Question: CASE STUDY ASSIGNMENT NO . 2 This assignment has two brief case studies. You are required to complete both. Question 1 : THE UNHAPPY EMPLOYEE

CASE STUDY ASSIGNMENT NO

This assignment has two brief case studies. You are required to complete both.

Question : THE UNHAPPY EMPLOYEE

Andy Wiltshire is the accounts payable manager of Homestead Property Ltd HPL

Andy started with HPL as an accounts clerk and worked his way up to his current management position. He was promoted due to his dedication to the company and his reliability he often works evenings and weekends, rarely calls in sick, and he never takes vacations.

Despite earning a good salary, Andy enjoys living large, and the majority of his earnings goes to pay for his luxury car and designer clothes. He finds himself living pay cheque to pay cheque and has no savings for retirement or emergency purposes.

HPL had a long history of profitability and had established a bonus scheme to reward its employees when profit targets were made. However, at the end of X employees were shocked when HPL announced it had its worst year in the companys history. Its losses were significant and the company instituted significant layoffs in an attempt to turn this situation around. The accounting departments staffing was reduced by and the remaining staff was asked to do more. Andy now found that not only is he managing an unhappy accounts payable group, he is also now signing cheques, processing payables, and reconciling the bank account. This meant Andy is required to work even more without any pay increase or bonus in sight.

For the first time in his career at HPL Andy is unhappy. While he is fearful of further layoffs, he also feels unappreciated and after all of his hard work, he is unhappy he is being asked to do more. He is also very worried that if he himself was laid off, his prospects of getting a similar job were bleak as he did not have an accounting qualification and his age may be a liability.

Required

a Explain the external auditors responsibilities in relation to the prevention and detection of fraud and error. marks

b Discuss the incentives, opportunities, and rationalizations to commit fraud in this case. marks

Question : Preliminary Analytics

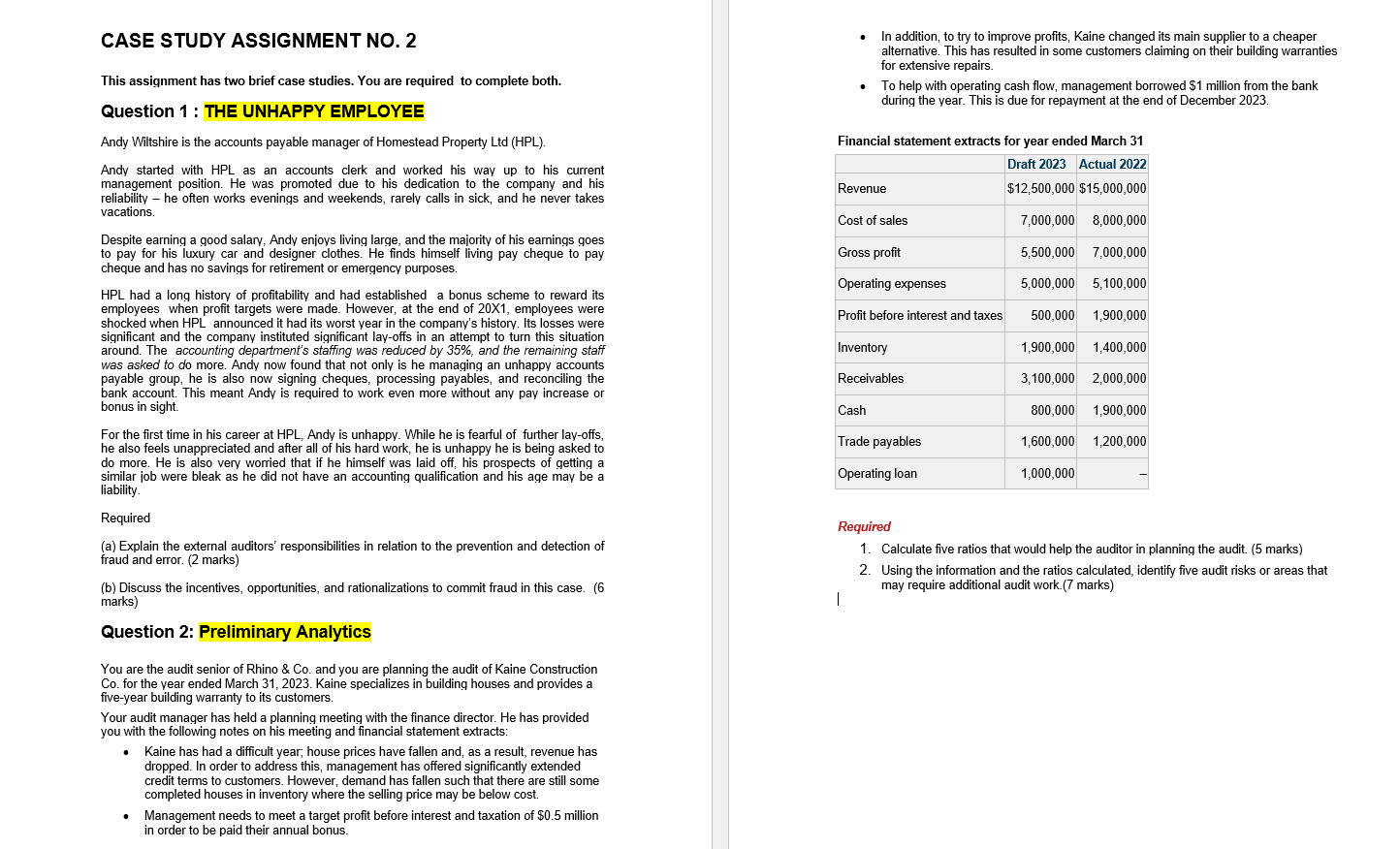

You are the audit senior of Rhino & Co and you are planning the audit of Kaine Construction Co for the year ended March Kaine specializes in building houses and provides a fiveyear building warranty to its customers.

Your audit manager has held a planning meeting with the finance director. He has provided you with the following notes on his meeting and financial statement extracts:

Kaine has had a difficult year; house prices have fallen and, as a result, revenue has dropped. In order to address this, management has offered significantly extended credit terms to customers. However, demand has fallen such that there are still some completed houses in inventory where the selling price may be below cost.

Management needs to meet a target profit before interest and taxation of $ million in order to be paid their annual bonus.

In addition, to try to improve profits, Kaine changed its main supplier to a cheaper alternative. This has resulted in some customers claiming on their building warranties for extensive repairs.

To help with operating cash flow, management borrowed $ million from the bank during the year. This is due for repayment at the end of December

Financial statement extracts for year ended March

Draft

Actual

Revenue

$

$

Cost of sales

Gross profit

Operating expenses

Profit before interest and taxes

Inventory

Receivables

Cash

Trade payables

Operating loan

Required

Calculate five ratios that would help the auditor in planning the audit. marks

Using the information and the ratios calculated, identify five audit risks or areas that may require additional audit work. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock