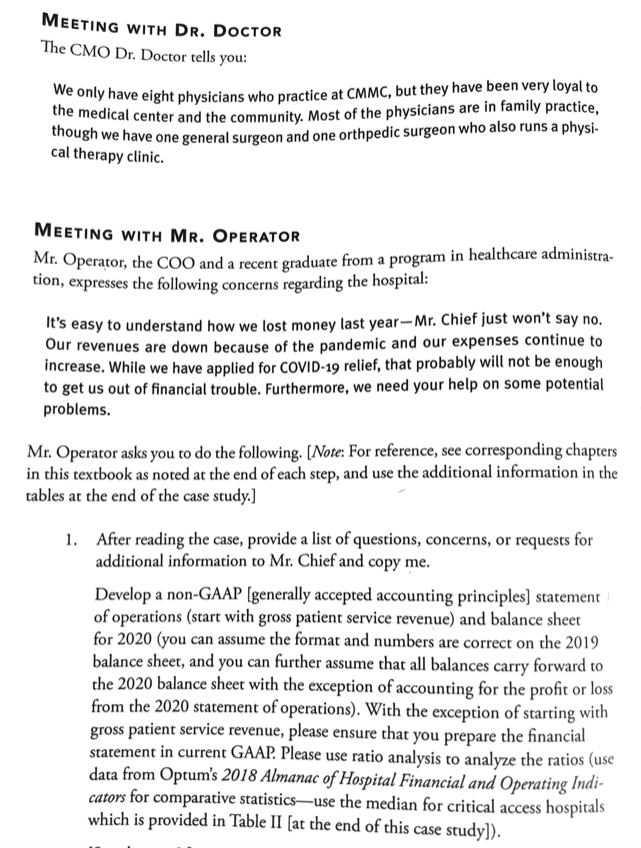

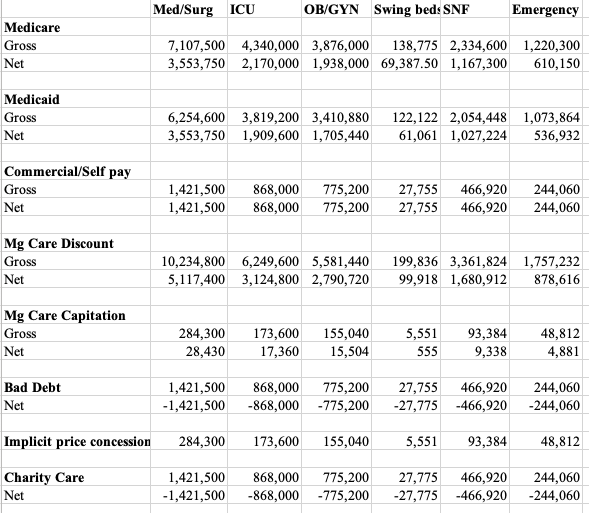

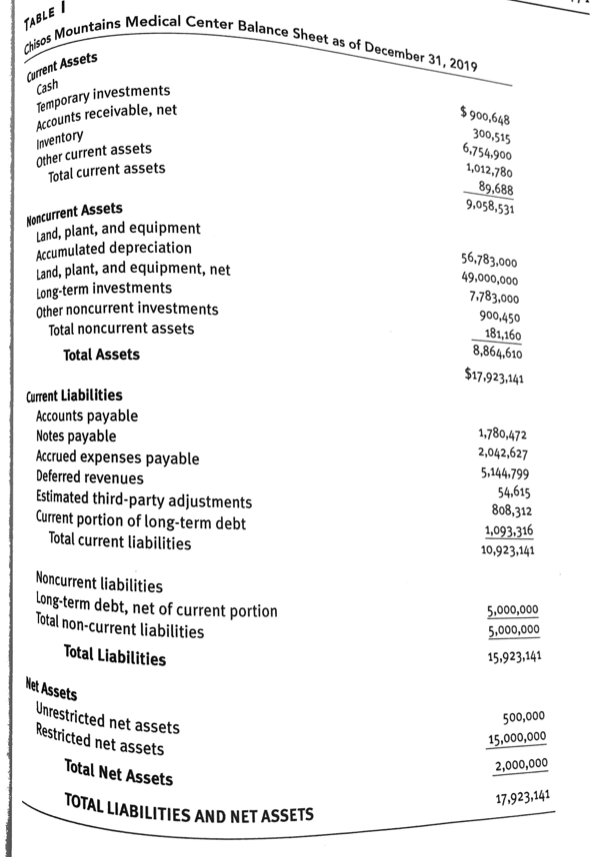

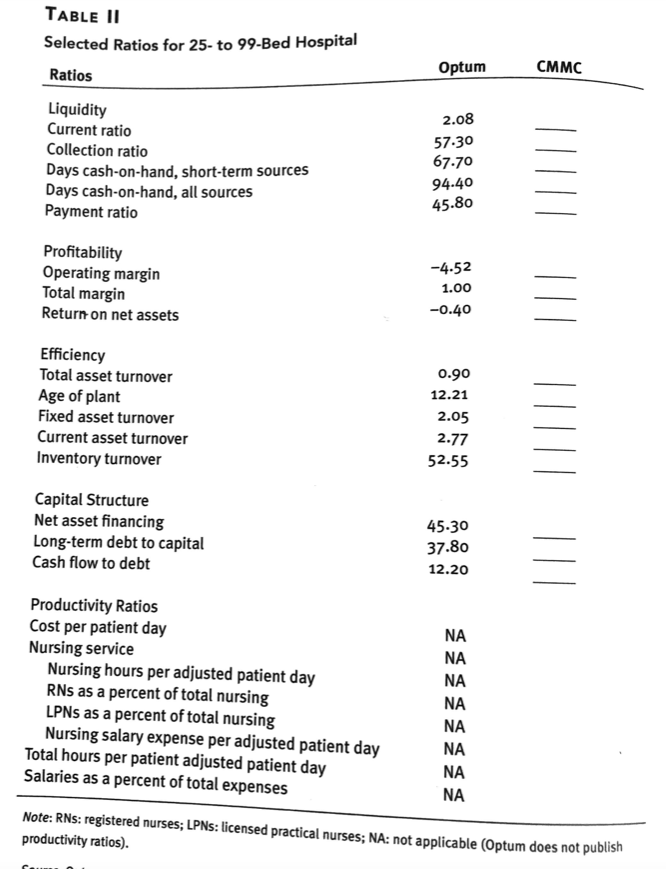

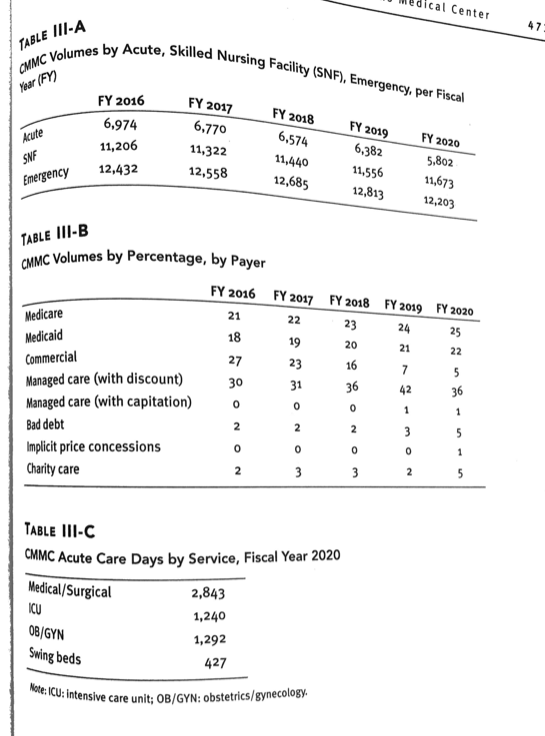

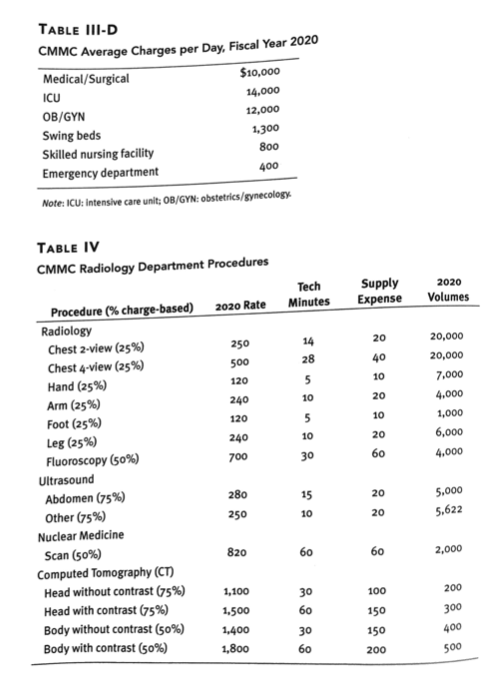

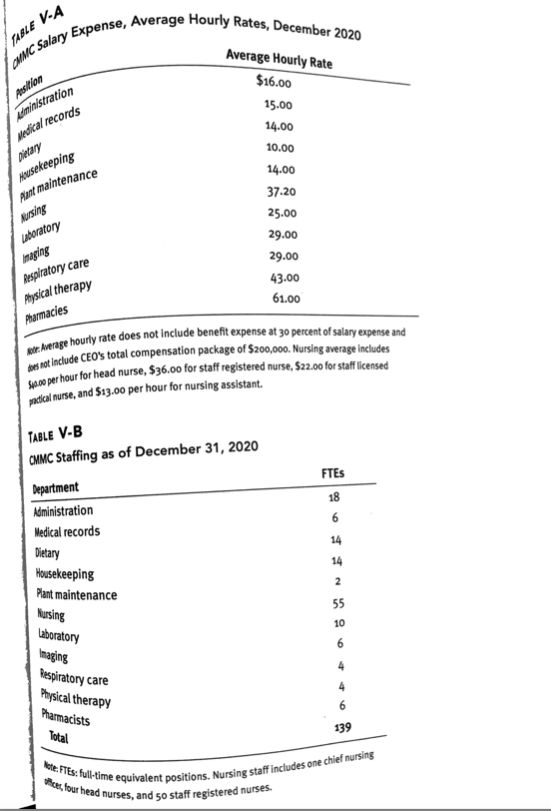

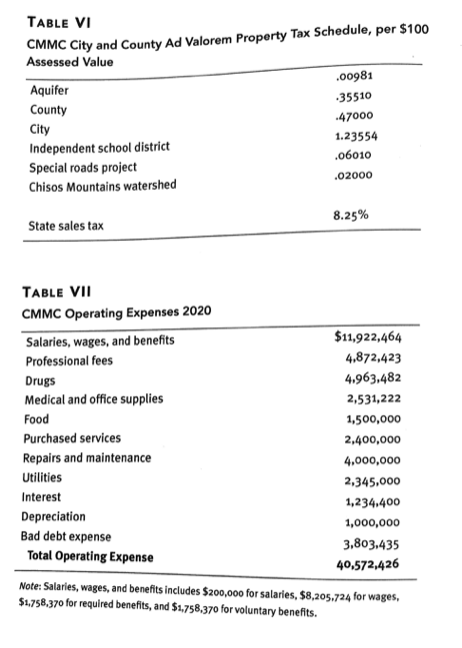

MEETING WITH MS. CONTROLLER Ms. Controller, the hospital controller, in answer to your question regarding last year's loss, believes the following: While patient days are decreasing and outpatient visits are limited to the emergency room because the physicians are seeing outpatients in the physician office building next door, the COVID-19 pandemic has further reduced our volumes because the state health department, on the advice of the CDC [Centers for Disease Control and Preven- tion], in the spring asked hospitals to defer elective cases and only take care of COVID cases (our medical center saw very few COVID cases during this time). Our real financial problems involve our patient mix by financial class-in 2020, 25 percent of our total volumes were Medicare; 22 percent were Medicaid; 36 percent were managed care with discount; 1 percent were managed care with capitation (the city agreement); 5 percent were bad debt; 1 percent were implicit price concession; 2 percent were charity care; and only 5 percent were self-pay or commercial insurance [see Table III-B at the end of this case study]. Since we are designated a critical access hospital, we have opted for cost-based reim- bursement from Medicare and Medicaid (both programs reimburse our cost for Medicareand Medicaid patients). Our average managed care discount from charges is 50 percent. Our managed care capitated agreement with the city covers 20 employees and their families and reimburses $400 per family per month. Currently we collect nothing from our bad debt patients and nothing from our charity care patients. Our self-pay/com- mercial patients reimburse 100 percent of charges. Our average acuity using DRGS [diagnosis-related groups] as a severity index is 1.00. Ms. Nurse has always convinced Mr. Chief that CMMC is a major trauma center and should be staffed with all RNs [ registered nurses] as a result. Our new capitated man- aged care agreement pays us $400 per month for each of the city's 20 employees and their families. We agreed to maintain that rate for the duration of the two-year contract, which started January 1, 2018. Although self-pay/commercial patients pay our charges, it would be difficult to justify to the board any rate increase while we're still suffering from COVID-19's economic impact on our community. The hospital board, in response to public pressure and COVID-19, changed the charity care eligibility policy in 2020 for the hospital from 100 percent of federal poverty guidelines to 140 percent of federal poverty guidelines. We expect our charity care to continue to increase in 2021 as a result, and with the new GAAP on bad debt, we expect bad debt expense to decrease. MEETING WITH MS. NURSE The CNO Ms. Nurse seeks your support in the following proposal: While our financial loss is serious; most of it is attributable to low rates-we need to increase our rates to reflect our quality services. Our nurses are overworked and underpaid. I've been working on two solutions that I would like you to support. First, I believe strongly in primary care nursing and as a result, 100 percent of the nursing staff is RNS. RNs can perform more tasks than LPNs [licensed practical nurses] and nursing assistants and therefore are more efficient. This can be further justified by the acuity of our patients. Using the DRG scale as a severity index, our patients are sicker than those in the average hospital. However, I am having some difficulty getting the RNs to administer meds, empty bedpans, and feed patients. Therefore, I have developed a TOM [total quality management] program designed to convince the RNs that all their tasks are important. All RNs are required to attend five hours of TOM training each week for one year at the medical center's expense. Even though patient days are down, I would like to hire ten more RNs to help cover the floors when the other RNs are in training. To recruit these RNs, we need to increase their average hourly rate from $36 to $40. This, of course, would be in addition to the cost-of-living raises already announced by Human Resources.470 Case Study: Chisos Mountains Med MEETING WITH MS. PEOPLE Ms. People, the human resources director, reluctantly admits the following to you: Hospital practice in the past has been to give the employees a cost-of-living raise equal to the year's percent increase in the CPI [consumer price index]. Also, historically, we have allocated 5 percent of total wages to a merit pool to be awarded to meritorious employees based on their annual evaluations. Because Mr. Chief treats the employees like family, virtually everyone gets the raise. One of our cost problems may be our labor costs-specifically productivity. Some pro- ductivity measures I have listed in Table II [at the end of this case study]. You may want to consider others when developing next year's budget. [See chapter 14.] MEETING WITH MR. MATERIALS Mr. Materials, the materials manager, reports the following information to you: I am projecting a 3 percent increase in all nonlabor prices next year, with the exception of drugs and insurance, which should go up about 5 percent. [See chapter 12.]YOUR MEDICAL CENTER Imagine that it is December 2020 and you have just accepted the chief financial officer (CFO) position at Chisos Mountains Medical Center (CMMC), which includes a 25-bed critical access hospital, a 36-bed long-term care facility, and a separate freestanding 24-hour emergency facility. You will be reporting to Mr. Chief, the CEO. Also reporting to Mr. Chief are Mr. Operator, the chief operating officer (COO); Dr. Doctor, the chief medical officer (CMO); and Ms. Nurse, the chief nursing officer (CNO). When announcing your appointment, Mr. Chief stated that your primary objective in the coming year, which begins January 1, 2021, would be to reverse the ominous financial trend that began in 2019 and continues in 2020 with a $50,000 budgeted operating loss. CMMC was built with Hill-Burton Funds in 1948 as a 25-bed rural hospital. With the help of Medicare and Medicaid funds, 36 long-term care beds were added in 1968. In 1998, after almost going bankrupt, CMMC was designated a critical access hospital and has been cost-based reimbursed from Medicare and Medicaid ever since. In 2010, Chisos Mountains Hospital became Chisos Mountains Medical Center with the addition of the freestanding 24-hour emergency facility 40 miles west of the hospital in the rugged Chisos Mountains of western Texas. CMMC is accredited by The Joint Commission and licensed by the Texas Department of State Health Services. To acquire background information, you decide to meet with executive team mem- bers individually first as well as with other key personnel such as the controller, the human resources director, and the materials manager.MEETING WITH DR. DOCTOR The CMO Dr. Doctor tells you: We only have eight physicians who practice at CMMC, but they have been very loyal to the medical center and the community. Most of the physicians are in family practice, though we have one general surgeon and one orthpedic surgeon who also runs a physi- cal therapy clinic. MEETING WITH MR. OPERATOR Mr. Operator, the COO and a recent graduate from a program in healthcare administra- tion, expresses the following concerns regarding the hospital: It's easy to understand how we lost money last year-Mr. Chief just won't say no. Our revenues are down because of the pandemic and our expenses continue to increase. While we have applied for COVID-19 relief, that probably will not be enough to get us out of financial trouble. Furthermore, we need your help on some potential problems. Mr. Operator asks you to do the following. [ Note: For reference, see corresponding chapters in this textbook as noted at the end of each step, and use the additional information in the tables at the end of the case study.] 1. After reading the case, provide a list of questions, concerns, or requests for additional information to Mr. Chief and copy me. Develop a non-GAAP [generally accepted accounting principles] statement of operations (start with gross patient service revenue) and balance sheet for 2020 (you can assume the format and numbers are correct on the 2019 balance sheet, and you can further assume that all balances carry forward to the 2020 balance sheet with the exception of accounting for the profit or loss from the 2020 statement of operations). With the exception of starting with gross patient service revenue, please ensure that you prepare the financial statement in current GAAP. Please use ratio analysis to analyze the ratios (use data from Optum's 2018 Almanac of Hospital Financial and Operating Indi- cators for comparative statistics-use the median for critical access hospitals which is provided in Table II [at the end of this case study]).Med/Surg ICU OB/GYN Swing bed: SNF Emergency Medicare Gross 7,107,500 4,340,000 3,876,000 138,775 2,334,600 1,220,300 Net 3,553,750 2,170,000 1,938,000 69,387.50 1,167,300 610,150 Medicaid Gross 6,254,600 3,819,200 3,410,880 122, 122 2,054,448 1,073,864 Net 3,553,750 1,909,600 1,705,440 61,061 1,027,224 536,932 Commercial/Self pay Gross 1,421,500 868,000 775,200 27,755 466,920 244,060 Net 1,421,500 868,000 775,200 27,755 466,920 244,060 Mg Care Discount Gross 10,234,800 6,249,600 5,581,440 199,836 3,361,824 1,757,232 Net 5,117,400 3,124,800 2,790,720 99,918 1,680,912 878,616 Mg Care Capitation Gross 284,300 173,600 155,040 5,551 93,384 48,812 Net 28,430 17,360 15,504 555 9,338 4,881 Bad Debt 1,421,500 868,000 775,200 27,755 466,920 244,060 Net -1,421,500 -868,000 -775,200 -27,775 -466,920 -244,060 Implicit price concession 284,300 173,600 155,040 5,551 93,384 48,812 Charity Care 1,421,500 868,000 775,200 27,775 466,920 244,060 Net -1,421,500 -868,000 -775,200 -27,775 -466,920 -244,060TABLE I chisos Mountains Medical Center Balance Sheet as of December 31, 2019 Current Assets Cash Temporary investments Accounts receivable, net $ 900,648 300,515 Inventory 6,754.900 Other current assets 1,012,780 Total current assets 89,688 9.058,531 Noncurrent Assets Land, plant, and equipment Accumulated depreciation 56,783,000 Land, plant, and equipment, net 49,000,000 Long-term investments 7,783,000 Other noncurrent investments 900,450 Total noncurrent assets 181,160 8,864,610 Total Assets $17.923,141 Current Liabilities Accounts payable 1,780,472 Notes payable 2,042,627 Accrued expenses payable 5,144.799 Deferred revenues 54,615 Estimated third-party adjustments 808,312 Current portion of long-term debt 1,093.316 Total current liabilities 10,923,141 Noncurrent liabilities Long-term debt, net of current portion 5,000,000 Total non-current liabilities 5,000,000 Total Liabilities 15,923,141 Net Assets 500,000 Unrestricted net assets 15,000,000 Restricted net assets 2,000,000 Total Net Assets 17,923,141 TOTAL LIABILITIES AND NET ASSETSTABLE II Selected Ratios for 25- to 99-Bed Hospital Optum CMMC Ratios Liquidity 2.08 Current ratio 57.30 Collection ratio 67.70 Days cash-on-hand, short-term sources 94-40 Days cash-on-hand, all sources 45.80 Payment ratio Profitability -4-52 Operating margin 1.00 Total margin -0.40 Return on net assets Efficiency Total asset turnover 0.90 Age of plant 12.21 Fixed asset turnover 2.05 Current asset turnover 2.77 Inventory turnover 52.55 Capital Structure Net asset financing 45-30 Long-term debt to capital 37.80 111 Cash flow to debt 12.20 Productivity Ratios Cost per patient day NA Nursing service NA Nursing hours per adjusted patient day NA RNs as a percent of total nursing NA LPNs as a percent of total nursing NA Nursing salary expense per adjusted patient day NA Total hours per patient adjusted patient day NA Salaries as a percent of total expenses NA Note: RNs: registered nurses; LPNs: licensed practical nurses; NA: not applicable (Optum does not publish productivity ratios).medical Center 47 TABLE III-A WMC Volumes by Acute, Skilled Nursing Facility (SNF), Emergency, per Fiscal Year (FY) FY 2016 FY 2017 FY 2018 FY 2019 6,974 6,770 FY 2020 6.574 6,382 Acute 11,206 11,322 5.802 11,440 11,556 SNF 12,558 11,673 12,432 12,685 Emergency 12,813 12,203 TABLE III-B CMMC Volumes by Percentage, by Payer FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 21 22 23 24 25 Medicare 18 19 20 21 22 Medicaid 27 23 16 7 5 Commercial 30 31 36 42 36 Managed care (with discount) 0 Managed care (with capitation) 0 N WONO Bad debt NOW Implicit price concessions w N Charity care TABLE III-C CMMC Acute Care Days by Service, Fiscal Year 2020 Medical/Surgical 2,843 ICU 1,240 OB/GYN 1,292 Swing beds 427 Note: ICU: intensive care unit: OB/GYN: obstetrics/gynecology.TABLE III-D CMMC Average Charges per Day, Fiscal Year 2020 Medical/Surgical $10,000 ICU 14.000 OB/GYN 12,000 Swing beds 1,300 Skilled nursing facility 800 Emergency department 400 Note: ICU: Intensive care unit; OB/GYN: obstetrics/gynecology TABLE IV CMMC Radiology Department Procedures Tech Supply 2020 Procedure (% charge-based) 2020 Rate Minutes Expense Volumes Radiology Chest 2-view (25%) 250 14 20 20,000 Chest 4-view (25%) 500 28 40 20,000 Hand (25%) 120 5 10 7,000 Arm (25%) 240 10 20 4.000 Foot (25%) 120 5 10 1,000 Leg (25%) 240 10 20 6,000 Fluoroscopy (50%) 700 30 60 4,000 Ultrasound Abdomen (75%) 280 15 20 5.000 Other (75%) 250 10 20 5.622 Nuclear Medicine Scan (50%) 820 60 60 2,000 Computed Tomography (CT) Head without contrast (75%) 1,100 30 100 200 Head with contrast (75%) 1,500 60 150 300 Body without contrast (50%) 1,400 30 150 400 Body with contrast (50%) 1,800 60 200 500TABLE V-A UMC Salary Expense, Average Hourly Rates, December 2020 Average Hourly Rate $16.00 Administration 15.00 Medical records 14.00 Dietary 10.00 Housekeeping 14.00 Plant maintenance 37.20 Nursing 25.00 usboratory 29.00 maging 29.00 Respiratory care 43-00 Physical therapy 61.00 Pharmacies for Average hourly rate does not include benefit expense at 30 percent of salary expense and does not include CEO's total compensation package of $200,000. Nursing average includes Space per hour for head nurse, $36.00 for staff registered nurse, $2z.00 for staff licensed practical nurse, and $13.00 per hour for nursing assistant. TABLE V-B CMMC Staffing as of December 31, 2020 FTEs Department 18 Administration 6 Medical records 14 Dietary 14 Housekeeping Plant maintenance 55 Nursing 10 Laboratory Imaging Respiratory care Physical therapy Pharmacists 139 Total ste: FTEs: full-time equivalent positions. Nursing staff includes one chief nursing ce, four head nurses, and 50 staff registered nurses.TABLE VI CMMC City and County Ad Valorem Property Tax Schedule, per $100 Assessed Value 00981 Aquifer .35510 County .47000 City 1.23554 Independent school district .06010 Special roads project -02000 Chisos Mountains watershed 8.25% State sales tax TABLE VII CMMC Operating Expenses 2020 Salaries, wages, and benefits $11,922,464 Professional fees 4.872,423 Drugs 4.963,482 Medical and office supplies 2,531,222 Food 1,500,000 Purchased services 2,400,000 Repairs and maintenance 4.000,000 Utilities 2.345,000 Interest 1,234.400 Depreciation 1,000,000 Bad debt expense 3,803.435 Total Operating Expense 40,572,426 Note: Salaries, wages, and benefits includes $200,ooo for salaries, $8,205.724 for wages, $1,758.370 for required benefits, and $1,758,370 for voluntary benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts